Christopher Giancarlo, the former chairman of the U.S. Commodity Futures Trading Commission (CFTC), has joined Sygnum, a pioneering crypto bank, as a senior policy advisor. This move underscores the growing institutional interest in digital assets and the increasing importance of regulatory navigation in the crypto space.

Giancarlo’s appointment places him among 12 other distinguished members of Sygnum’s Advisory Council, announced on May 27th. His primary responsibilities will include advising on regulatory matters and fostering strategic partnerships within both the public and private sectors.

Sygnum, based in Switzerland, is renowned as one of the first digital asset banks, providing a comprehensive suite of crypto asset services. The company achieved unicorn status after a successful $58 million funding round, highlighting its significant growth and market position.

Giancarlo, who led the CFTC from 2017 to 2019, expressed his enthusiasm for joining Sygnum at a crucial juncture for the digital asset industry. He believes the industry is on the cusp of widespread institutional adoption.

Known as “Crypto Dad” for his advocacy of digital assets, Giancarlo has been a prominent voice for progressive crypto regulation in the United States. In 2023, he emphasized the need for a significant political shift in Washington, D.C., to facilitate pro-industry legislation.

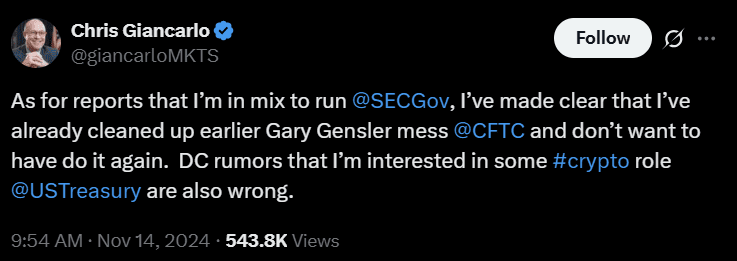

While there were rumors of Giancarlo potentially succeeding Gary Gensler as SEC Chair, he refuted these claims, affirming his commitment to contributing to the crypto industry through advisory and strategic roles.

Why is this appointment significant?

Giancarlo’s expertise is particularly valuable to Sygnum as the regulatory landscape for digital assets becomes increasingly complex. His insights will help the bank navigate the evolving global regulatory environment and capitalize on emerging opportunities.

Institutional Adoption of Digital Assets: A Key Driver

The appointment of Giancarlo comes at a time when institutional interest in digital assets is surging. Several factors are contributing to this trend:

- Pro-Crypto Policies: Governments worldwide are increasingly developing regulatory frameworks that provide clarity and legitimacy to the crypto market.

- Bitcoin ETF Success: The launch of Bitcoin ETFs has provided institutional investors with a more accessible and regulated way to gain exposure to Bitcoin.

- Tokenization and Stablecoins: Advances in tokenization and the increasing adoption of stablecoins are creating new use cases for digital assets and attracting institutional capital.

In the United States, Bitcoin ETFs are experiencing record inflows, indicating strong institutional demand. Furthermore, legislative efforts like the GENIUS Act aim to provide a clear regulatory framework for stablecoins, which could further accelerate institutional adoption.

Bitcoin’s rally to all-time highs has also played a role, with more institutions recognizing BTC as a mature and viable asset for inclusion in modern investment portfolios. Fidelity Digital Assets, in a recent report, highlighted this shift in perception.

Sygnum’s Role in the Evolving Crypto Landscape

Sygnum is strategically positioned to benefit from the increasing institutional adoption of digital assets. As a regulated crypto bank, it provides a secure and compliant platform for institutions to access a wide range of crypto services.

The company operates in key hubs like Singapore and the United Arab Emirates, where crypto adoption is growing rapidly. However, Sygnum’s CEO, Matthias Imbach, has cautioned that Switzerland, its home base, needs to maintain its innovative edge to remain a competitive crypto destination.

Key Takeaways:

- Christopher Giancarlo, former CFTC chair, joins Sygnum as a senior policy advisor.

- He will advise on regulations and strategic partnerships.

- Sygnum is a Swiss-based digital asset bank.

- Institutional adoption of digital assets is growing due to pro-crypto policies, Bitcoin ETF success, and advances in tokenization.

- Giancarlo’s expertise will help Sygnum navigate the evolving regulatory landscape.

This strategic appointment of Christopher Giancarlo signifies a pivotal moment for Sygnum and the broader digital asset industry, indicating a move towards greater institutional integration and regulatory maturity.