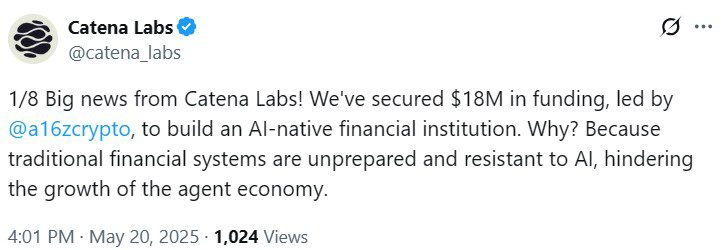

Circle co-founder Sean Neville has launched Catena Labs, an innovative project aimed at creating an “AI-native” financial institution. This venture seeks to leverage the power of artificial intelligence to transform traditional financial systems. Catena Labs secured $18 million in funding led by Andreessen Horowitz (a16z) Crypto, signaling strong investor confidence in the project’s potential.

Catena Labs envisions a fully regulated financial institution designed specifically for the AI economy. This institution will cater to both AI agents and human collaborators, operated by AI workers under human oversight, and managed with AI-specific risk management and compliance protocols.

The Need for AI-Native Financial Systems

Catena Labs argues that current financial systems are ill-equipped to handle the demands of AI technology. These systems are often resistant to AI integration, hindering the growth of the agent economy. Neville stated that AI agents will soon conduct a significant portion of economic transactions, but the existing financial infrastructure is unprepared for this shift.

Traditional systems are described as slow, expensive, and inflexible, creating friction in global transactions and failing to meet the unique needs and risks associated with AI. This realization prompted the creation of an AI-native financial institution designed to address these challenges.

“We’re building an AI-native financial institution that will give AI agents, and the businesses and consumers they serve, the ability to transact safely and efficiently,” Neville explained.

Agent Commerce Kit (ACK): A Building Block for the Future

Catena Labs has also introduced the Agent Commerce Kit (ACK), an open-source set of patterns, components, and emerging protocols for verifiable agent identity. This kit serves as an early building block for the development of AI-native financial solutions.

Stablecoins: The “AI-Native” Money

While AI agents can utilize traditional financial systems, Catena Labs believes that they gain significant advantages when paired with stablecoins, which they consider “AI-native money.” Regulated stablecoins like USDC facilitate near-instant, low-cost, and global transactions, making them ideal for AI agents.

“Using AI-native money, agents can unlock new business models and greater prosperity for humans and businesses,” Catena Labs emphasized.

Key Benefits of an AI-Native Financial Institution:

- Efficiency: Streamlined transactions and reduced processing times.

- Cost-Effectiveness: Lower transaction fees and operational costs.

- Global Reach: Seamless international transactions.

- Flexibility: Adaptable to the unique needs of AI agents and the AI economy.

- Risk Management: AI-specific compliance and security measures.

The Future of Finance with AI

Catena Labs’ vision represents a significant step towards the future of finance, where AI plays a central role. By creating a financial institution specifically designed for AI agents, the company aims to unlock new possibilities for economic growth and innovation. The project’s success could pave the way for a new era of AI-driven financial systems, transforming how businesses and individuals interact with money.

How Will This Affect Traditional Banking?

The emergence of AI-native financial institutions like Catena Labs raises questions about the future of traditional banking. While traditional banks may initially view these new entities as niche players, the long-term impact could be significant. Here’s a breakdown of potential impacts:

- Increased Competition: AI-native institutions could offer more efficient and cost-effective services, attracting customers who value speed and low fees.

- Pressure to Innovate: Traditional banks will need to accelerate their adoption of AI and other technologies to remain competitive.

- New Regulatory Challenges: Regulators will need to adapt to the unique risks and opportunities presented by AI-driven financial systems.

- Potential for Collaboration: Traditional banks could partner with AI-native institutions to leverage their technology and expertise.

The Role of Stablecoins

Stablecoins are poised to play a critical role in the AI economy. Their stability, speed, and low transaction costs make them ideal for AI agents that need to make frequent and small-value transactions. The use of stablecoins could also reduce the need for intermediaries, further streamlining financial processes.

Challenges and Considerations

While the potential benefits of AI-native financial institutions are significant, there are also challenges and considerations to keep in mind:

- Security Risks: AI systems are vulnerable to hacking and manipulation, which could compromise the security of financial transactions.

- Bias and Discrimination: AI algorithms can perpetuate existing biases, leading to unfair or discriminatory outcomes.

- Regulatory Uncertainty: The regulatory landscape for AI-driven financial systems is still evolving, creating uncertainty for businesses.

- Ethical Considerations: It is essential to ensure that AI systems are used ethically and responsibly.

Catena Labs’ initiative is a bold step toward a future where AI is deeply integrated into finance. As the AI economy continues to grow, AI-native financial institutions will likely play an increasingly important role.