Circle (CRCL) Soars 167% in NYSE Debut: What Does It Mean for USDC and the Stablecoin Market?

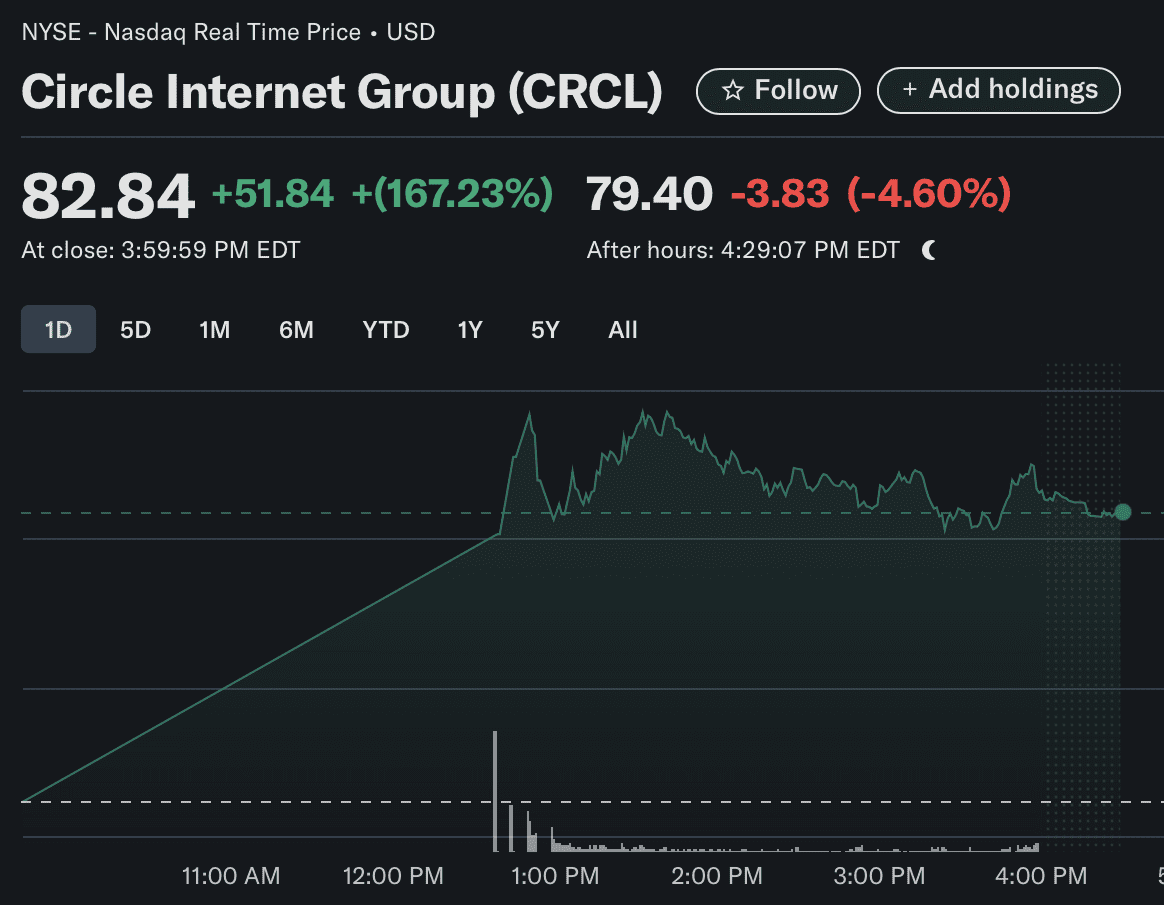

Stablecoin issuer Circle made a strong entry into the public market on June 5, with its shares climbing 167% on its first trading session on the New York Stock Exchange (NYSE).

Under the CRCL ticker, Circle’s shares opened at $31, surging 235% in the first hours of negotiation before closing at $82 at the end of the day. The company’s performance hints at a growing market appetite for stablecoin businesses.

The oversubscribed round had some significant tailwinds. On May 28, the world’s largest asset manager, BlackRock, revealed it was eyeing a 10% stake in the IPO. Cathie Wood’s ARK Investment was reportedly interested in buying $150 million worth of shares of the offering.

The demand led Circle to boost its offer to a marketed range of $1.05 billion, with 34 million shares available to investors.

Circle is behind the dollar-pegged stablecoin USDC (USDC). The company has been working on the offer for the past few months but ultimately delayed plans citing macroeconomic uncertainty caused by ongoing trade wars.

Quick Summary of the News

- Circle’s stock (CRCL) rose 167% on its NYSE debut on June 5th.

- Shares opened at $31 and closed at $82 after surging as high as 235% intraday.

- BlackRock reportedly considered taking a 10% stake in the IPO.

- The IPO was upsized to $1.05 billion due to strong demand.

- Circle is the issuer of the USDC stablecoin.

Why It Matters

Circle’s successful IPO is a significant event for several reasons. First, it demonstrates growing mainstream acceptance of stablecoins. Institutional investors like BlackRock showing interest provides further validation and could pave the way for greater adoption of USDC and other stablecoins in traditional financial markets.

Second, it signifies a potential turning point for the crypto market as a whole. A positive IPO performance from a major crypto company can boost investor sentiment and attract more capital to the space, especially after a prolonged period of market volatility and negative headlines. This could have a ripple effect, benefiting other crypto companies and projects.

Market Impact

While it’s still early days, Circle’s IPO could have several impacts on the market:

- Increased confidence in USDC: A strong performance could reinforce trust in USDC as a reliable stablecoin.

- Greater adoption of stablecoins: The IPO could encourage more businesses and individuals to use stablecoins for payments and other transactions.

- More institutional investment in crypto: Circle’s success might attract more institutional investors to the crypto market, leading to further growth and stability.

Expert Take or Personal Insight

Circle’s IPO performance is undoubtedly a positive sign for the crypto industry. However, it’s important to remember that the market can be volatile. While the initial surge in the stock price is encouraging, it’s crucial to monitor the company’s performance over the long term to see if it can sustain this momentum. I predict we’ll see increased regulatory scrutiny on Circle and the stablecoin market as a whole, which could impact its future growth.

Actionable Insight

For traders and investors, here are some key things to watch:

- CRCL stock price: Keep an eye on the stock’s performance in the coming weeks and months.

- USDC market cap: Monitor USDC’s market capitalization to see if it increases as a result of the IPO.

- Regulatory developments: Stay informed about any new regulations that could affect Circle or the stablecoin market.

Conclusion

Circle’s successful IPO is a significant milestone for the company and the crypto industry as a whole. It signals growing investor confidence in stablecoins and could pave the way for greater adoption in the future. While there are still challenges ahead, Circle’s debut is a positive sign for the long-term growth of the crypto market.