Coinbase is actively advocating for a change in the U.S. Office of Government Ethics (OGE) rule that prevents Securities and Exchange Commission (SEC) staff from holding cryptocurrencies. Chief Legal Officer Paul Grewal argues that hands-on experience with crypto assets is essential for SEC staff to develop a comprehensive understanding of the technology and its implications for regulation.

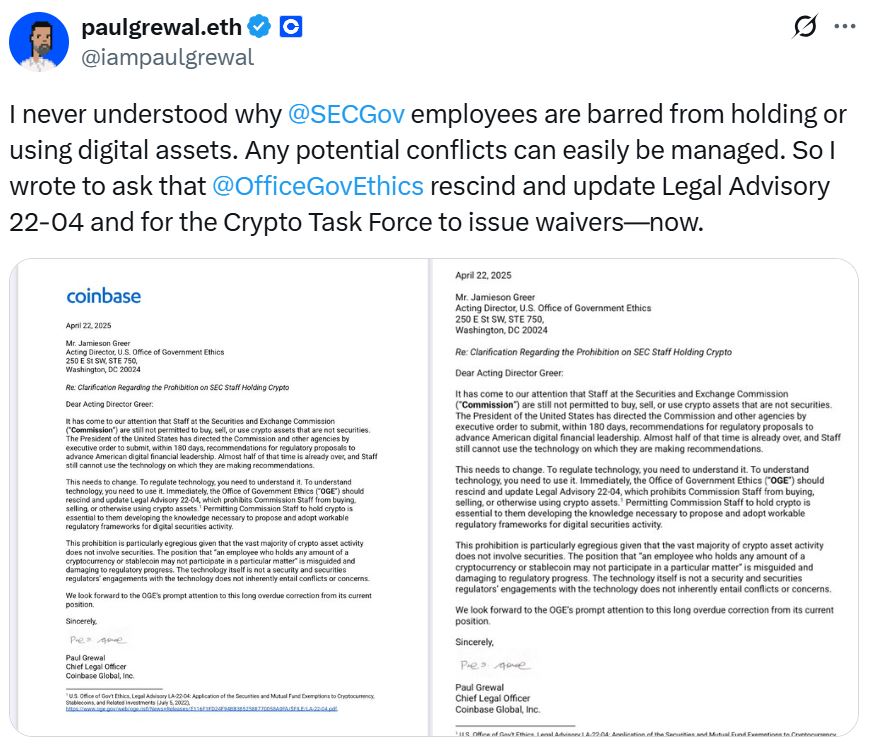

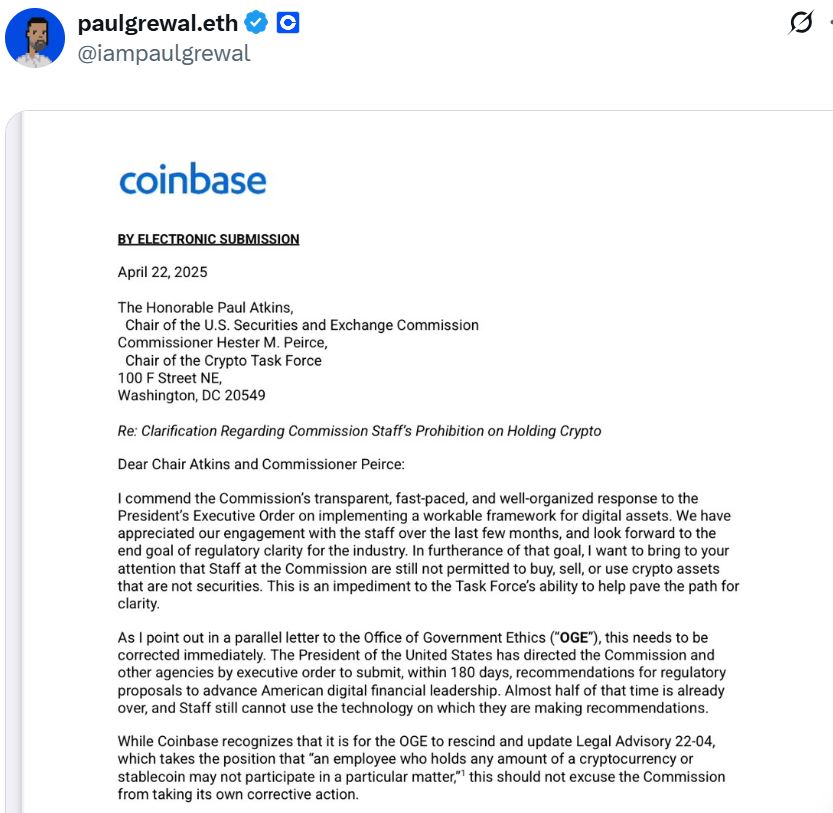

In open letters addressed to OGE Acting Director Jamieson Greer and SEC Chair Paul Atkins, Grewal emphasized the necessity for regulators to engage with the technology they oversee. He stated, “To regulate technology, you need to understand it. To understand technology, you need to use it.” Grewal believes that allowing SEC staff to hold crypto assets will enable them to gain the practical knowledge required to propose and implement effective regulatory frameworks for digital securities.

The current OGE Legal Advisory 22-04, issued in July 2022, prohibits SEC staff from buying, selling, or using cryptocurrencies and stablecoins, categorizing them differently from publicly traded securities. Coinbase contends this restriction hinders the SEC’s ability to effectively regulate the crypto space.

Coinbase’s Argument for Waivers

Grewal highlighted that with the increasing focus on crypto regulation, particularly following directives for agencies to submit recommendations, SEC staff should not be barred from using the very technology they are tasked with regulating. He suggests that the SEC should consider issuing waivers, especially to members of the Crypto Task Force actively involved in shaping crypto regulations. This would allow them to directly experience and evaluate the technology.

The push for regulatory clarity in the crypto space has seen various developments, including shifts in the SEC’s approach to lawsuits against crypto firms. For example, the SEC opted out of a swathe of lawsuits against crypto firms, including Coinbase, on Feb. 27 and, in a more recent April 24 walkback, flagged plans to drop its enforcement against blockchain firm Dragonchain.

Key Arguments for SEC Staff Crypto Holdings:

- Enhanced Understanding: Practical experience with crypto provides a deeper understanding of the technology’s intricacies.

- Effective Regulation: Informed regulators are better equipped to create appropriate and workable regulatory frameworks.

- Consistency: Allowing staff to hold crypto aligns with measures taken in similar advisory situations.

The Broader Context of Crypto Regulation

The debate surrounding crypto regulation has intensified in recent years, with various stakeholders expressing differing views on the appropriate level of oversight. Some argue for strict regulations to protect consumers and prevent illicit activities, while others advocate for a more laissez-faire approach to foster innovation and growth. The departure of former SEC Chair Gary Gensler, known for his stringent stance on crypto, marked a potential shift in the regulatory landscape.

Ultimately, the decision regarding whether SEC staff should be allowed to hold crypto rests with the OGE and the SEC itself. However, Coinbase’s advocacy underscores the importance of ensuring that regulators have the necessary knowledge and experience to effectively navigate the complex world of digital assets.