Coinbase is facing a new lawsuit stemming from a recent data breach and alleged non-compliance with a UK regulatory agreement. This proposed class-action lawsuit, filed on May 22nd in a Pennsylvania federal court, alleges that these issues led to a significant drop in Coinbase’s stock price, resulting in financial damages for investors.

Key Takeaways:

- Data Breach: Coinbase disclosed a data breach where customer support agents were bribed to access user data, potentially costing the company up to $400 million.

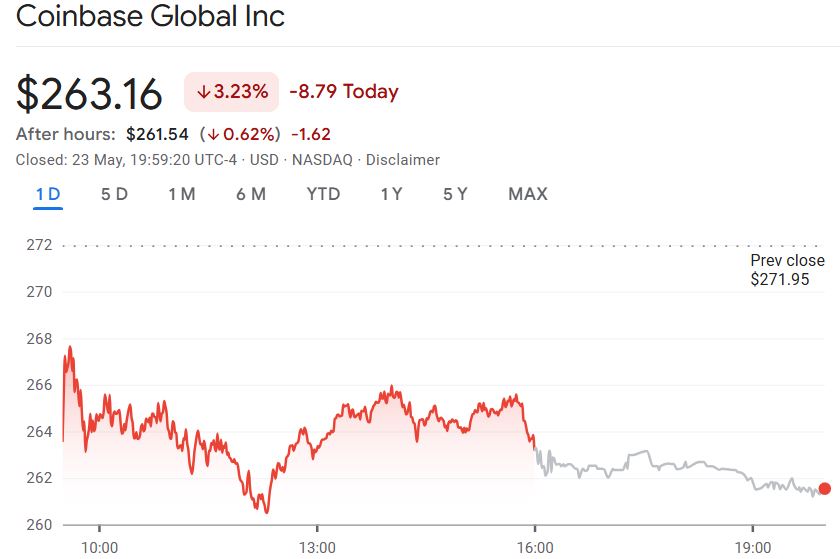

- Stock Price Impact: The lawsuit claims Coinbase’s stock (COIN) dropped 7.2% upon disclosure of the data breach.

- UK Regulatory Breach: The lawsuit also alleges Coinbase violated an agreement with the UK’s Financial Conduct Authority (FCA) regarding onboarding high-risk customers.

- Investor Claims: Investors claim they suffered losses due to the stock drop caused by these events and that Coinbase failed to disclose the FCA agreement violation when listing on the Nasdaq.

The Data Breach and Extortion Attempt

On May 15th, Coinbase revealed that it had been targeted by cybercriminals who stole customer data after bribing customer support agents. This incident led to an extortion attempt, with potential damages estimated at up to $400 million. The lawsuit alleges that this disclosure directly impacted the company’s stock price.

Stock Market Reaction

According to the lawsuit, Coinbase’s stock (COIN) fell by 7.2% on May 15th following the data breach disclosure. While the stock rebounded somewhat the following day, closing at $266, it highlights the immediate negative reaction from the market. The stock closed at $263 on May 23rd, down over 3% for the day.

Alleged Breach of UK Regulatory Agreement

The lawsuit also points to a previous incident involving the UK’s Financial Conduct Authority (FCA). In July 2024, the FCA fined Coinbase’s UK arm $4.5 million for violating a 2020 agreement that prohibited the exchange from onboarding customers deemed high-risk. The FCA stated that Coinbase onboarded over 13,000 high-risk customers and offered them crypto services.

The lawsuit claims that this fine caused Coinbase’s stock to fall by over 5% on July 25, 2024. Furthermore, it alleges that Coinbase did not disclose this breach when it first listed its shares on the Nasdaq in April 2021, artificially inflating the stock price.

Investor Allegations

The lead plaintiff, Brady Nessler, claims that she would not have purchased Coinbase stock at the artificially inflated prices had she known about the violation of the agreement with the FCA. The lawsuit seeks damages and a jury trial on behalf of anyone who purchased Coinbase stock between April 14, 2021, and May 14, 2025. Coinbase CEO Brian Armstrong and CFO Alesia Haas are also named as defendants.

Other Legal Challenges

Coinbase is facing other legal challenges as well. Another lawsuit filed in Illinois alleges that the company failed to properly notify users about the collection, storage, and sharing of their biometric data, violating Illinois’ biometric privacy law.

Impact on Coinbase and the Crypto Market

This latest lawsuit adds to the growing legal challenges facing Coinbase. The allegations of a data breach, stock manipulation, and regulatory non-compliance could have significant implications for the company’s reputation and financial stability.

The outcome of these legal battles could also have broader implications for the cryptocurrency market as a whole. Increased regulatory scrutiny and concerns about data security could impact investor confidence and slow down the adoption of cryptocurrencies.

Expert Opinion and Analysis

Industry experts suggest that Coinbase needs to prioritize data security and regulatory compliance to regain investor trust and mitigate future legal risks. This includes strengthening internal security protocols, enhancing transparency with regulatory bodies, and improving communication with investors.

Furthermore, the lawsuit highlights the importance of due diligence for investors in the cryptocurrency market. Understanding the regulatory landscape and potential risks associated with investing in crypto assets is crucial for making informed decisions.

Conclusion

The lawsuit against Coinbase underscores the challenges and risks associated with the rapidly evolving cryptocurrency industry. The outcome of this case will be closely watched by investors, regulators, and the broader crypto community, as it could set a precedent for future legal actions and regulatory oversight in the sector.