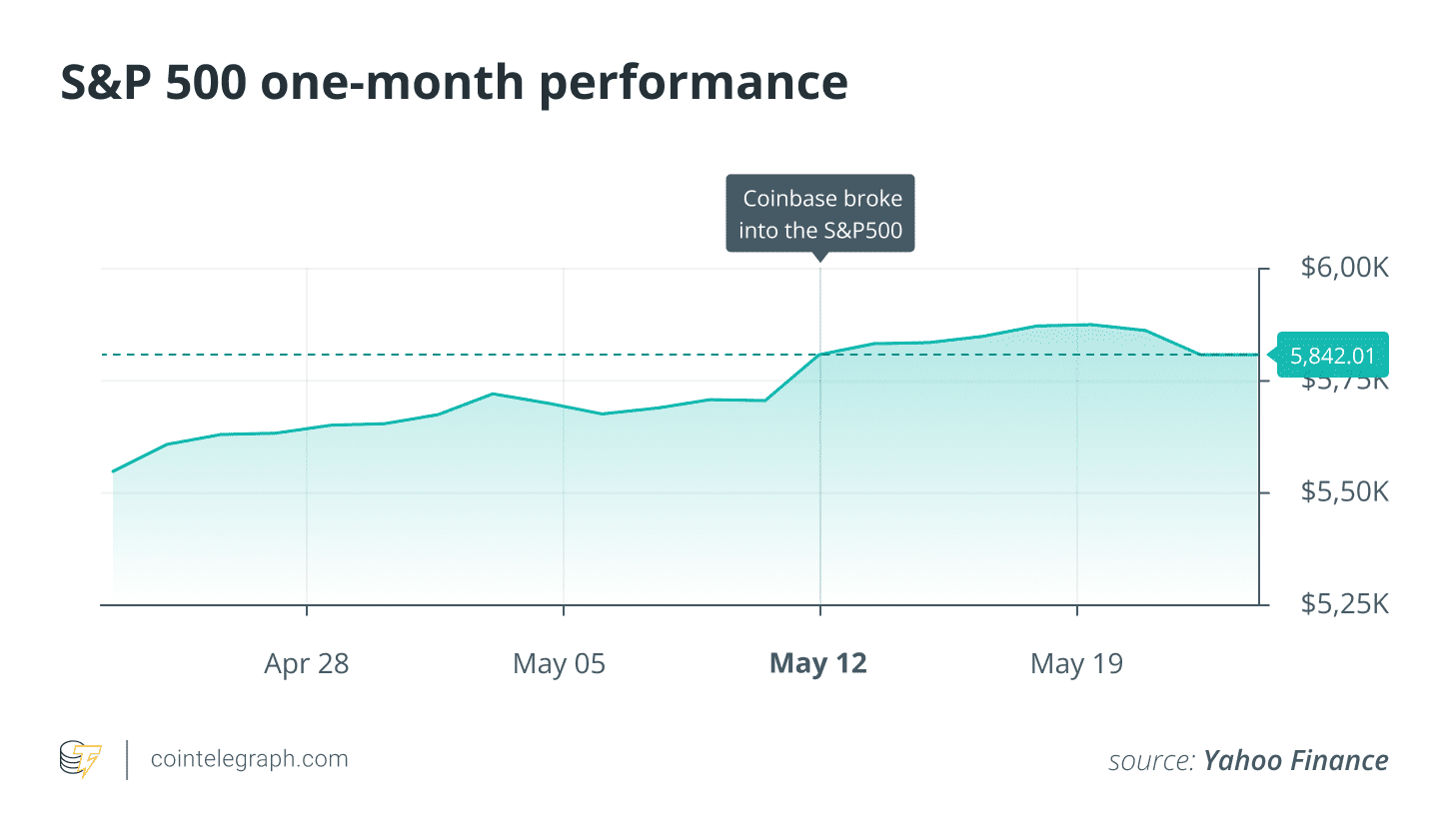

Coinbase’s recent addition to the S&P 500, a premier stock index, represents a significant achievement for the cryptocurrency industry. This move signifies a growing acceptance of crypto assets within mainstream finance and could pave the way for other crypto firms to follow suit.

Coinbase’s S&P 500 Inclusion: A Triumph for Crypto

Coinbase’s inclusion in the S&P 500 marks a turning point for the crypto industry, signaling increased legitimacy and potential for further integration with traditional finance. Here’s why it matters:

- Legitimacy: Inclusion in a major index like the S&P 500 signals to institutional investors that crypto infrastructure has matured and is a credible part of the financial ecosystem.

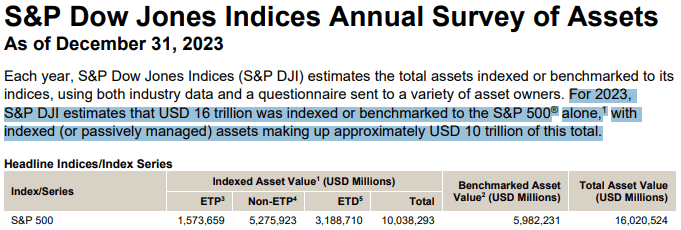

- Passive Investment: Index funds that track the S&P 500 must now allocate capital to Coinbase, leading to billions of dollars in potential passive investment flows.

- Mainstream Exposure: Equity investors in S&P 500 index funds now have indirect exposure to crypto through Coinbase.

As Meryem Habibi, chief revenue officer of Bitpace, stated, this milestone goes beyond Coinbase and “cements the legitimacy of an entire asset class.”

The Impact of Index Inclusion

Coinbase’s presence in the S&P 500 has several far-reaching impacts:

- Capital Inflow: Estimates suggest Coinbase could see as much as $10 billion in new capital inflows due to passive investing in S&P 500 tracking funds.

- Institutional Acceptance: The move underscores that public markets are increasingly valuing regulatory compliance, operational maturity, and long-term vision within the crypto space.

- Broader Adoption: The inclusion normalizes crypto exposure in conservative portfolios, potentially leading to indirect adoption by retirement plans and sovereign wealth funds.

Despite past legal battles with the SEC, Coinbase’s inclusion highlights the growing acceptance of crypto in mainstream finance. Benchmark analyst Mark Palmer noted that this “normalizes crypto exposure in conservative portfolios.”

The Path to Convergence: Crypto and TradFi

The inclusion of Coinbase in the S&P 500 raises questions about the ongoing convergence of crypto and traditional finance (TradFi). While some experts believe full convergence is still a ways off, others argue that it’s already underway.

Arguments for Convergence:

- Infrastructure Solutions: Examples include JPMorgan’s Onyx platform, Nasdaq’s digital asset custody infrastructure, and PayPal’s PYUSD stablecoin.

- Mutual Reliance: TradFi firms are increasingly relying on crypto-native firms for infrastructure needs, as evidenced by Coinbase’s role as custodian for multiple ETFs.

- Acquisitions: The acquisition of Bitstamp by Robinhood and Ninja Trader by Kraken show a move towards convergence.

Arguments Against Full Convergence:

- Scale: Crypto remains a small fraction of the overall economy.

- Payment Adoption: True convergence will occur when traditional finance companies widely adopt crypto as a means of payment.

Owen Lau, executive director at Oppenheimer & Co, believes that TradFi-crypto convergence is happening and will continue. Kennard adds that regulatory clarity is still emerging, but institutional rails are being laid fast.

Who’s Next? Potential Crypto Firms for S&P 500 Inclusion

While Coinbase’s inclusion is a major step, the bar for other crypto firms to join the S&P 500 remains high. Key requirements include:

- Large Market Capitalization

- Profitability: Candidates must demonstrate profitability in the most recent year and quarter.

Several firms have been mentioned as possible contenders, but face challenges:

- Galaxy Digital: Newly listed on Nasdaq but needs consistent profitability.

- MicroStrategy (MSTR): Has the market cap but struggles to meet earnings requirements.

- Marathon Digital & Riot Platforms: May be too early in their journey.

Seoyoung Kim, associate professor of finance at Santa Clara University, suggests that existing S&P 500 firms may increasingly adopt blockchain/crypto services before another “true-blue” crypto firm joins the index.

Conclusion: A New Era for Crypto

Coinbase’s inclusion in the S&P 500 is a watershed moment, signifying the growing integration of crypto into the mainstream financial system. While challenges remain, this milestone sets the stage for further innovation and collaboration between the crypto and traditional finance worlds. Whether other crypto firms will soon follow remains to be seen, but the door is now open for a new era of institutional-grade crypto finance.