Coinbase, a leading cryptocurrency exchange, has launched the Coinbase Bitcoin Yield Fund (CBYF) on May 1st, designed to offer institutional investors outside the U.S. exposure to Bitcoin (BTC) with a targeted annual net return of 4% to 8%. This initiative addresses the increasing institutional demand for Bitcoin yield and aims to bridge the gap between traditional investment strategies and the emerging digital asset landscape.

What is the Coinbase Bitcoin Yield Fund?

The Coinbase Bitcoin Yield Fund (CBYF) is a new investment product by Coinbase Asset Management that allows institutional investors to earn yield on their Bitcoin holdings. This is particularly significant because Bitcoin, unlike Ether (ETH) or Solana (SOL), doesn’t natively support staking for passive income generation. CBYF offers a solution, aiming to lower the investment and operational risks typically associated with Bitcoin yield products.

Key Features of the Coinbase Bitcoin Yield Fund:

- Targeted Returns: Aims for a 4% to 8% annual net return.

- Institutional Focus: Designed specifically for institutional investors outside the U.S.

- Cash-and-Carry Strategy: Generates yield through the difference between spot Bitcoin prices and derivatives.

- Risk Mitigation: Seeks to reduce investment and operational risks associated with other Bitcoin yield products.

How Does the Fund Generate Yield?

The fund employs a cash-and-carry strategy to generate yield. This involves simultaneously buying Bitcoin in the spot market and selling Bitcoin futures contracts. The difference between the spot price and the futures price (the “carry”) is captured as profit, generating yield for the fund’s investors. This strategy is designed to be relatively low-risk compared to other yield-generating activities in the crypto space.

Why is Coinbase Launching This Fund?

Coinbase cites growing institutional crypto adoption as the primary driver behind launching the fund. The company believes that institutions are increasingly looking for ways to gain exposure to Bitcoin and generate yield, but are often deterred by the complexities and risks involved. CBYF aims to provide a more accessible and secure way for institutions to participate in the Bitcoin market.

The Role of Institutional Investors in Bitcoin’s Price Recovery

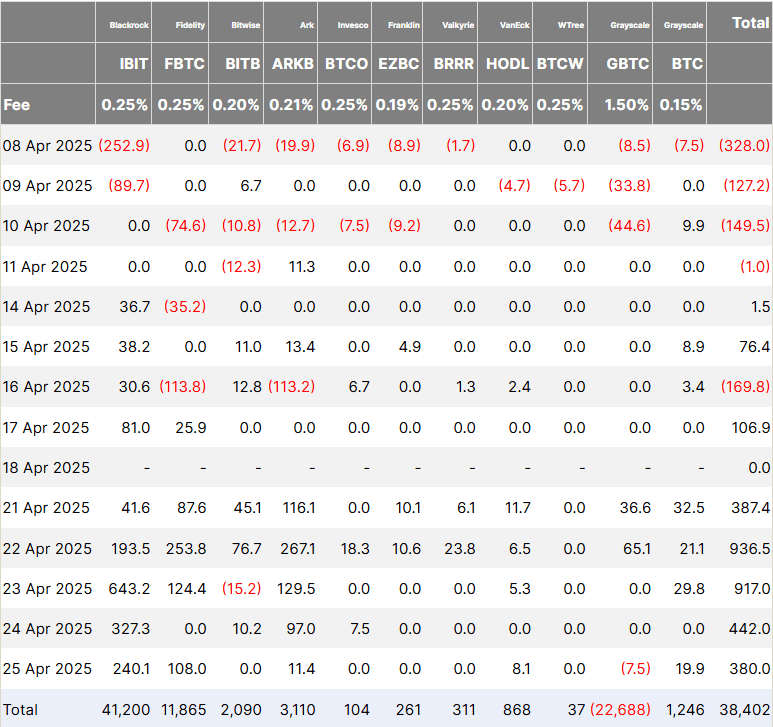

The launch of the Bitcoin Yield Fund coincides with a period of significant price recovery for Bitcoin, driven in large part by institutional interest. Bitcoin rose by over 9% in the week leading up to April 28th, fueled by substantial inflows into Bitcoin ETFs. According to Farside Investors data, these ETFs recorded their second-highest week of inflows, exceeding $3 billion.

Ryan Lee, chief analyst at Bitget Research, noted that Bitcoin’s recovery to $94,000 was primarily supported by ETF inflows and corporate buying, with retail interest lagging behind. He suggested that a break above $100,000 could reignite retail interest, driven by media hype and FOMO (fear of missing out).

Aspen Digital’s Involvement

The Coinbase Bitcoin Yield Fund is backed by multiple investors, including Aspen Digital, a digital asset manager based in Abu Dhabi and regulated by the Financial Services Regulatory Authority. This partnership underscores the growing institutional acceptance of Bitcoin and the increasing integration of digital assets into the traditional financial system.

Bitcoin ETFs and Institutional Adoption

The surge in Bitcoin ETF inflows highlights the increasing appetite among institutional investors for Bitcoin exposure. These ETFs provide a regulated and convenient way for institutions to invest in Bitcoin without directly holding the asset. The success of Bitcoin ETFs has been a key factor in driving Bitcoin’s recent price recovery and attracting further institutional investment.

Expert Predictions and Market Sentiment

On April 21st, BitMEX co-founder Arthur Hayes predicted that it might be the last chance to buy Bitcoin below $100,000, anticipating that upcoming US Treasury buybacks could trigger the next major catalyst for Bitcoin’s price. This highlights the bullish sentiment among some market participants and the expectation of further price appreciation driven by macroeconomic factors.

Conclusion

Coinbase’s launch of the Bitcoin Yield Fund represents a significant step towards mainstream adoption of Bitcoin by institutional investors. By offering a relatively low-risk and accessible way to generate yield on Bitcoin holdings, CBYF has the potential to attract significant capital inflows and further legitimize Bitcoin as an asset class. The fund’s success will depend on its ability to consistently deliver targeted returns while effectively managing risk. As institutional interest in Bitcoin continues to grow, products like CBYF are likely to play an increasingly important role in the evolution of the cryptocurrency market.