Two former executives from the now-bankrupt crypto lending platform, Cred, have pleaded guilty to wire fraud, marking a significant development in the aftermath of the company’s collapse. Daniel Schatt, former CEO, and Joseph Podulka, former CFO, admitted to the charges as part of a plea agreement with prosecutors.

Key Takeaways:

- Former Cred executives Daniel Schatt and Joseph Podulka pleaded guilty to wire fraud.

- Sentencing is scheduled for August 26, with potential penalties of up to 20 years in prison and significant fines.

- Customer losses from Cred’s collapse are estimated between $65 million and $150 million.

- The executives are accused of misleading customers about Cred’s lending practices and financial stability.

The Guilty Plea and Sentencing

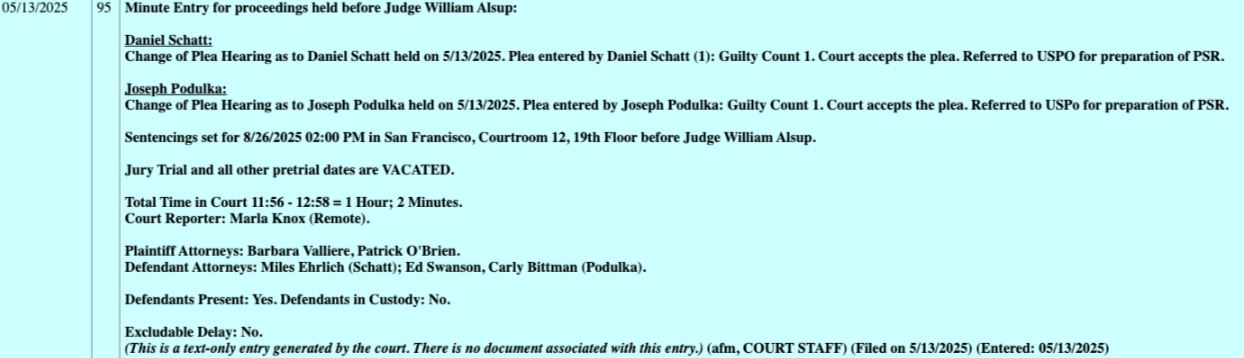

The guilty pleas were accepted by District Judge William Alsup, who has scheduled the sentencing hearing for August 26. The charges of wire fraud carry severe penalties, potentially including up to 20 years in prison and fines reaching $250,000 for individuals and $500,000 for businesses. According to court filings, prosecutors have suggested a possible sentence range of up to 72 months for Schatt and up to 62 months for Podulka.

Details of the Fraud

As part of the plea agreement, Schatt and Podulka admitted to selectively presenting positive information while concealing negative news to induce customers to lend their US currency and digital currencies to Cred. This deception played a significant role in the company’s eventual downfall and the substantial losses incurred by its customers. Prosecutors alleged that the Cred executives misled customers about Cred’s lending and investment practices and didn’t disclose that its loan book relied heavily on the Chinese firm MoKredit, which made unsecured microloans to Chinese gamers.

Customer Losses and Bankruptcy

When Cred filed for bankruptcy, customers faced losses totaling between $65 million and $150 million. While the company’s assets have since increased in market value, the initial collapse caused significant financial distress for many users. The defendants agreed that their actions led to these substantial losses. Former Cred chief commercial officer James Alexander was also hit with wire fraud and money laundering charges.

Cred’s Misleading Practices

The Cred executives are accused of several misleading practices, including:

- Claiming to engage only in collateralized lending.

- Asserting that all crypto investments were hedged.

- Failing to disclose the company’s heavy reliance on unsecured microloans to Chinese gamers through MoKredit.

These claims were allegedly false and contributed to a distorted perception of Cred’s risk profile among its customers.

Impact of Bitcoin Price Drop

The situation worsened when the price of Bitcoin (BTC) dropped by 40% on March 11, 2020. Cred struggled to meet its margin calls and teetered on the brink of insolvency. Instead of being transparent about the company’s financial difficulties, the executives allegedly sought out new customers while downplaying the risks involved.

Related Cases and the Broader Crypto Landscape

The Cred case is not an isolated incident. Other crypto founders have also faced legal consequences for similar misconduct. For example, Alex Mashinsky, the founder and former CEO of Celsius, received a 12-year prison sentence for fraud. Travis Ford, co-founder and head trader of Wolf Capital, pleaded guilty to wire fraud conspiracy charges for raising over $9 million from investors with false promises of high returns. These cases highlight the ongoing regulatory scrutiny and legal challenges within the crypto industry.

Looking Ahead

As the sentencing hearing approaches, the Cred case serves as a stark reminder of the importance of transparency and ethical conduct in the crypto space. The outcome of this case could set a precedent for future legal actions against crypto executives accused of fraud and financial misconduct. The crypto industry continues to evolve, regulatory bodies are working to establish clear guidelines and protections for investors.