Understanding Currency Debasement and the Need for Alternatives

Currency debasement, the intentional devaluation of a currency by a government, erodes purchasing power over time. In an era marked by increased monetary easing and inflation, investors are seeking alternative assets to preserve their wealth. Cryptocurrencies and Non-Fungible Tokens (NFTs) have emerged as potential solutions, offering unique properties that can potentially outpace traditional assets in a debasing currency environment.

Why Crypto? A Decentralized Store of Value

Cryptocurrencies like Bitcoin are designed with a limited supply, making them inherently resistant to inflation. This scarcity, combined with their decentralized nature, makes them attractive as a store of value. Key advantages of using crypto as a hedge include:

- Limited Supply: Bitcoin’s capped supply of 21 million coins ensures that it cannot be inflated by central banks.

- Decentralization: Cryptocurrencies operate outside of government control, shielding them from political and economic instability.

- Global Accessibility: Cryptocurrencies can be easily transferred across borders, providing a convenient way to store and move wealth.

NFTs: Beyond Speculation, a Store of Cultural and Digital Value

NFTs, unique digital assets representing ownership of items like art, collectibles, and virtual land, offer a different kind of value proposition. While some NFTs are purely speculative, others represent ownership of valuable digital and physical assets, and benefit from a network effect and strong community.

Raoul Pal, founder and CEO of Global Macro Investor, suggests that investors do not own enough crypto, and then they don’t own enough NFT’s, as art is upstream of wealth. He argues that NFTs are “the single best long term store of wealth I know and you get to buy it before network effects kick in.”

Key benefits of NFTs as a store of value:

- Uniqueness and Scarcity: Each NFT is unique, creating scarcity and potentially driving up value.

- Digital Ownership: NFTs provide verifiable ownership of digital assets, which can be especially valuable in the metaverse.

- Community and Utility: Some NFTs offer access to exclusive communities, experiences, or digital goods, adding utility and value.

The Role of NFTs in Asset Diversification

Nicolai Sondergaard, research analyst at Nansen, pointed out that NFTs and art become a vehicle for the wealthy once a certain level of wealth is reached, calling it a natural move for asset diversification. NFTs are partially about speculating on future returns, Sondergaard said, adding that NFTs benefit from the allure of strong communities, beyond just wealth creation.

NFT Art and the Future of Digital Ownership

Anndy Lian, author and intergovernmental blockchain expert, believes that art NFTs may see a resurgence as digital ownership gains acceptance among younger, tech-savvy cohorts. However, Lian noted that broader adoption depends on blockchain networks improving scalability and security to instill confidence, and art NFTs must transcend hype, anchoring value in cultural significance or utility.

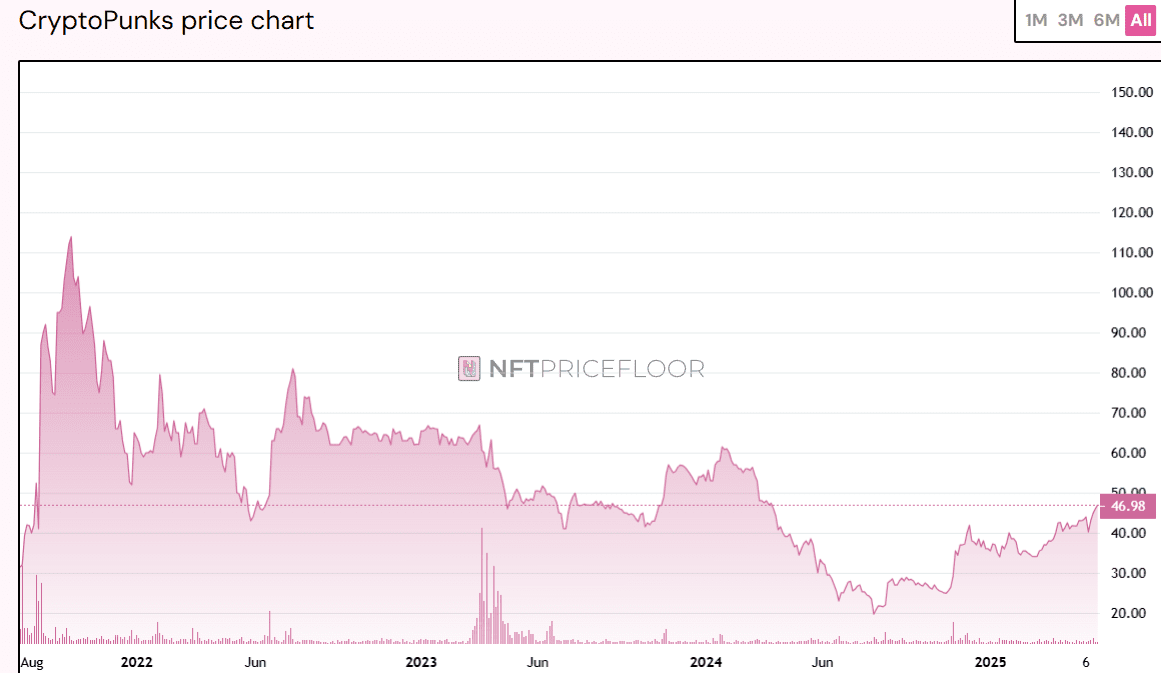

NFT Market Trends and Future Outlook

While the NFT market experienced a boom in 2021, it has since cooled off. However, experts believe that the market is poised for a recovery, potentially driven by profits from the next Bitcoin cycle top rotating into other digital assets. Yehudah Petscher, strategist at CryptoSlam NFT data platform and SlamAI, predicts that the peak of the NFT market is likely in Q1 2026.

Challenges and Considerations

Investing in crypto and NFTs comes with risks:

- Volatility: Crypto and NFT prices are highly volatile and can experience significant price swings.

- Regulation: The regulatory landscape for crypto and NFTs is still evolving and may impact their value.

- Security: Crypto and NFTs are susceptible to theft and scams, requiring careful storage and security measures.

Conclusion: Crypto and NFTs as Potential Hedges

Cryptocurrencies and NFTs offer a potential avenue for investors seeking to protect their wealth from currency debasement. While risks exist, their unique characteristics – scarcity, decentralization, digital ownership – make them compelling alternatives in an era of economic uncertainty. As the digital economy continues to grow, these assets may play an increasingly important role in preserving and growing wealth.