Key Takeaways:

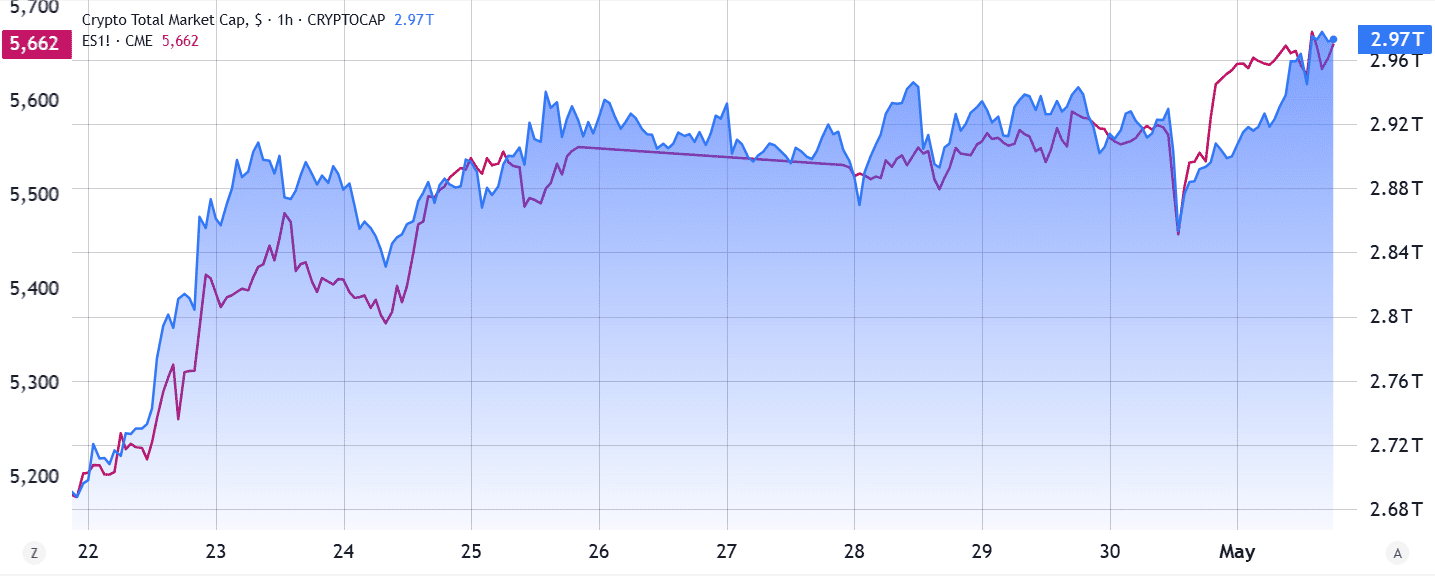

- Equities and crypto markets are currently correlated due to factors like Federal Reserve liquidity and corporate earnings.

- Despite weak US manufacturing data, both markets have shown resilience.

- The total crypto market capitalization has outperformed the S&P 500 in recent months.

For quite some time, cryptocurrency traders have been heavily invested in the concept of Bitcoin showing a clear “decoupling” from the traditional stock market. However, recent trends indicate a continued correlation between Bitcoin (BTC) and major altcoins with the S&P 500, even amidst ongoing global trade tensions.

The idea behind decoupling is that digital assets would be validated as an independent asset class, potentially offering a hedge against global economic uncertainty. The persistent correlation, however, raises questions about whether crypto’s fate is intertwined with the stock market’s performance and what it would take for a true divergence to occur.

Stock Market Resilience Amid Trade Tensions

The S&P 500, despite facing pressure from trade disputes and tariffs, has demonstrated considerable resilience. Recent reports suggest that the United States and China have been quietly engaging in trade negotiations, signaling potential concessions from both sides.

Positive responses to robust first-quarter earnings have also bolstered the stock market, as companies adapt to tariffs by diversifying production locations. For example, Microsoft reported substantial revenue growth and strong demand for AI, while Meta exceeded expectations with its earnings and revenue. This performance has eased concerns about an AI bubble and the potential impact of the trade war on corporate investments.

The Federal Reserve’s Influence

Market participants are closely watching the Federal Reserve’s policy decisions. After a period of balance sheet reduction, the Fed is now considering asset purchases to alleviate selling pressure. An increase in liquidity typically benefits risk assets, potentially supporting cryptocurrencies even if a full decoupling doesn’t materialize.

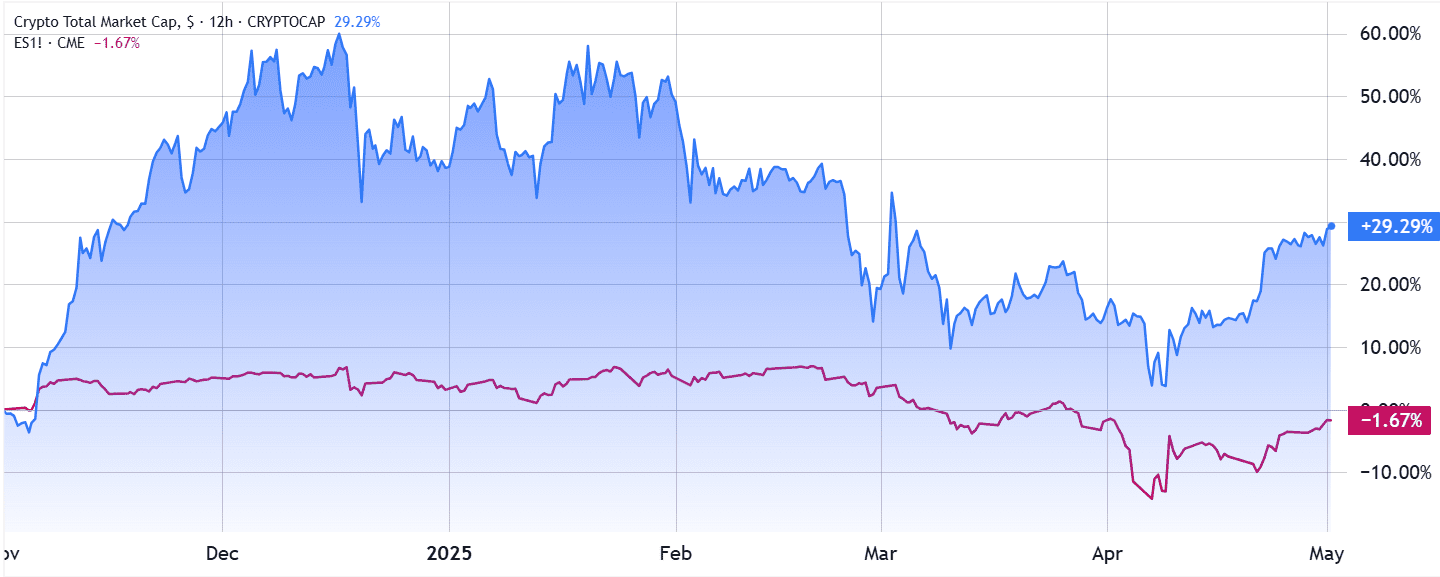

Crypto Market Outperformance: Despite the short-term correlation, the cryptocurrency market has shown superior performance compared to equities in recent months. Since March, the total crypto market capitalization has risen by 8.5%, while the S&P 500 has declined by 5.3%. Over a six-month timeframe, the divergence is even more significant, with crypto up 29% and the S&P 500 down 2%. This highlights that a perfect synchrony between the two markets is not always the case, especially when considering longer periods.

Factors Influencing the Crypto-Stock Correlation

Several factors contribute to the observed correlation:

- Macroeconomic Sentiment: Both crypto and stocks are influenced by overall macroeconomic sentiment. Positive economic news and investor confidence tend to boost both asset classes, while negative news can lead to declines.

- Risk Appetite: Both are considered risk assets. When investors are risk-averse, they tend to reduce their exposure to both crypto and stocks.

- Institutional Investment: Increased institutional investment in cryptocurrencies has further tied their performance to traditional financial markets.

- Regulatory Landscape: Regulatory developments can significantly impact both markets, leading to correlated price movements.

Potential Scenarios for Decoupling

While a complete decoupling is difficult to predict, certain scenarios could potentially lead to a divergence between crypto and stock market performance:

- Increased Adoption of Crypto as a Store of Value: If Bitcoin and other cryptocurrencies become widely accepted as a store of value, similar to gold, their price movements could become less correlated with traditional assets.

- Development of Unique Crypto Use Cases: The development of new and innovative use cases for blockchain technology and cryptocurrencies could drive demand independent of the stock market.

- Shift in Investor Perception: A shift in investor perception towards viewing crypto as a distinct asset class with its own fundamentals could lead to decoupling.

Conclusion

While it’s too early to definitively declare a bottom for the S&P 500 or to claim that the trade war is resolved, the current strength in equities suggests reduced risk aversion among investors. For now, the elevated correlation between cryptocurrencies and stocks might represent a favorable scenario for both markets, reflecting a shared sensitivity to macroeconomic factors and investor sentiment. Ultimately, the future relationship between these markets will depend on a complex interplay of economic, technological, and regulatory factors.