This week’s Crypto Biz explores key trends and developments shaping the cryptocurrency landscape. From innovative financial strategies leveraging Bitcoin to institutional adoption and the evolving role of stablecoins, we delve into the forces driving the market forward.

Hedging Against Currency Instability with Bitcoin

Mauricio di Bartolomeo, co-founder of Ledn, shares his experience of using Bitcoin as a hedge against fiat currency devaluation. Drawing parallels from his past experience shorting the Venezuelan Bolivar, he explains how borrowing against Bitcoin can be a strategy to safeguard against the weakening US dollar.

Di Bartolomeo emphasizes that borrowing against Bitcoin effectively positions you to hold a stronger asset (Bitcoin) while taking a short position on a potentially weaker currency (the US dollar). This strategy has gained traction, evident in Ledn’s significant loan book value.

Banco Industrial Integrates Crypto for Cross-Border Payments

Banco Industrial, Guatemala’s largest bank, has integrated SukuPay’s crypto infrastructure into its mobile banking app. This move enables users to receive US dollars more efficiently, marking a significant step towards mainstream adoption of blockchain technology in Latin America.

According to SukuPay CEO Yonathan Lapchik, the integration aims to make blockchain technology seamless for end-users. The partnership provides a flat fee for receiving USD, significantly lower than traditional remittance costs.

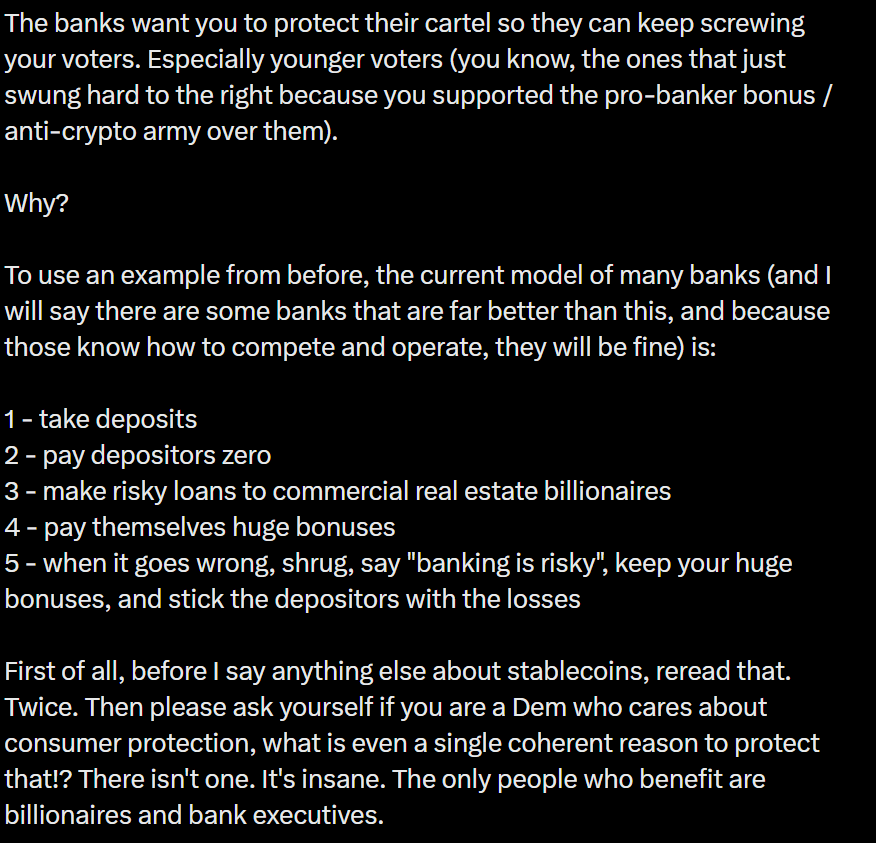

Bankers’ Concerns Over Yield-Bearing Stablecoins

NYU Professor Austin Campbell suggests that the traditional banking sector perceives yield-bearing stablecoins as a potential threat to their established business model. Banks rely on taking deposits, paying minimal interest, and investing those funds for higher returns, which yield-bearing stablecoins could disrupt by offering competitive interest rates.

Campbell highlights the potential impact of stablecoins on the banking industry, potentially altering the landscape of deposits and lending.

MicroStrategy’s Continued Bitcoin Accumulation

MicroStrategy, led by Michael Saylor, continues to bolster its Bitcoin holdings. The company recently acquired an additional 7,390 BTC, bringing its total holdings to a substantial amount. This purchase reaffirms MicroStrategy’s commitment to Bitcoin as a core treasury asset.

MicroStrategy’s accumulation demonstrates a strong belief in the long-term value of Bitcoin, as their unrealized gains from their Bitcoin holdings continue to grow.

Key Takeaways:

- Bitcoin as a Hedge: Bitcoin is being utilized as a tool to hedge against the devaluation of traditional currencies.

- Institutional Adoption: Banks are integrating crypto infrastructure to improve financial services, particularly in cross-border payments.

- Stablecoin Impact: Yield-bearing stablecoins are potentially disrupting traditional banking models.

- MicroStrategy’s Strategy: Continued accumulation of Bitcoin by companies like MicroStrategy demonstrates confidence in the asset’s long-term value.

These developments highlight the increasing integration of cryptocurrency into the financial system and the diverse strategies employed by businesses and individuals in navigating the evolving landscape.

Crypto Biz is your weekly pulse on the business behind blockchain and crypto, delivered directly to your inbox every Thursday.