Crypto Hack Losses Plummet 40% in May, but $244M Still Targeted: PeckShield Report

In May, the total amount stolen from crypto hacks declined drastically compared to April, with the largest incident making up around 90% of the month’s total, according to a blockchain security firm.

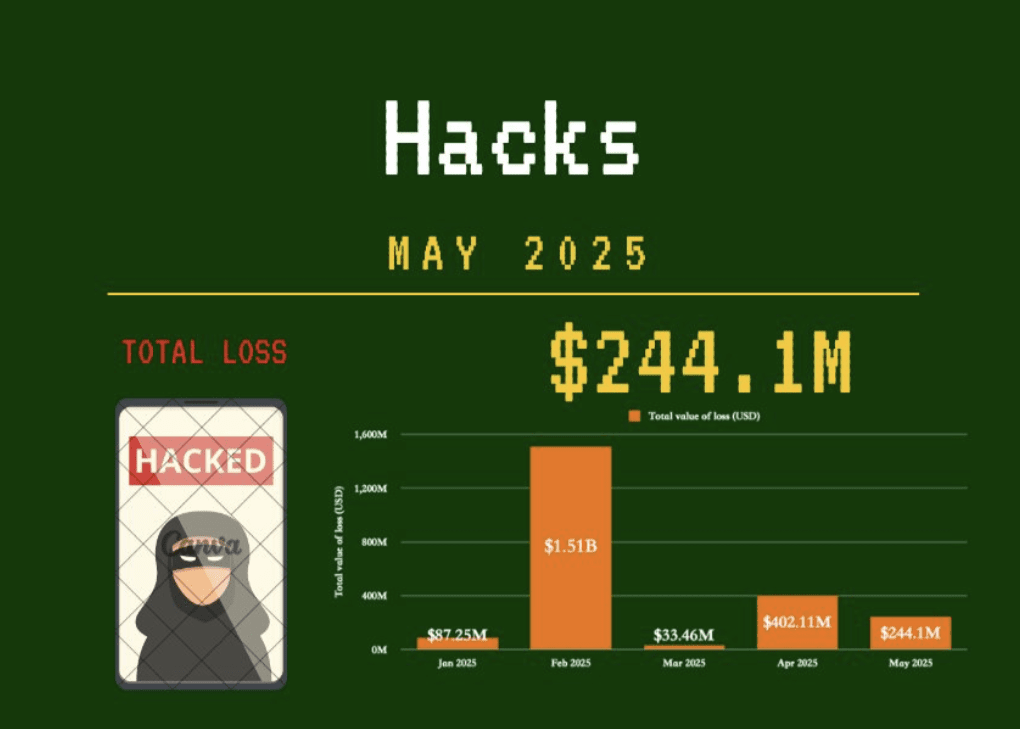

The decline comes as the crypto industry has been stepping up its efforts to stay ahead of hackers. “In May 2025, ~20 major crypto hacks were recorded, resulting in total losses of $244.1M — a 39.29% decrease from April,” blockchain security firm PeckShield said in a May 31 X post.

Quick Summary of the News

- Crypto hacks saw a 40% decrease in May compared to April, totaling $244.1 million in losses.

- The Cetus decentralized exchange hack accounted for approximately 90% of May’s total losses, amounting to $223 million.

- Around 71% ($157 million) of the stolen funds from the Cetus hack were successfully frozen.

- The second-largest hack targeted Cork Protocol, resulting in a $12 million loss.

- The crypto industry is actively increasing security measures to combat cybercrime.

Why It Matters

The decrease in overall hack losses is a positive sign, indicating that enhanced security measures within the crypto space may be starting to bear fruit. However, the concentration of losses in a single major hack (Cetus) highlights the persistent vulnerabilities within DeFi platforms. The ability to freeze a significant portion of the stolen funds also showcases the growing effectiveness of collaborative efforts between exchanges, blockchain security firms, and projects in mitigating the damage caused by these attacks. The fact that smaller protocols like Cork Protocol are still being targeted emphasizes the need for robust security audits and ongoing monitoring across the entire ecosystem.

Market Impact

While a single month’s data doesn’t establish a trend, a reduction in hack losses can have a positive impact on market sentiment. Reduced risk translates to increased investor confidence. The successful freezing of stolen funds also helps restore faith in the ability of the crypto community to respond effectively to security breaches. However, the constant threat of large-scale hacks continues to cast a shadow over the DeFi sector, potentially hindering wider adoption by institutional investors.

Expert Take or Personal Insight

While the drop in hack losses is encouraging, celebrating prematurely would be a mistake. The concentration of losses in the Cetus hack reveals that vulnerabilities persist, and sophisticated attackers will continue to seek out weaknesses. The focus should shift towards proactive security measures, including rigorous code audits, bug bounty programs, and real-time monitoring systems. Furthermore, enhanced collaboration between different actors in the crypto space is crucial to rapidly respond to and mitigate the impact of future attacks. I predict we will see a greater emphasis on insurance solutions and formal verification techniques to address these evolving threats.

Actionable Insight

- For Traders: Be extra cautious when interacting with smaller or newer DeFi platforms. Research their security track record and audit reports before committing funds.

- For Investors: Diversify your holdings across multiple platforms and asset types to minimize the impact of a potential hack. Consider using hardware wallets for long-term storage.

- For Developers: Prioritize security in your development process. Engage reputable security firms for audits and implement robust monitoring systems.

Conclusion

The decrease in crypto hack losses in May offers a glimmer of hope, but the industry must remain vigilant. The evolving threat landscape requires continuous innovation and collaboration to stay ahead of malicious actors. By prioritizing security and fostering a culture of proactive risk management, the crypto community can build a more resilient and trustworthy ecosystem for everyone.