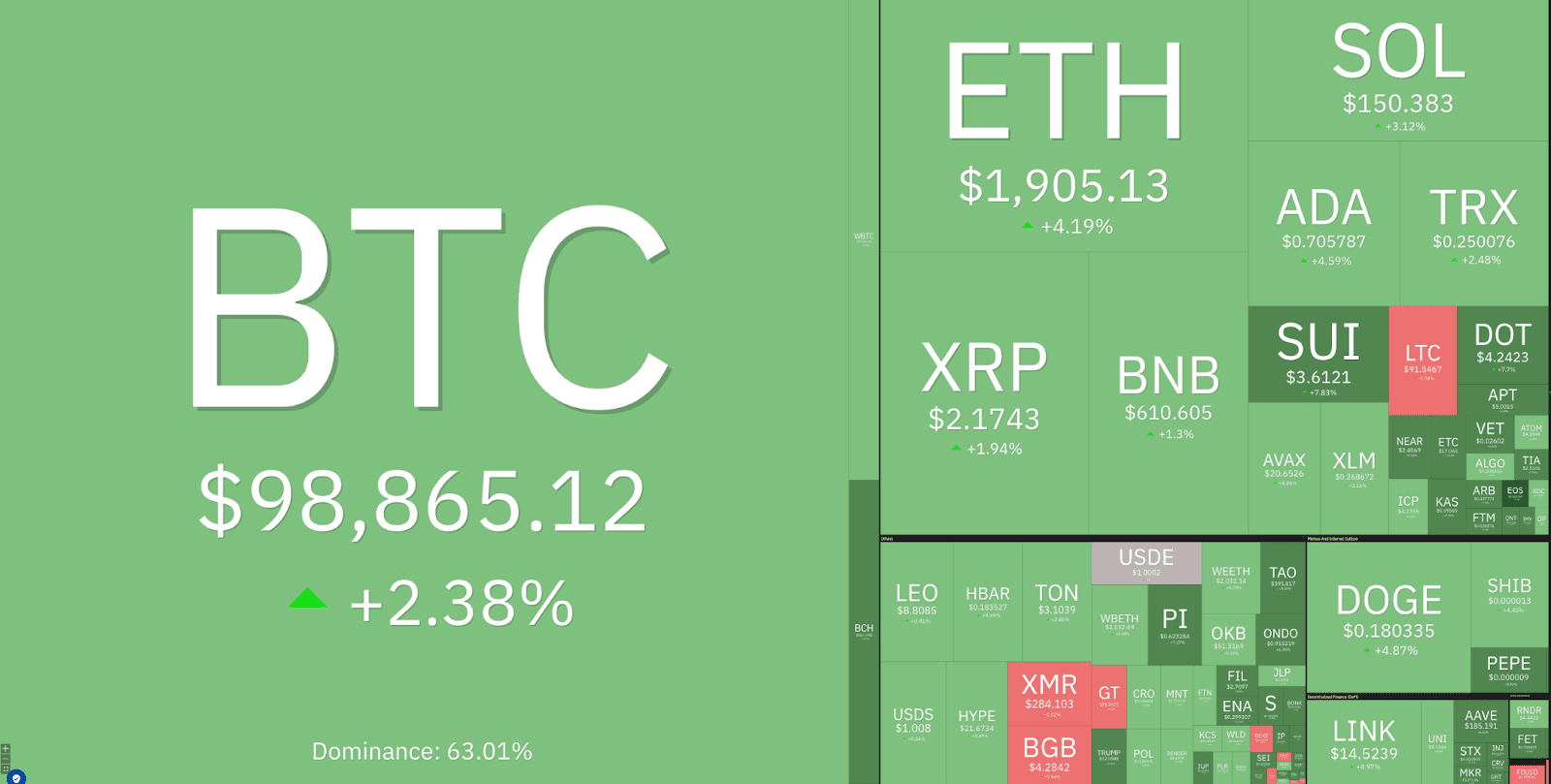

The cryptocurrency market is experiencing a significant upswing today, with the total market capitalization climbing by approximately 2.5% to reach $3.06 trillion on May 8. This resurgence marks a notable recovery, driven by a confluence of factors that are influencing investor sentiment and market dynamics.

Key Takeaways:

- The crypto market is up 2.5% on May 8, with its capitalization exceeding $3 trillion for the first time in over eight weeks.

- Bitcoin and Ether are leading the gains, fueled by factors like the Fed’s steady rates and stagflation concerns.

- Anticipation of a US-UK trade deal and a technical rebound further contribute to market optimism.

Factors Fueling the Crypto Market Surge:

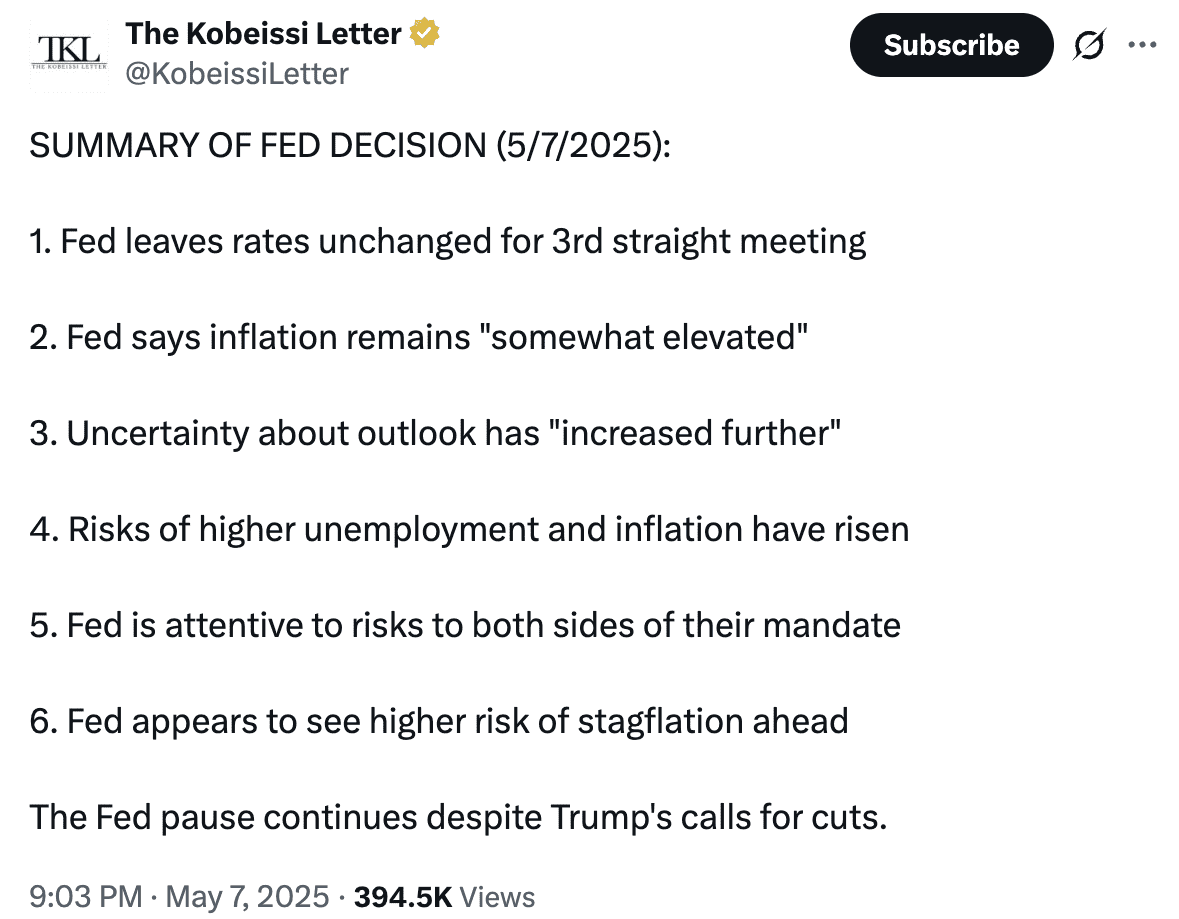

1. Federal Reserve’s Stance and Stagflation Fears:

The Federal Reserve’s recent decision to maintain steady interest rates within the 4.25%-4.50% range has played a crucial role in bolstering the appeal of cryptocurrencies. Fed Chair Jerome Powell’s commentary following the decision highlighted the growing risks of stagflation – a combination of slow economic growth and persistent inflation. This environment elevates Bitcoin’s attractiveness as a store of value, often compared to “digital gold.” Investors, seeking refuge from inflationary pressures eroding traditional fiat currencies, are increasingly turning to Bitcoin as a hedge, mirroring the trends observed during the 2020 monetary easing period when the crypto market experienced a substantial rally.

2. Anticipation of a US-UK Trade Deal:

Market optimism is further fueled by the anticipation of a potential trade agreement between the United States and the United Kingdom. Signals from the US administration suggest a pro-crypto stance, and reports indicate that a significant trade deal could be announced soon. Such a deal is perceived as a signal of de-escalation in global trade tensions, fostering increased risk appetite across various markets, including cryptocurrencies. Positive news surrounding this trade agreement has contributed to Bitcoin’s recent gains, extending its week-long rally as macroeconomic conditions show signs of improvement.

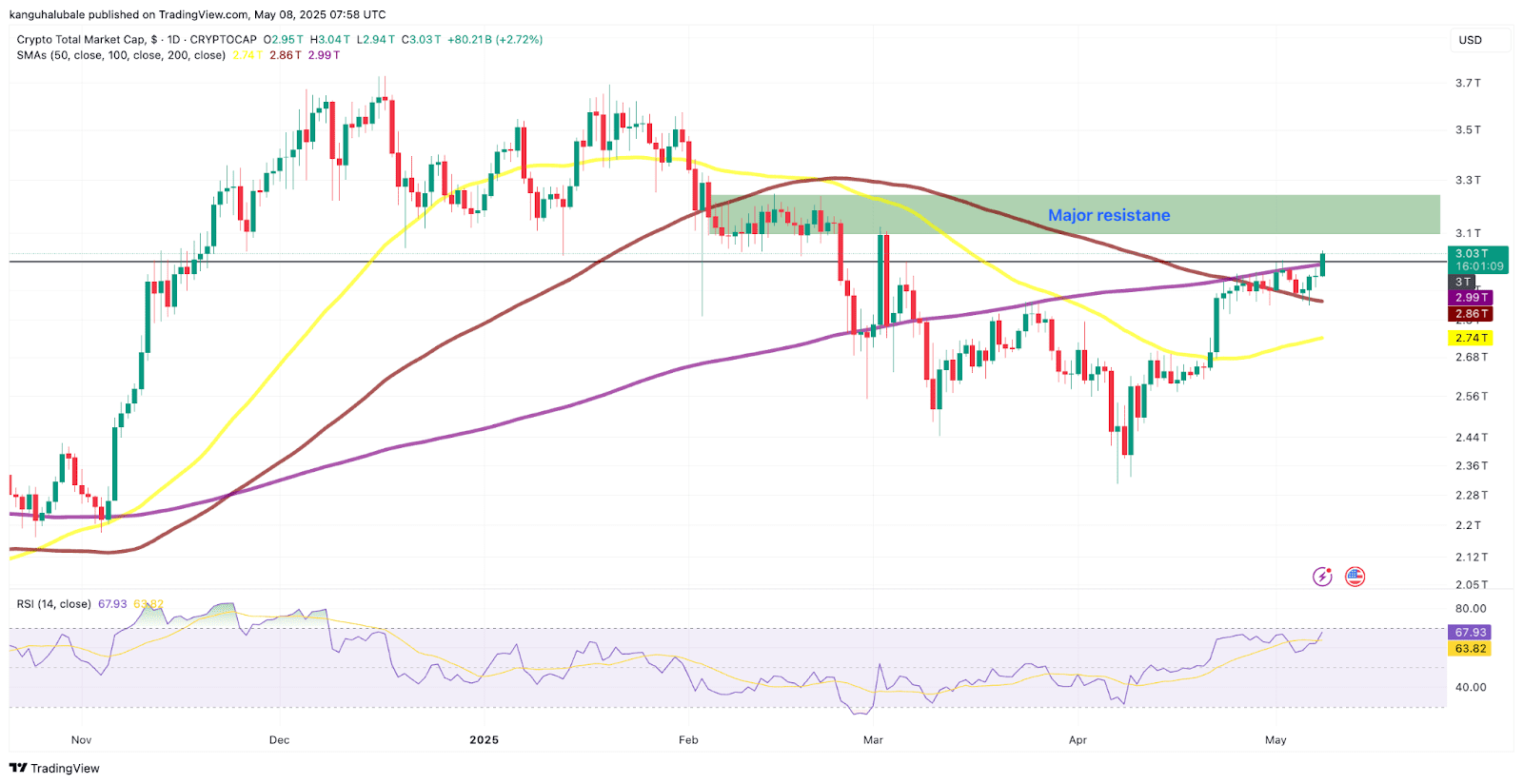

3. Crypto Market Technical Rebound:

From a technical analysis perspective, the current gains in the overall cryptocurrency market capitalization (TOTAL) represent a rebound that began at the $2.4 trillion support level. The market has since rallied by approximately 30%, surpassing $3 trillion for the first time in two months. This level coincides with the 200-day simple moving average (SMA), suggesting a potential strengthening of the uptrend. The last instance of the market capitalization exceeding $3 trillion occurred on March 3, prior to a tariff-driven sell-off that pushed it down to as low as $2.27 trillion on April 7.

Bitcoin and Ether Leading the Charge:

Today’s market gains are primarily driven by Bitcoin (BTC) and Ether (ETH), which have experienced rises of approximately 2.3% and 4%, respectively. These leading cryptocurrencies often set the tone for the broader market, and their positive performance contributes to overall market confidence.

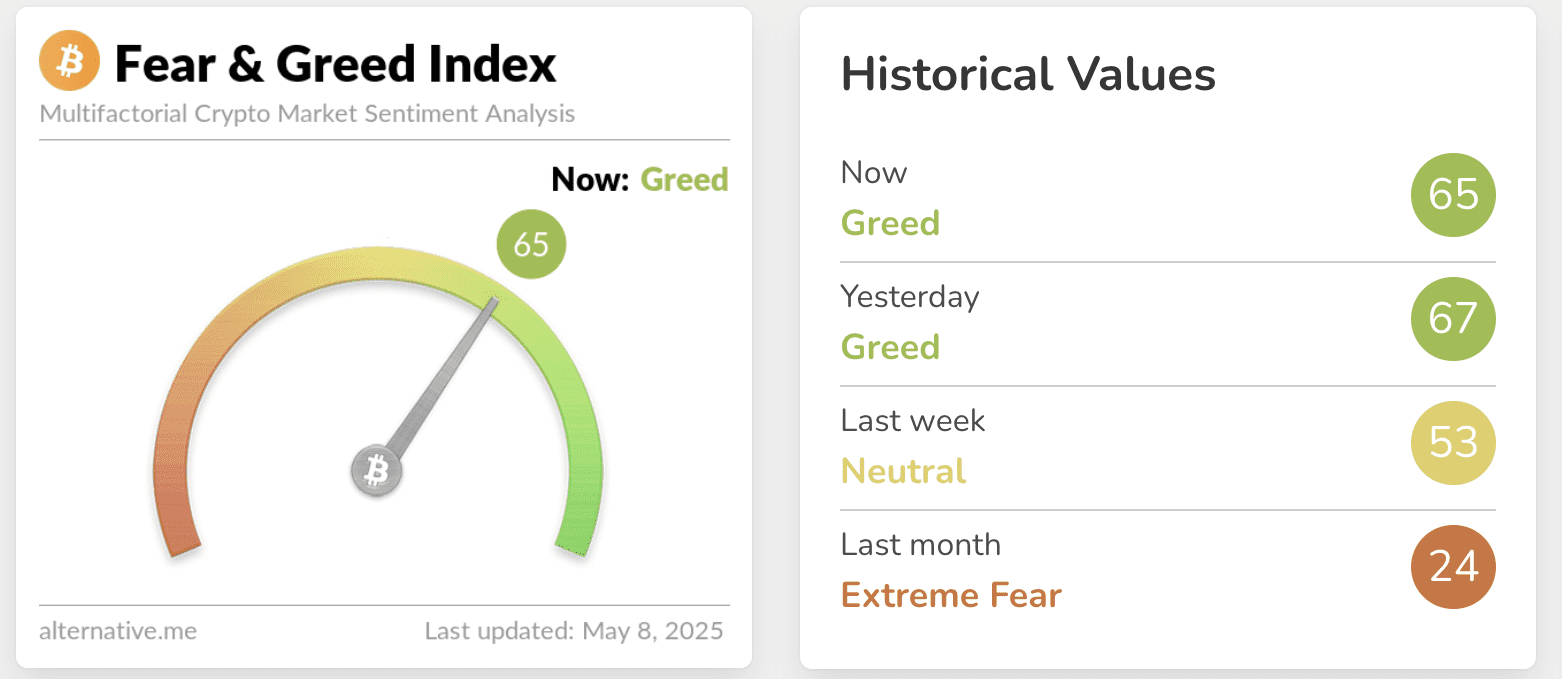

Analyzing the Market Sentiment:

The recent positive momentum has shifted market sentiment, with the Crypto Fear & Greed Index moving back into “greed” territory. This indicates a growing sense of optimism and willingness among investors to participate in the market. However, it’s crucial to remember that market sentiment can be volatile, and investors should exercise caution and conduct thorough research before making any investment decisions.

Technical Outlook and Resistance Levels:

The TOTAL market cap is currently attempting to break through the resistance zone between $3.1 trillion and $3.25 trillion. A successful breach of this zone would signal a potential continuation of the uptrend, with the ultimate target being the all-time highs above $3.69 trillion. Furthermore, the daily Relative Strength Index (RSI) has been steadily increasing from oversold conditions at 30 on April 7 to its current value of 68, indicating accelerating bullish momentum.

Disclaimer:

This analysis is for informational purposes only and should not be considered investment advice. The cryptocurrency market is inherently volatile, and investors should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions. Every investment and trading move involves risk.