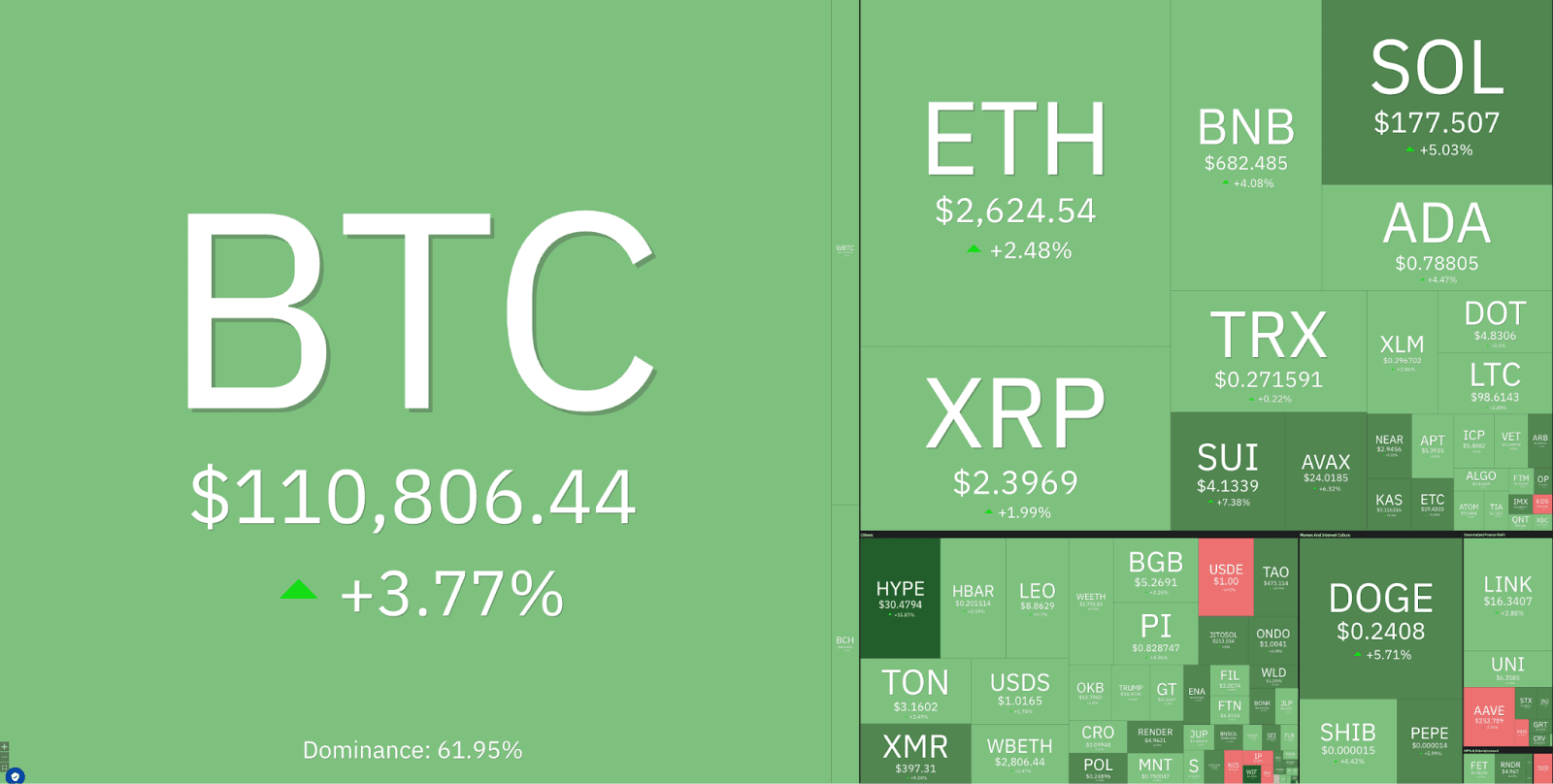

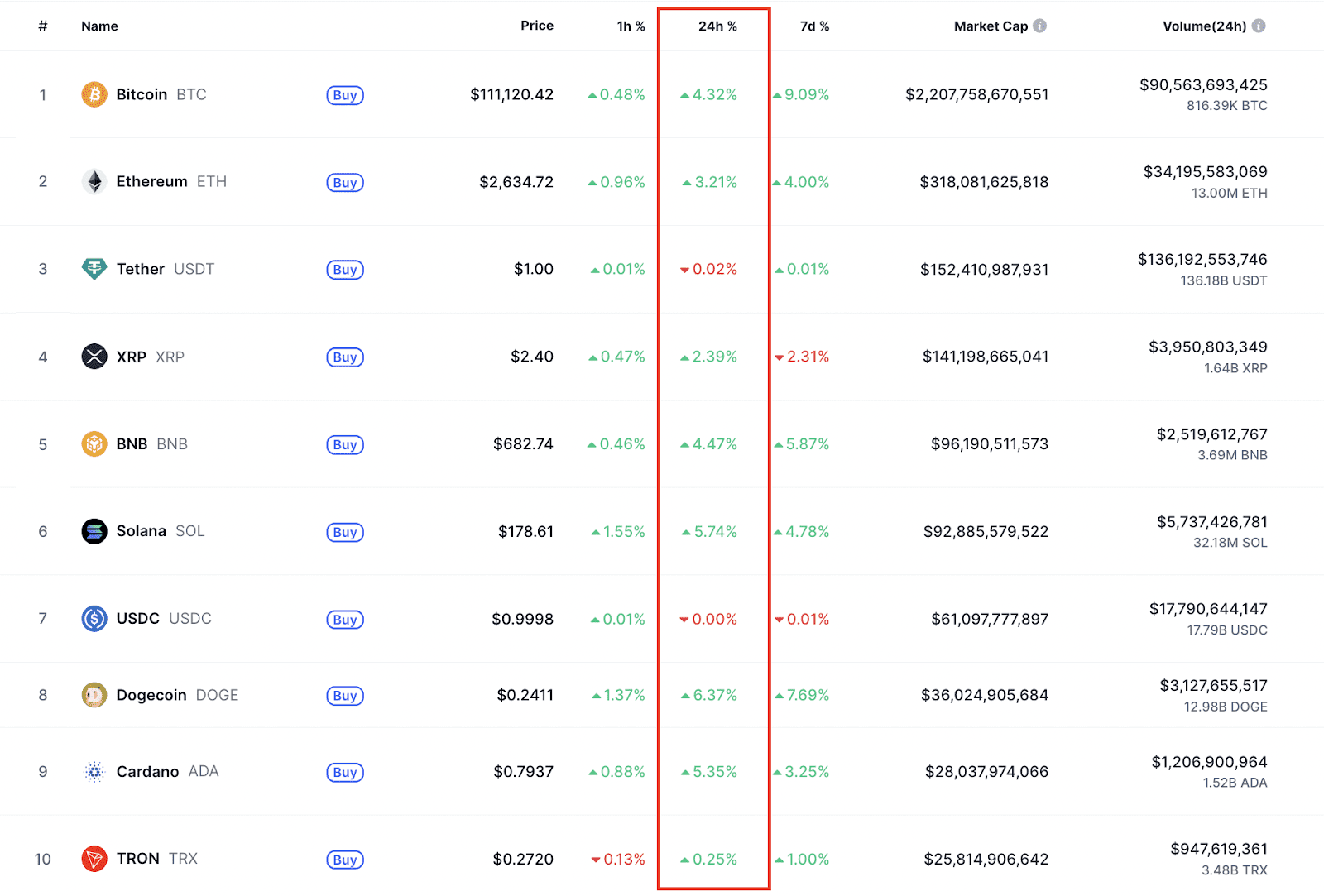

The cryptocurrency market is experiencing a significant upswing today, with the total market capitalization surging by approximately 2.5% to reach $3.48 trillion. This rally is fueled by several key factors, creating a bullish environment for various crypto assets.

Key Factors Driving the Crypto Market Rally

-

Bitcoin’s All-Time High: Bitcoin (BTC) recently broke through $111,000, setting a new all-time high of $111,888. This milestone has significantly boosted investor confidence across the entire crypto market.

-

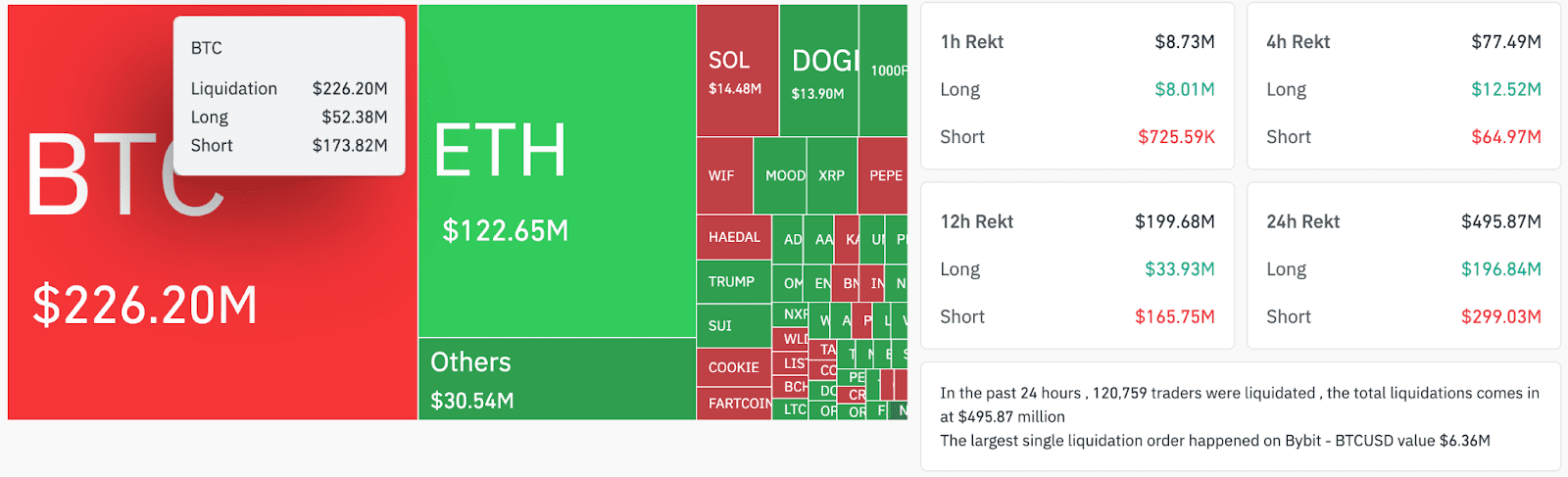

Short Liquidations: A massive wave of short liquidations has triggered a powerful short squeeze, amplifying the price surge. Over $495 million in crypto positions were liquidated, with approximately $300 million representing short positions.

-

Bull Flag Pattern: The combined market capitalization of all cryptocurrencies (TOTAL) confirmed a bull flag pattern, signaling a potential continuation of the uptrend. It is currently testing the resistance level at $3.5 trillion.

Detailed Analysis of Market Drivers

Bitcoin’s Record-Breaking Performance

Bitcoin’s performance is a primary driver of the overall market sentiment. The surge past $111,000 has caught the attention of both retail and institutional investors, creating a sense of FOMO (fear of missing out). As Bitcoin leads, other cryptocurrencies tend to follow, reinforcing the market’s upward trajectory.

The Impact of Short Liquidations

Short liquidations occur when traders who bet against the price of an asset (short positions) are forced to close their positions due to rising prices. This creates a buying frenzy, further driving up the price. The recent liquidation event, with $300 million in short positions being closed, has significantly contributed to the current rally.

Technical Analysis: Bull Flag Pattern

From a technical analysis perspective, the confirmation of a bull flag pattern is a bullish signal. This pattern suggests that after a period of consolidation, the market is likely to resume its upward trend. The current resistance level at $3.5 trillion is a key area to watch. A breakout above this level could lead to further gains.

Altcoin Performance

Major altcoins like Ether (ETH), Cardano (ADA), and Solana (SOL) are also showing positive momentum, mirroring Bitcoin’s gains. This indicates a broad-based rally, with investors diversifying their portfolios and seeking opportunities in different crypto assets.

Broader Economic Factors

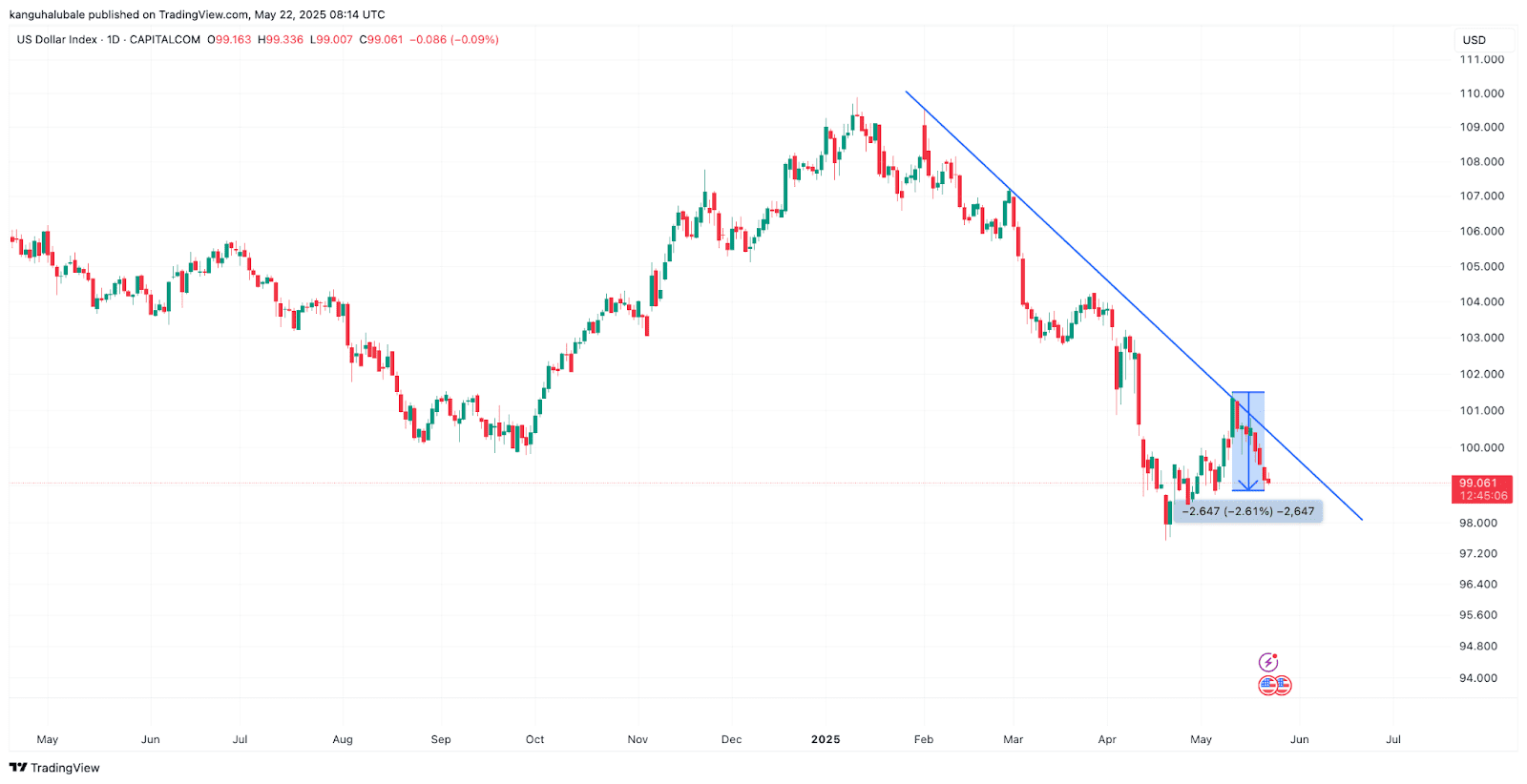

Easing trade tensions between the United States and China, coupled with Moody’s downgrading of the US debt rating, have also played a role. These factors have prompted investors to seek alternative stores of value, with Bitcoin being a primary beneficiary.

Expert Opinions and Market Outlook

Market analysts are closely monitoring these developments. Some experts believe that the current rally is sustainable, citing increased institutional involvement and growing mainstream adoption. Others caution against potential pullbacks, emphasizing the inherent volatility of the crypto market.

Traditional Finance Firms

Increased involvement from traditional financial firms is seen as a positive sign. JPMorgan Chase CEO Jamie Dimon recently announced that the bank will offer clients access to Bitcoin, signaling a shift in attitude towards cryptocurrencies among established financial institutions.

US Dollar Index Downtrend

Additionally, the US Dollar Index (DXY) has been on a downtrend, further supporting the crypto market. A weaker dollar often leads investors to seek alternative assets, such as Bitcoin, which can act as a hedge against inflation and currency devaluation.

Future Prospects and Potential Risks

Looking ahead, the crypto market’s future performance will depend on several factors, including regulatory developments, technological advancements, and broader economic conditions. While the current rally is encouraging, investors should remain vigilant and conduct thorough research before making any investment decisions.

The recent surge in the crypto market is driven by a confluence of factors, including Bitcoin’s new all-time high, short liquidations, and technical indicators. While the outlook is positive, investors should remain cautious and stay informed about market developments.