Crypto News Today: CZ Responds to WSJ, US Perpetual Futures Loom, and Stablecoin Concerns

Here’s a breakdown of the significant events shaping the cryptocurrency landscape today, focusing on Changpeng Zhao’s (CZ) response to allegations, the potential arrival of crypto perpetual futures in the US, and legislative efforts to address stablecoin conflicts of interest.

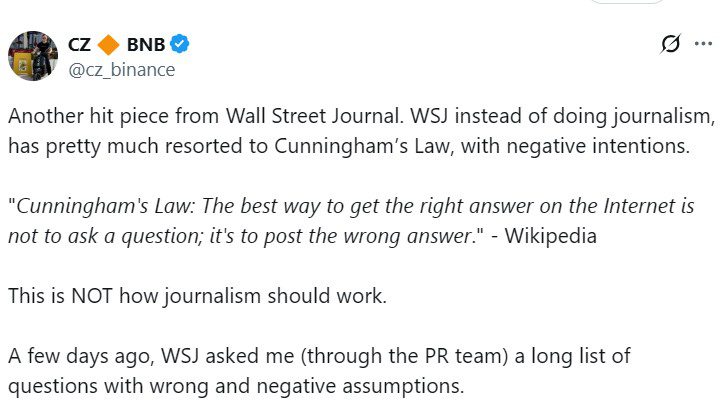

CZ Denies WSJ Report on Trump-Linked Crypto Involvement

Changpeng Zhao, the former CEO of Binance, has strongly refuted a recent Wall Street Journal (WSJ) report linking him to World Liberty Financial (WLF), a decentralized finance (DeFi) project associated with entities connected to Donald Trump. Zhao characterized the report as inaccurate and biased, specifically denying allegations that he acted as a ‘fixer’ for WLF during foreign trips.

The WSJ article suggested Zhao facilitated introductions and meetings for WLF leaders, including a visit to Pakistan. Zhao firmly denies these claims, stating he did not connect Pakistani officials with WLF and that his meeting with a Mr. Saqib was independent of any WLF involvement. This denial highlights the ongoing scrutiny surrounding the intersection of cryptocurrency and political figures.

US Crypto Perpetual Futures on the Horizon: CFTC

Summer Mersinger, outgoing Commissioner of the Commodities and Futures Trading Commission (CFTC), indicated that the US could soon approve crypto perpetual futures contracts. She mentioned that the regulator is reviewing applications and anticipates these products will be trading live in the US shortly. This development could mark a significant step forward for the US crypto market by bringing derivative trading back onshore.

Crypto perpetual futures are derivative contracts that allow traders to speculate on the price of cryptocurrencies without direct ownership, often using high leverage. Mersinger believes regulating and trading these derivatives in the US would benefit the industry by providing regulatory clarity and market integrity.

Senators Aim to Amend GENIUS Act to Address Presidential Stablecoin Conflicts

Several US senators are planning an amendment to the Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act) to prevent a US president from profiting from stablecoins. This move comes in response to concerns over Donald Trump’s connections to World Liberty Financial (WLFI), which launched the USD1 stablecoin.

The proposed amendment aims to address potential conflicts of interest arising from Trump’s involvement in WLFI. Critics argue that Trump could personally benefit from legislation recognizing stablecoins like USD1 as financial instruments. This amendment reflects growing concerns about the influence of political figures in the cryptocurrency space and the need for safeguards against corruption.

In Summary:

- CZ vs. WSJ: Changpeng Zhao denies involvement as a ‘fixer’ for a Trump-linked DeFi project in response to a WSJ report.

- Perp Futures Incoming: The CFTC signals imminent approval for crypto perpetual futures trading in the US.

- Stablecoin Amendment: Senators plan to amend stablecoin legislation to prevent presidential profiteering.

These developments represent a dynamic and evolving crypto landscape, marked by regulatory advancements, allegations of conflicts of interest, and ongoing efforts to bring greater clarity and integrity to the digital asset market.