CZ Proposes Dark Pool DEXs: A Solution to Crypto Manipulation?

Changpeng “CZ” Zhao, co-founder of Binance, has thrown a curveball into the DeFi space by proposing the creation of dark pool perpetual swap decentralized exchanges (DEXs). His aim? To tackle the persistent problem of market manipulation, front-running, and MEV (Maximum Extractable Value) bot attacks. But what exactly are dark pools, and could this proposal be a game-changer or just another utopian idea?

Quick Summary of the News:

- CZ proposed a dark pool DEX to hide large orders and prevent manipulation.

- The suggestion comes after a reported incident of coordinated liquidation hunting on Hyperliquid.

- Dark pools are used in TradFi to conceal large orders until execution.

- Implementing dark pools in DeFi requires complex solutions like ZK-proofs.

- Experts highlight regulatory challenges and the need for robust risk engines.

Why It Matters

The current transparency of DEXs, while generally seen as a positive, has a dark side. Knowing others can see your orders in real-time opens the door to exploitation, especially with liquidations on perpetual DEXs. CZ’s proposal addresses the issue that large traders wanting to purchase substantial amounts of a coin don’t want their intentions known until the trade is complete. This is to avoid front-running, slippage, and MEV attacks, all of which inflate costs and reduce profitability.

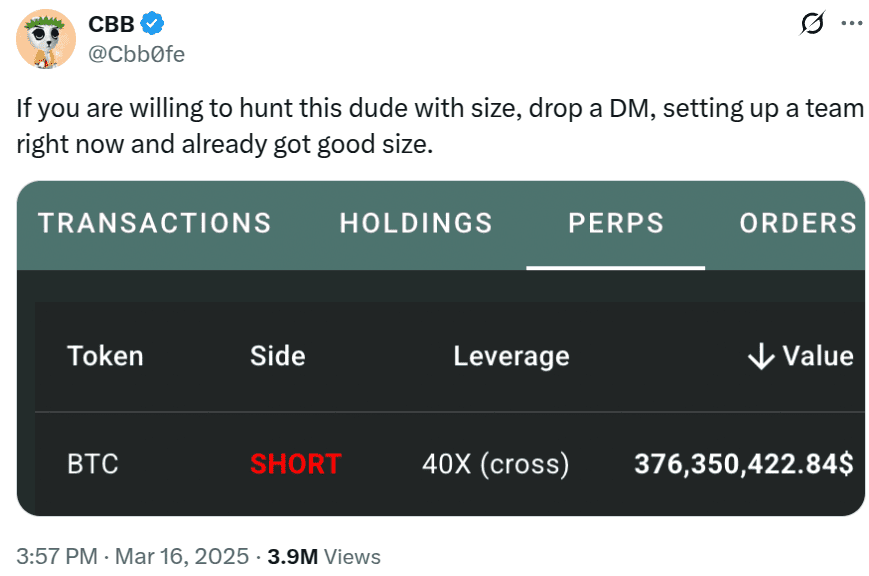

The timing of this proposal is interesting, following the liquidation of nearly $100 million in Bitcoin long positions on Hyperliquid. Allegations surfaced that some users coordinated to “hunt” the liquidation, highlighting the vulnerabilities CZ is trying to address.

Market Impact

While it’s difficult to quantify the immediate market impact, a successful implementation of dark pool DEXs could have a significant effect on trading strategies and market dynamics. Here’s a simplified comparison:

| Feature | Traditional DEX | Dark Pool DEX (Proposed) |

|---|---|---|

| Order Visibility | Public, Real-Time | Hidden Until Executed |

| Risk of Front-Running | High | Low |

| MEV Attacks | Vulnerable | Potentially Mitigated |

| Transparency | High | Lower |

If dark pool DEXs gain traction, we could see:

- Increased institutional interest in DeFi due to reduced manipulation risks.

- A shift in trading strategies, with less emphasis on immediate execution and more on strategic positioning.

- A decrease in the profitability of MEV bots, potentially leading to their redeployment or obsolescence.

Expert Take or Personal Insight

CZ’s proposal is intriguing and addresses a legitimate concern within the DeFi space. The existing transparency of DEXs, while beneficial in many ways, also creates opportunities for malicious actors to exploit large traders. Dark pools have been a staple in TradFi for this very reason, and bringing this concept to DeFi could level the playing field. However, the challenges are significant. Implementing decentralized dark pools requires advanced cryptographic solutions like ZK-proofs, which are still under development and not yet widely adopted. Moreover, the regulatory landscape is murky, and launching an on-chain dark pool could attract unwanted attention from regulators.

Personally, I believe that while the technical and regulatory hurdles are considerable, the potential benefits of dark pool DEXs are worth exploring. They could create a more equitable and less exploitable trading environment, attracting more sophisticated and institutional investors to the DeFi space.

Actionable Insight

For traders and investors, here’s what to watch:

- ZK-Proof Developments: Keep an eye on advancements in zero-knowledge proof technology, as this is crucial for the feasibility of dark pool DEXs.

- Regulatory Scrutiny: Monitor how regulators react to the concept of dark pools in DeFi. Any regulatory guidance or enforcement actions could significantly impact the viability of these platforms.

- DEX Innovation: Look for DEXs that are experimenting with privacy-enhancing technologies or alternative order execution models. These could be early indicators of the future direction of DeFi trading.

Conclusion

CZ’s call for dark pool DEXs marks an important step in the evolution of decentralized finance. While significant technical and regulatory challenges remain, the potential benefits of reducing market manipulation and attracting institutional investors are too significant to ignore. As the DeFi space matures, expect to see more experimentation with privacy-enhancing technologies and alternative trading models aimed at creating a more fair and efficient market.