Binance co-founder Changpeng “CZ” Zhao has ignited a fresh debate in the DeFi space with his proposal for dark pool decentralized exchanges (DEXs). The core idea? To shield large orders from prying eyes and prevent market manipulation.

Quick Summary of the News:

- CZ proposed a dark pool perpetual swap DEX to combat market manipulation.

- He argues real-time order visibility on DEXs allows for front-running and MEV attacks.

- Dark pools, common in TradFi, hide order details until execution.

- Implementing this on-chain requires complex solutions like zero-knowledge proofs.

- Experts highlight regulatory challenges alongside technical hurdles.

Why It Matters:

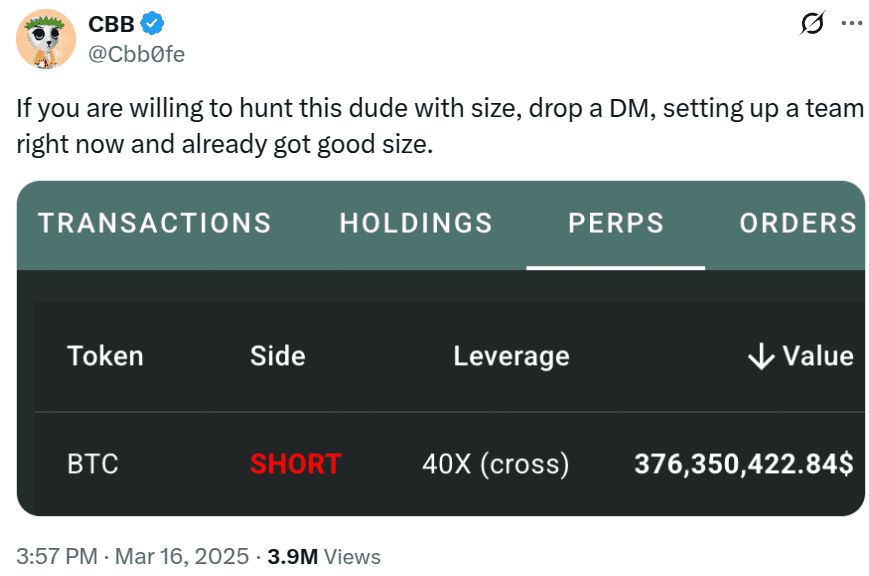

CZ’s proposal addresses a critical vulnerability in current DEX infrastructure: transparency. While openness is a core tenet of DeFi, it also creates opportunities for malicious actors to exploit large traders. Knowing the size and price of an incoming order allows sophisticated bots and even coordinated groups to front-run the trade, resulting in slippage and losses for the original trader. This is especially problematic in perpetual swap DEXs, where liquidation levels are also visible, opening the door to targeted liquidation attacks.

The recent liquidation of nearly $100 million in Bitcoin long positions on Hyperliquid, allegedly targeted by coordinated users, underscores the urgency of this issue. This incident, whether proven to be malicious or not, highlights the potential for abuse in a transparent trading environment.

Market Impact:

The introduction of dark pool DEXs could significantly alter the dynamics of decentralized trading, particularly for institutional investors and high-net-worth individuals. Here’s a potential impact breakdown:

| Feature | Current DEXs | Potential Dark Pool DEXs |

|---|---|---|

| Order Visibility | Real-time, fully transparent | Hidden until execution |

| MEV Vulnerability | High | Significantly Reduced |

| Slippage for Large Orders | High | Potentially Lower |

| Appeal to Institutional Traders | Limited | Increased |

Expert Take or Personal Insight:

CZ’s suggestion is more than just a technical tweak; it’s a fundamental rethinking of how DEXs operate. While transparency has its merits, the current system inadvertently disadvantages large traders. Dark pools could level the playing field, attracting more significant capital to DeFi and fostering a more mature trading environment. However, the implementation will be fraught with challenges. Ensuring true privacy without creating new avenues for manipulation or regulatory scrutiny will require careful design and robust security measures.

Actionable Insight:

Traders and investors should closely monitor the development of privacy-focused technologies like zero-knowledge proofs and secure multi-party computation. Projects exploring these solutions for DEXs are worth watching. Also, keep an eye on regulatory discussions surrounding DeFi privacy and potential impacts on market access.

Conclusion:

CZ’s dark pool DEX proposal is a bold move that could reshape the future of decentralized trading. While challenges remain, the potential benefits of reduced manipulation and increased institutional adoption are significant. The coming months will be crucial in determining whether this vision can become a reality and what impact it will have on the broader crypto ecosystem.