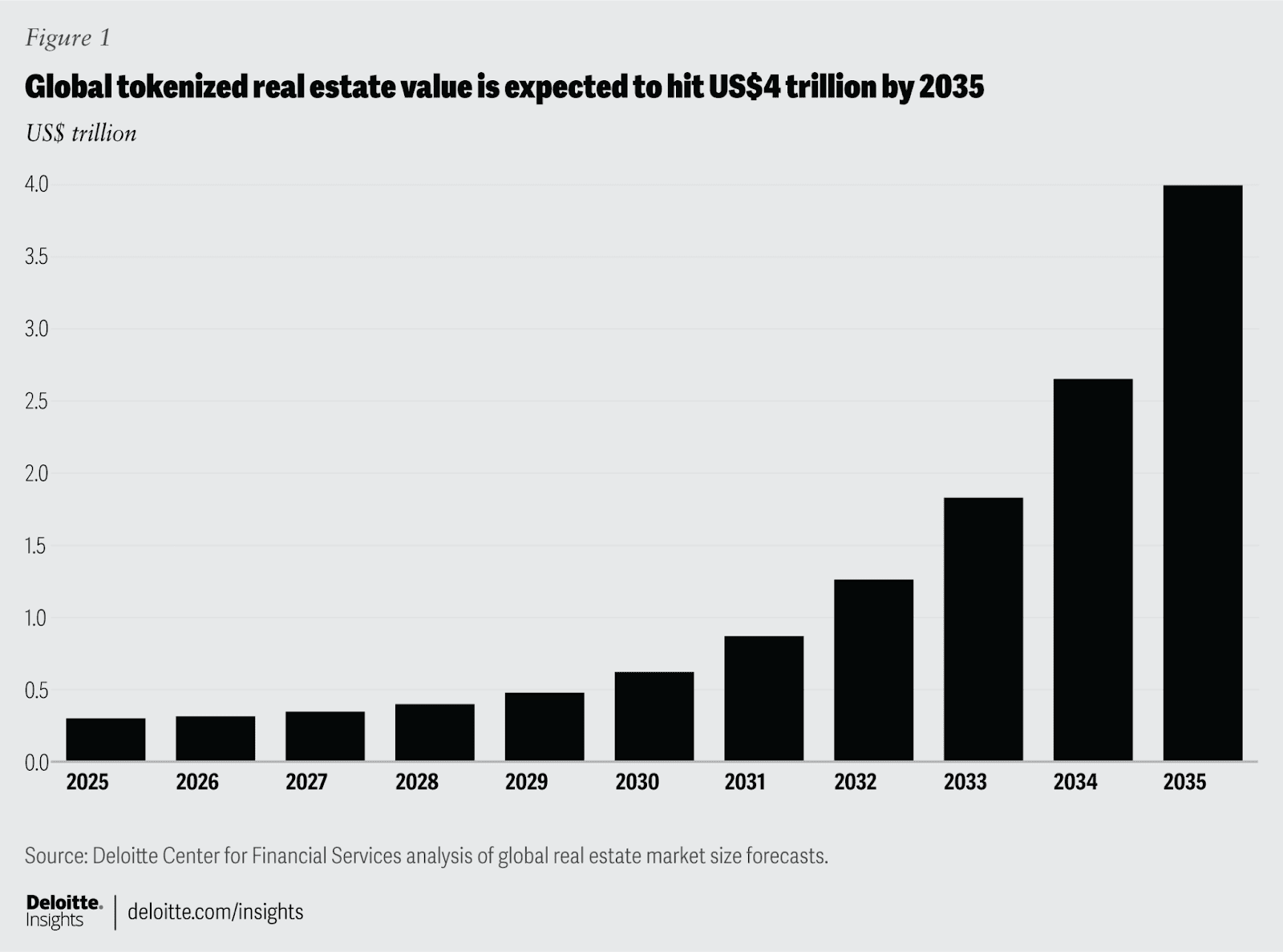

A recent Deloitte report projects that the tokenization of real estate on blockchain networks could reach a staggering $4 trillion by 2035, marking a significant shift in property investment and ownership. This forecast, detailed in the Deloitte Center for Financial Services’ analysis, represents a compound annual growth rate (CAGR) exceeding 27% from the current $300 billion in 2024.

What is Tokenized Real Estate?

Tokenized real estate involves representing ownership rights to properties as digital tokens on a blockchain. Each token represents a fraction of the underlying asset, making it easier to buy, sell, and trade real estate ownership. This fractionalization opens the door to a broader range of investors who may not have the capital to purchase entire properties outright.

Key Drivers of Tokenized Real Estate Growth

Several factors are fueling the projected growth of tokenized real estate:

- Increased Accessibility: Tokenization lowers the barrier to entry for real estate investment, allowing smaller investors to participate.

- Enhanced Liquidity: Blockchain-based tokens can be traded more easily than traditional real estate assets, providing greater liquidity.

- Improved Transparency: Blockchain technology offers a transparent and secure record of ownership and transactions.

- Reduced Costs: Tokenization can streamline real estate transactions, reducing administrative and legal fees.

Deloitte’s Predictions: A Closer Look

The Deloitte report highlights the transformative potential of blockchain in reshaping real estate. Chris Yin, co-founder of Plume Network, a blockchain focused on real-world assets (RWAs), notes that evolving trends such as post-pandemic work-from-home arrangements, climate risk, and digitization are reshaping property fundamentals. The repurposing of office buildings into AI data centers, logistics hubs, and energy-efficient residential communities further drives the need for flexible investment options.

“Investors want targeted access to these modern use cases, and tokenization enables programmable, customizable exposure to such evolving asset profiles,” Yin explained.

Tokenization as a Safe Haven

The rise of tokenized assets also reflects investor demand for safe havens amid global economic uncertainty. Concerns surrounding import tariffs and other geopolitical events have led to increased interest in RWAs and stablecoins. Juan Pellicer, senior research analyst at IntoTheBlock, observes that both stablecoins and RWAs have attracted significant capital as investors seek refuge from market volatility.

This trend was evident in the surge of tokenized gold volume, which surpassed $1 billion in trading volume on April 10, reaching its highest level since the US banking crisis in March 2023, triggered by the collapse of Silicon Valley Bank and the liquidation of Silvergate Bank.

Regulatory Implications and Challenges

While the growth potential of tokenized real estate is significant, regulatory clarity remains a crucial factor. Chris Yin believes that increased adoption of RWAs could encourage a more favorable regulatory environment.

“While regulation is a hurdle, regulation follows usage,” he stated, drawing a parallel to Uber’s growth before widespread regulatory acceptance. He emphasized the importance of ensuring that tokenized products comply with international regulations to facilitate broader market access.

Skepticism and Alternative Perspectives

Despite the optimistic outlook, some industry experts express caution about the immediate focus on real estate tokenization. Michael Sonnenshein, chief operating officer of Securitize, suggested at Paris Blockchain Week 2025 that tokenization efforts should prioritize more liquid assets.

“I don’t think tokenization should have its eyes directly set on real estate,” Sonnenshein stated. He acknowledged the potential for blockchain to streamline real estate processes but argued that the on-chain economy currently demands more readily tradable assets.

The Future of Real Estate Tokenization

The Deloitte prediction of $4 trillion in tokenized real estate by 2035 represents a significant shift in the landscape of property ownership and investment. While challenges remain, including regulatory uncertainty and differing industry perspectives, the potential benefits of increased accessibility, liquidity, and transparency make tokenization a compelling force in the future of real estate.

The key to realizing this potential lies in addressing regulatory hurdles, fostering collaboration among industry stakeholders, and developing robust and secure blockchain platforms that can support the growing demand for tokenized real estate assets.