Tesla CEO Elon Musk has vehemently criticized The Wall Street Journal (WSJ) for publishing what he calls an “EXTREMELY BAD BREACH OF ETHICS.” This rebuke comes after the WSJ reported that Tesla’s board is actively seeking Musk’s replacement due to concerns about his focus across multiple ventures and his increasing political involvement. This incident has also drawn support for Musk from various crypto executives, who have previously accused the WSJ of biased reporting against the digital asset industry.

Key Takeaways:

- Elon Musk denies WSJ report of Tesla board seeking his replacement.

- Tesla board chair Robyn Denholm supports Musk, stating the report is false.

- Crypto executives have also criticized the WSJ for biased coverage.

- Musk’s involvement with Donald Trump’s DOGE is facing scrutiny.

Musk’s Response

According to the original WSJ report, published on April 30, the Tesla board allegedly approached recruitment firms to find a successor due to concerns about Musk’s divided attention and political activities. Musk quickly responded via X, stating that the WSJ knowingly published false information and omitted an “unequivocal denial” from Tesla’s board.

Robyn Denholm, Tesla’s board chair, supported Musk’s denial, posting on Tesla’s official X account: “This is absolutely false. The CEO of Tesla is Elon Musk, and the Board is highly confident in his ability to continue executing on the exciting growth plan ahead.”

Growing Scrutiny of Musk’s Activities

The WSJ report coincides with increasing scrutiny of Musk’s involvement in political spheres, including his advisory role in former US President Donald Trump’s Department of Government Efficiency (DOGE). Critics argue that Musk’s political affiliations could harm Tesla’s brand, especially in international markets. Tesla’s recent financial performance, including a 71% plunge in first-quarter profit and a significant decline in market value, has further fueled these concerns.

Tesla’s Q1 results revealed revenues of $19.34 billion, falling short of estimates by 7.85% and indicating a 9.2% decrease from the previous year. Despite these challenges, Tesla has maintained its Bitcoin holdings. While the value of these digital assets decreased by 11.61% in Q1, mirroring Bitcoin’s price decline, the company continues to hold them on its balance sheet.

Musk, who also leads SpaceX, Neuralink, and X (formerly Twitter) along with xAI, has committed to dedicating more time to Tesla in response to shareholder pressure. Reports suggest he is now advising DOGE remotely, reducing his physical presence in Washington.

Crypto Community Stands with Musk

Musk’s criticism of the WSJ is part of a broader trend of crypto executives challenging the publication’s coverage. They allege biased and misleading reporting practices against the digital asset industry.

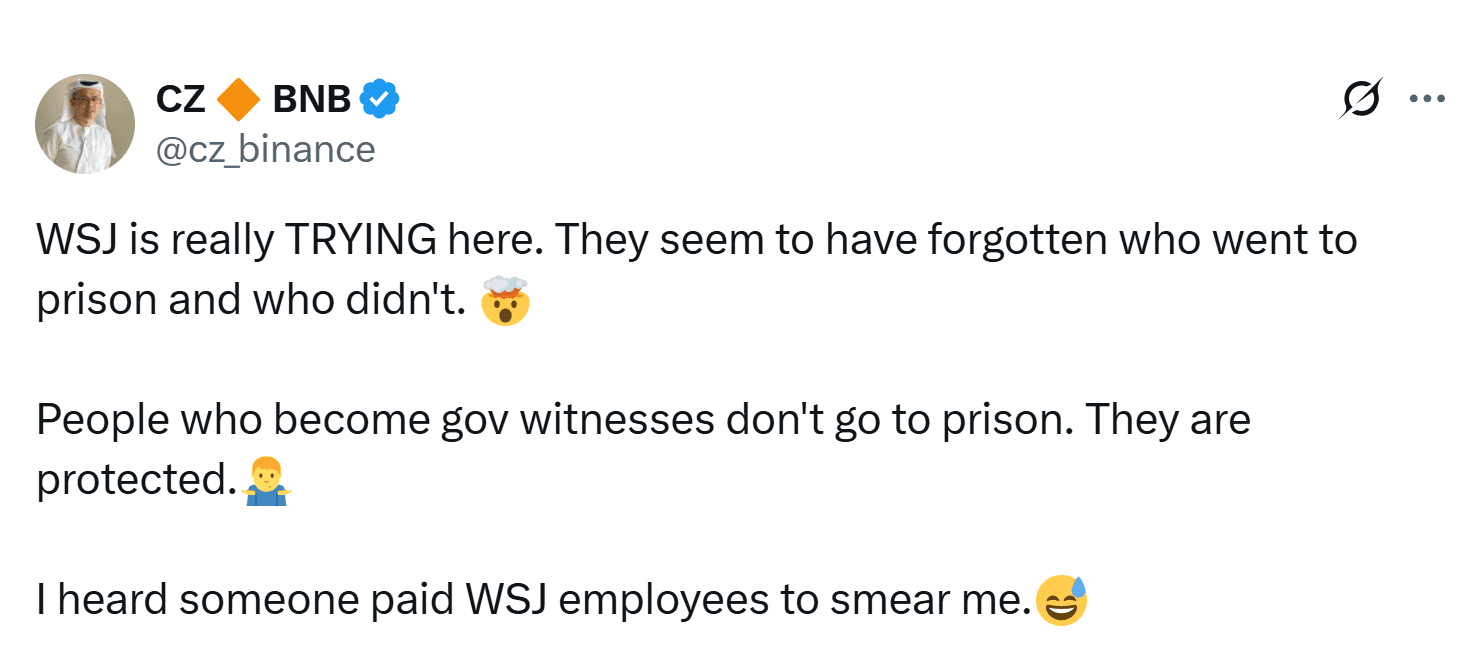

Changpeng Zhao (CZ), former CEO of Binance, recently refuted a WSJ report claiming he would provide evidence against Tron founder Justin Sun as part of a plea deal with the U.S. Department of Justice (DOJ). Zhao dismissed the report as an attempt to smear his reputation, stating that individuals who become government witnesses typically receive protection and do not face imprisonment.

Similarly, Tether previously rejected a WSJ report that alleged the company used fake documents and shell companies to maintain banking access. Tether labeled the claims as inaccurate, misleading, and based on outdated information.

Why This Matters

This ongoing dispute between Musk, crypto leaders, and the WSJ highlights the growing tension between established media outlets and new tech and financial sectors. Concerns over biased reporting and ethical practices are at the forefront of these discussions, potentially influencing public perception and regulatory scrutiny.

In Conclusion

The clash between Elon Musk and the WSJ, supported by criticisms from crypto executives, underscores the importance of accurate and unbiased reporting, particularly in rapidly evolving industries. As Musk focuses on Tesla’s growth plans, the scrutiny from media outlets and regulatory bodies will likely persist, adding complexity to his leadership across multiple ventures.