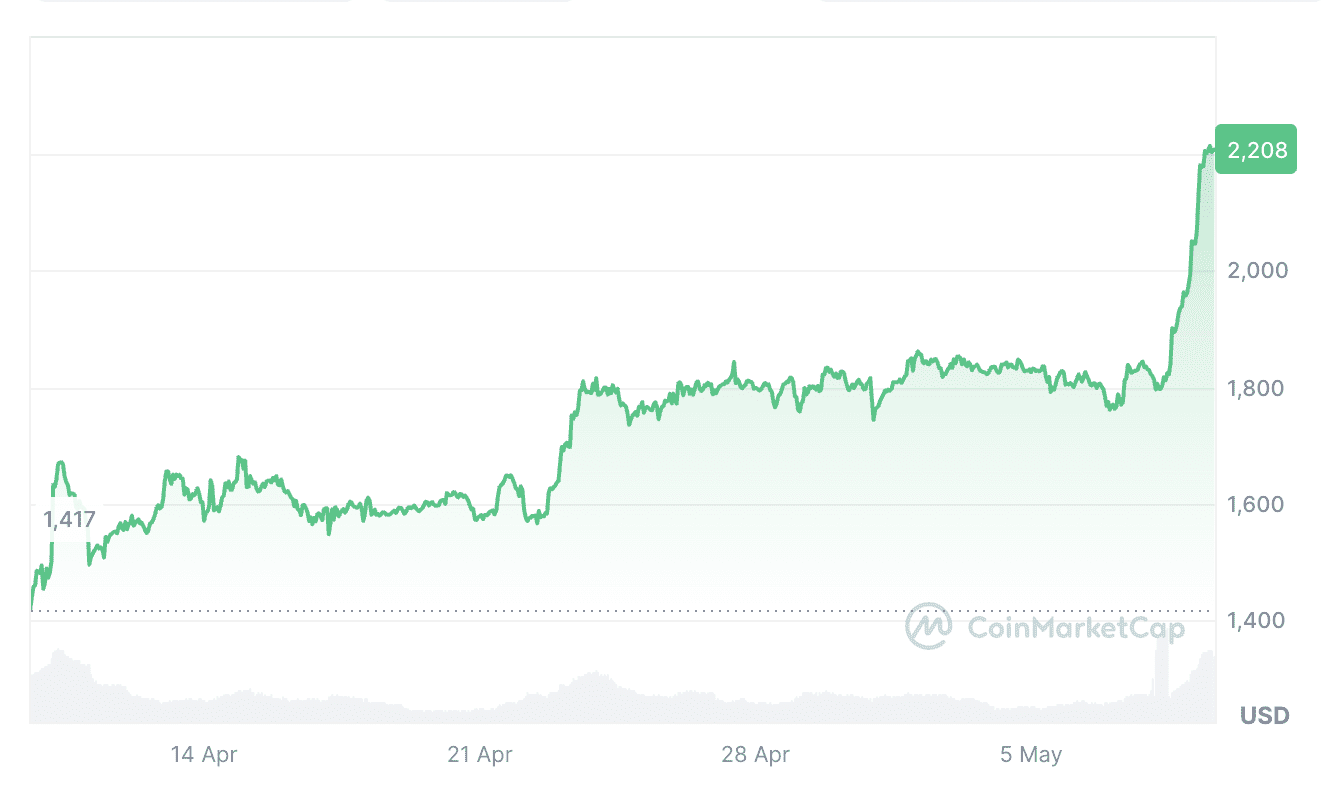

Ether (ETH) has seen a remarkable surge in price, climbing 20% in the 24 hours following the launch of the Pectra upgrade. This price movement has sparked discussions among crypto traders, with some suggesting it could mark a turning point for Ether, an asset that has faced fluctuating sentiment throughout 2025.

Currently trading around $2,230, Ether’s price pump has been described as an “insane candle” by crypto analyst Daan Crypto Trades. This surge coincided with a 21% spike in Ether Open Interest (OI), indicating increased trading activity and speculation.

Factors Contributing to Ether’s Price Surge

Several factors have contributed to Ether’s recent price increase:

- Pectra Upgrade: The long-awaited Pectra upgrade, which went live on May 7, introduced new features such as enhanced wallet functionalities, increased staking limits, and improvements to Ethereum’s scalability. These upgrades are seen as positive developments for the Ethereum network.

- New Long Positions: Crypto trader Alex Kruger suggests that the price spike is primarily fueled by an influx of new long positions in Ether.

- Broader Market Sentiment: Ether’s rally coincides with a general upswing in the crypto market, with Bitcoin reclaiming the $100,000 mark.

- Macroeconomic Factors: Derive founder Nick Forster pointed to factors beyond Pectra, including a US trade deal with the UK and Coinbase’s acquisition of Deribit, as contributors to the price movement.

Potential Risks and Liquidation Levels

While the price surge is encouraging for Ether holders, there are also potential risks to consider. CoinGlass data indicates that a fall back to $2,000 could trigger the liquidation of approximately $2.06 billion in long positions. The recent surge also resulted in the liquidation of around $328 million in Ether short positions, highlighting the volatility in the market.

Is This a True Turning Point for Ether?

The question remains whether this price surge represents a sustainable turning point for Ether. While the Pectra upgrade and positive market sentiment are encouraging signs, Ether’s price has experienced a volatile year, falling 56% between January and April.

Looking back, Ether has historically performed well in the second quarter, averaging a 62.2% return. If this trend continues, Ether could potentially reach around $2,950 by the end of June.

Ether ETF Flows and Market Sentiment

Despite the positive price action, spot Ether ETFs have experienced outflows for the third consecutive day, totaling $16.1 million on May 8, according to Farside data. This suggests that institutional investors may be taking a cautious approach.

Overall crypto market sentiment has improved, with the Crypto Fear & Greed Index moving further into “Greed” territory, reaching a score of 73. This indicates a growing optimism among crypto investors.

Key Takeaways:

- Ether’s price surged 20% following the Pectra upgrade launch.

- Factors contributing to the surge include the Pectra upgrade, new long positions, and positive market sentiment.

- Potential risks include liquidation of long positions if the price falls back to $2,000.

- Spot Ether ETFs have experienced outflows despite the price surge.

- Overall crypto market sentiment has improved, indicating growing optimism.