According to crypto analytics firm Glassnode, most investors who bought into spot Ether exchange-traded funds (ETFs) from major asset managers like BlackRock and Fidelity Investments are currently facing considerable losses.

In their May 29 report, Glassnode stated, “The average investor in the BlackRock and Fidelity Ethereum ETFs are now substantially underwater on their position, holding an unrealized loss of approximately -21% on average.”

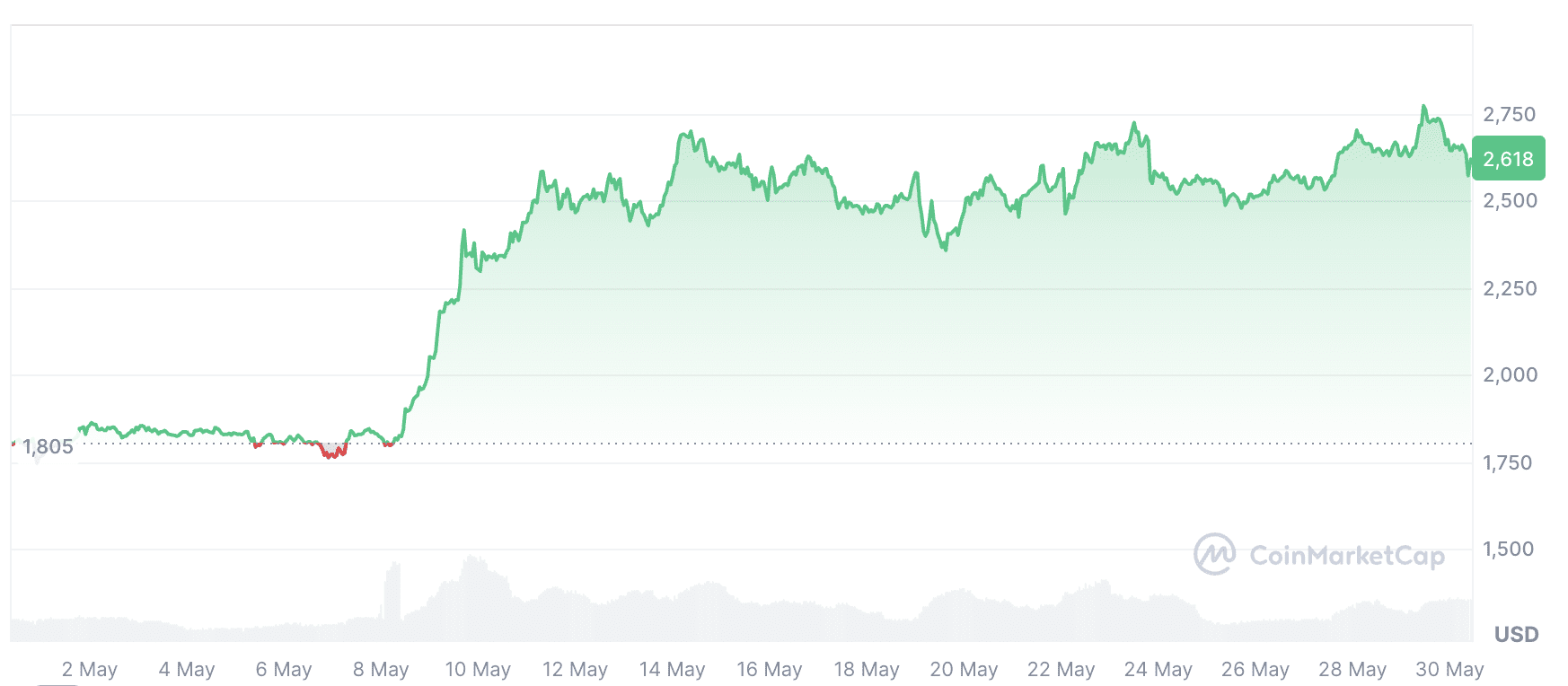

Currently, Ether (ETH) trades around $2,601, according to CoinMarketCap data. However, the cost basis for BlackRock’s spot Ether ETF is approximately $3,300, while Fidelity’s is even higher at $3,500.

Funds dropped on Trump tariffs

The last time Ether traded above $3,000 was on Feb. 2, before entering a downtrend following former US President Donald Trump’s executive order imposing import tariffs on goods from China, Canada, and Mexico.

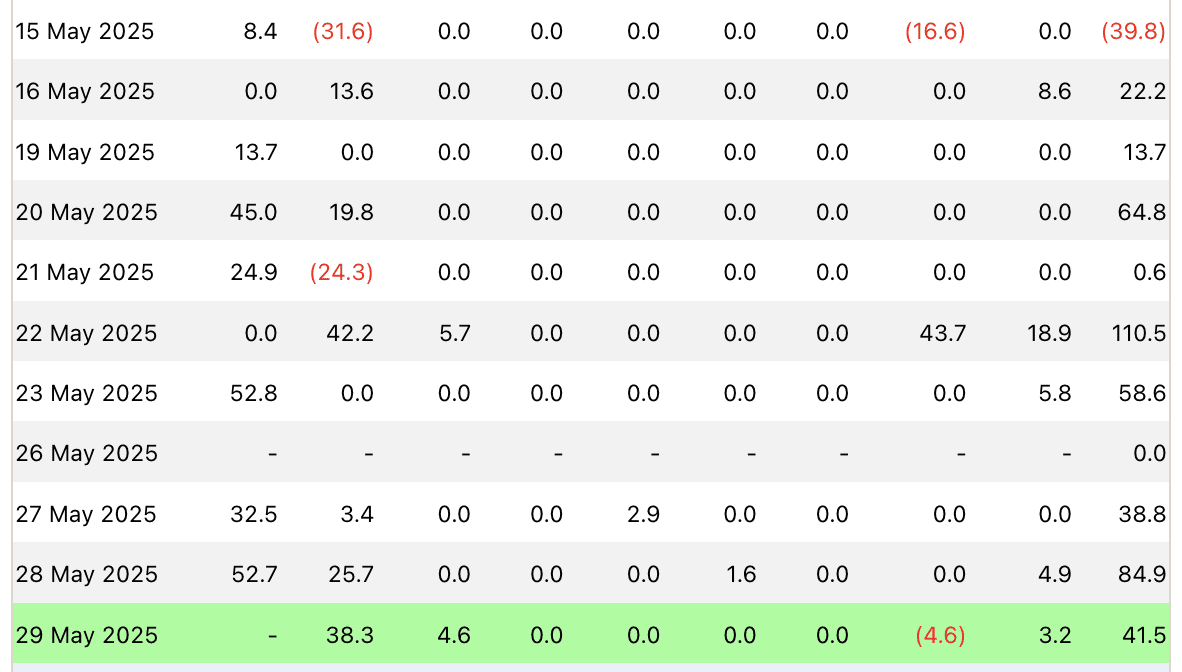

“We can see that net outflows begin to accelerate when the spot price dropped below this average ETF investor cost-basis level in August 2024 and January and March of 2025,” the firm noted, highlighting a correlation between price dips and investor behavior.

Ether reached its yearly low of $1,472 on April 9, coinciding with the implementation of Trump’s global tariffs. Since then, however, Ether has rebounded, climbing 44.25% over the past month. Spot Ether ETFs have also experienced nine consecutive days of inflows, totaling $435.6 million since May 16, potentially fueled by easing trade war concerns.

Some analysts predict further uptrend in the crypto market after a US federal court blocked many of Trump’s tariffs on May 28.

Since their launch in the US in July 2024, spot Ether ETFs have accumulated $2.94 billion in total inflows. On July 23, their launch date, Ether was trading at approximately $3,536.

Glassnode suggests that the ETFs have had a limited impact on Ether’s spot price. “The Ethereum ETFs initially accounted for just ±1.5% of the trade volume in spot markets, suggesting a relatively lukewarm reception on launch,” the report stated.

Glassnode also noted a period of stronger growth for the ETFs in November 2024, where their trade volume share increased to over 2.5%. This period coincided with Donald Trump winning the US presidential election, triggering a broader crypto market rally that saw Ether reach $4,007 on Dec. 8. However, this measure has since declined back toward 1.5%, according to Glassnode.

Back on March 20 at the Digital Asset Summit, BlackRock’s head of digital assets, Robbie Mitchnick, mentioned that the spot Ether ETF is “less perfect” without staking.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.