Ethereum (ETH) has recently experienced a price surge, bringing its holders back into profit. This development raises the possibility of a significant rally towards $3,000 and beyond. However, several factors, including resistance levels and potential sell-off triggers, need to be considered.

Ethereum’s Return to Profitability

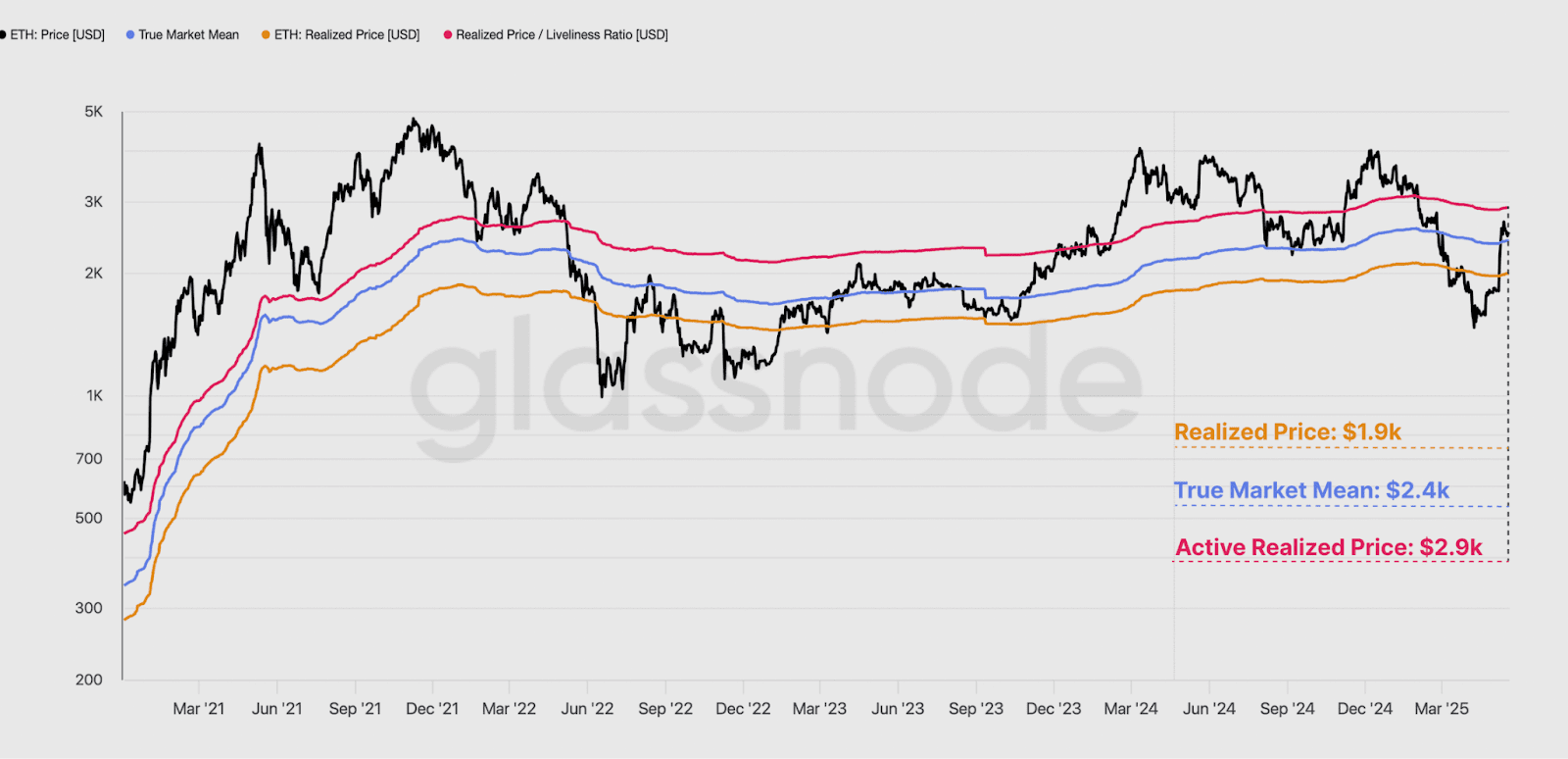

Ether’s price recently surged to $2,700, surpassing its realized price (the average price at which ETH was acquired). According to Glassnode, this indicates that the average ETH holder is now in an unrealized profit. This return to profitability can have a positive impact on market sentiment and potentially attract new investors.

Key Takeaways:

- ETH’s price exceeding its realized price signals a bullish outlook.

- Holders in profit are more likely to hold firm, supporting upward momentum.

- Fresh capital inflows are entering the market at higher prices.

Potential Resistance and Breakout Levels

Despite the positive momentum, Ethereum faces resistance in the $2,400-$2,900 range. Glassnode analysts emphasize that decisively reclaiming the $2,900 level is crucial for sustaining investor confidence. Overcoming this resistance could pave the way for a breakout towards $3,000.

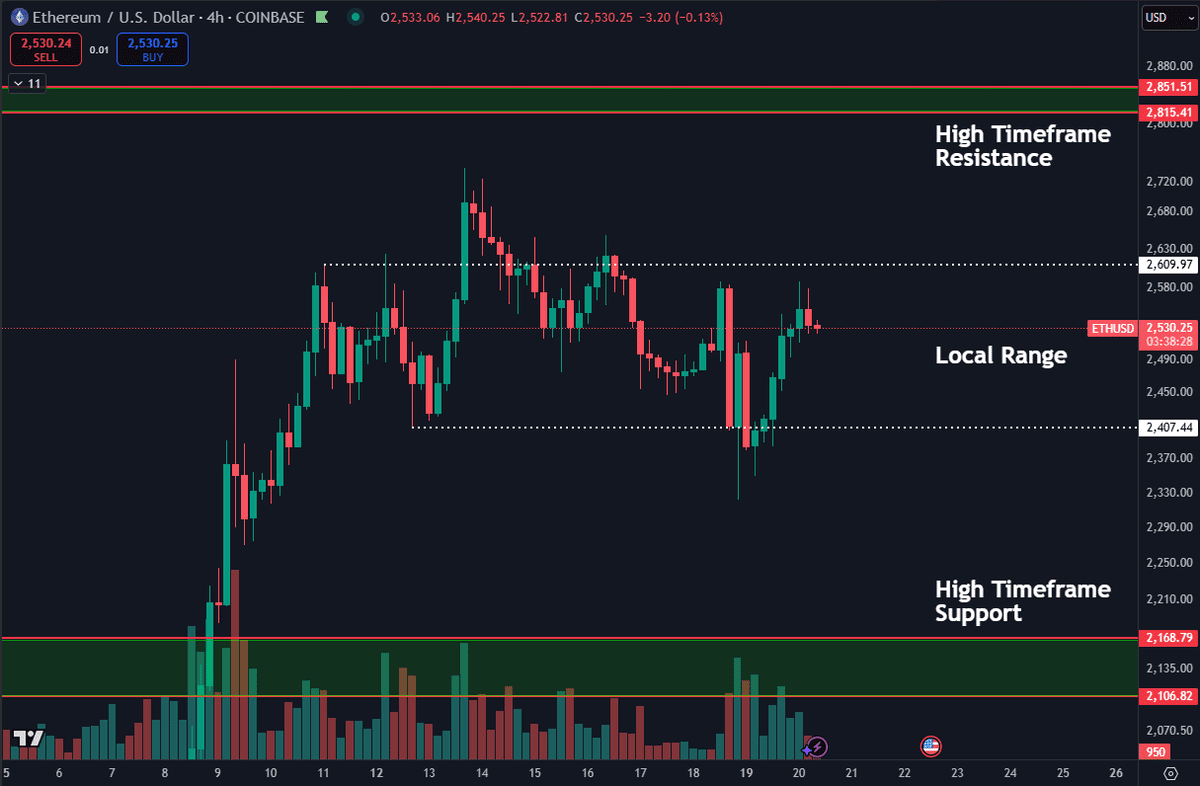

Popular trader Daan Crypto Trades echoes this sentiment, stating that ETH needs to convincingly break out of the $2,400-$2,600 range before targeting higher resistance levels between $2,800 and $2,850.

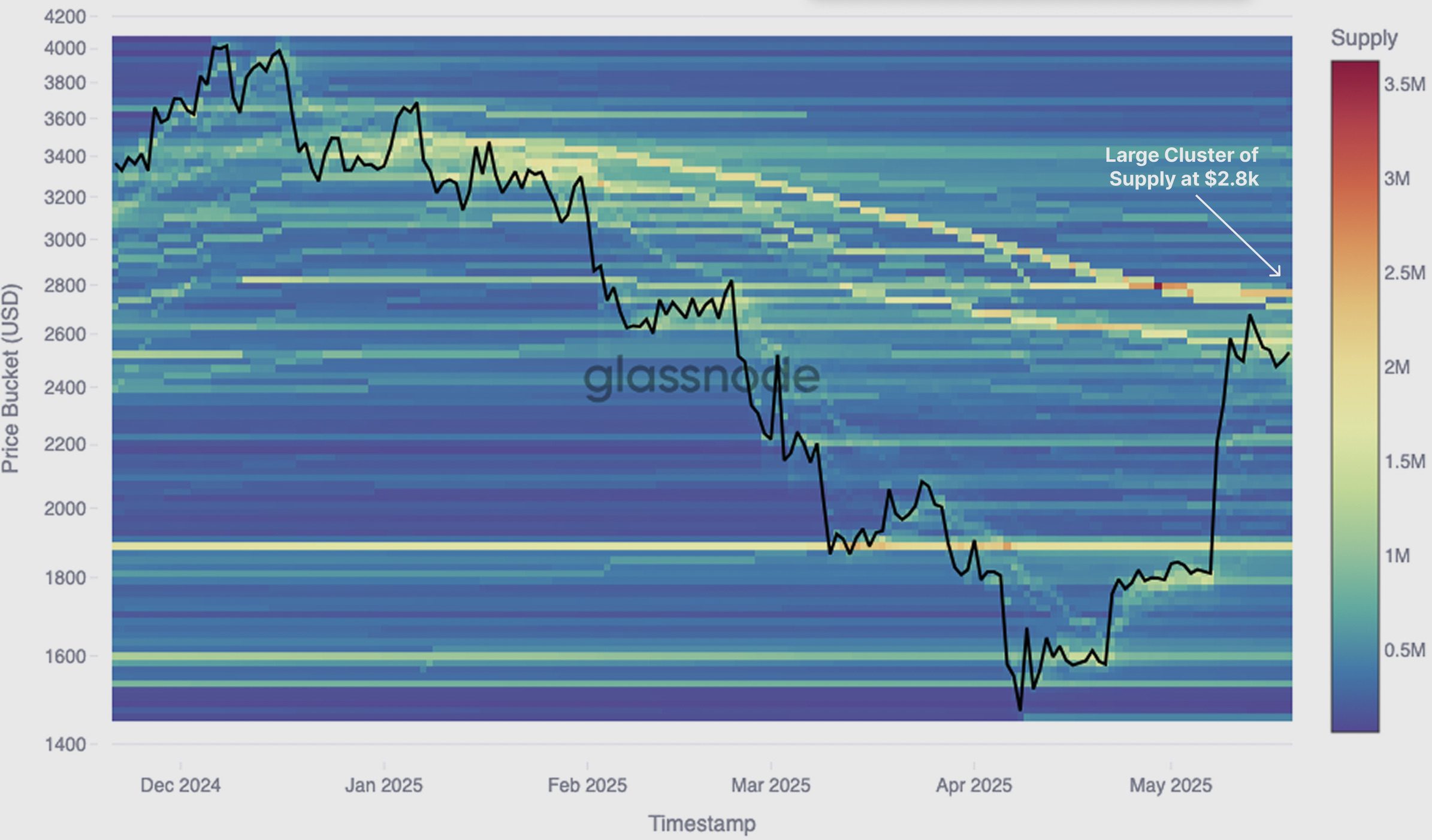

Sell-Off Risk at $2,800

Cost basis distribution data reveals that investors hold approximately 2.27 million ETH at an average cost basis of $2,767. This concentration creates a potential resistance zone around $2,800, as many investors may choose to sell at break-even, potentially hindering further upward momentum.

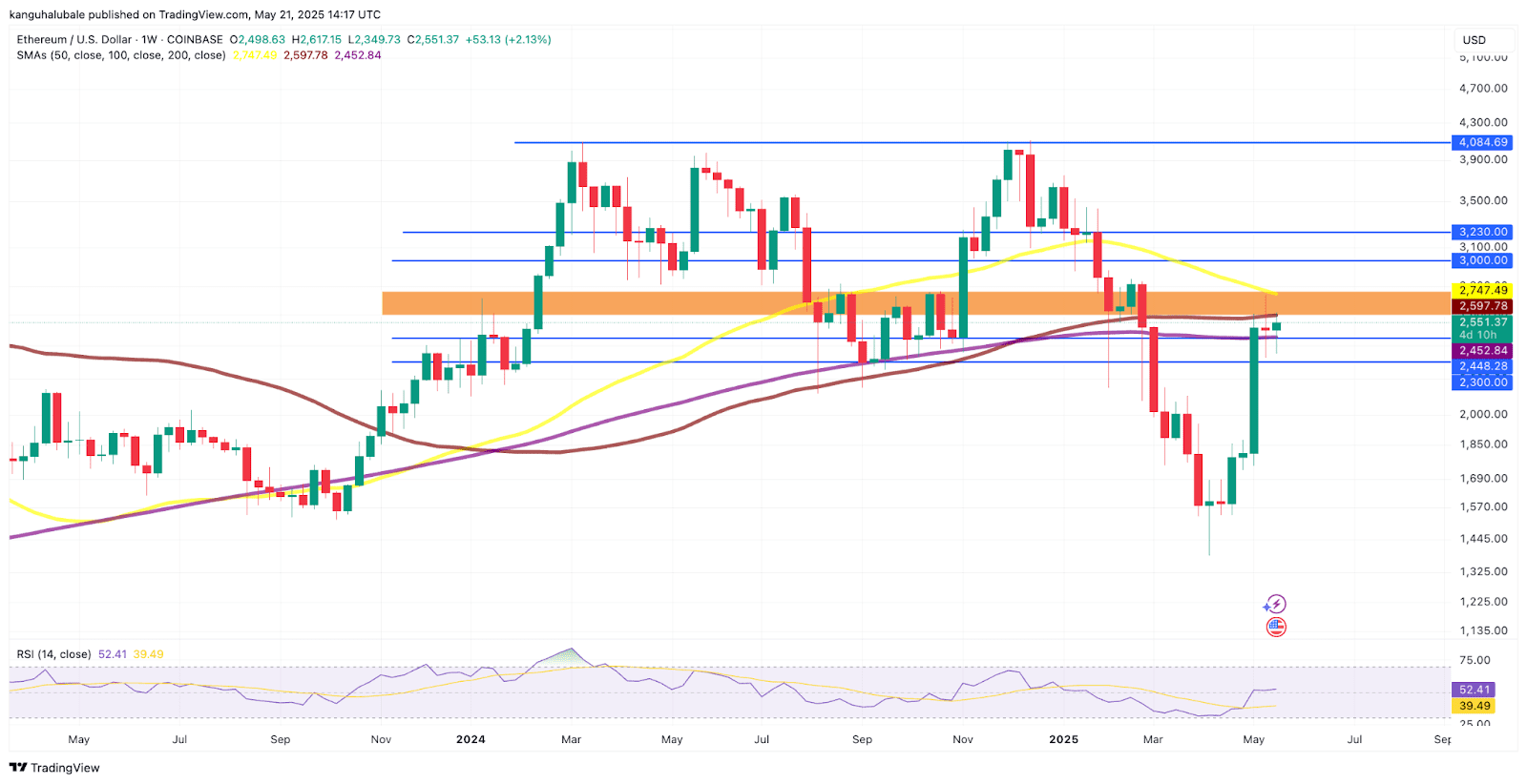

Technical Analysis and Key Levels to Watch

From a technical standpoint, ETH needs to flip the $3,000 resistance level into support to target higher highs above $4,000. The immediate hurdle is closing above the $2,600-$2,800 range, where the 100-day and 50-day simple moving averages (SMA) currently reside.

Critical support and resistance levels:

- Resistance: $2,600 – $2,800, $2,900, $3,000

- Support: $2,400 (200-day SMA), $2,200, $2,000, $1,800

Potential Catalysts

One positive catalyst for ETH could be continued demand from spot Ethereum ETFs, which registered $100.7 million in net inflows recently. Conversely, if bears maintain the $2,600 resistance, a price pullback towards the $2,400 level (or the 200-day SMA) becomes more likely. A drop to $1,800 would erase the gains made following the Pectra upgrade.

The Pectra Upgrade and its impact

The Pectra upgrade is a pivotal network enhancement, aiming to bolster Ethereum’s efficiency, scalability, and security. By optimizing gas usage and introducing enhanced smart contract functionalities, Pectra paves the way for decentralized applications (dApps) to flourish within the Ethereum ecosystem. With Pectra, Ethereum seeks to solidify its position as a leading blockchain platform.

Ethereum and the Market Landscape

Ethereum’s significance extends far beyond its monetary value. It forms the bedrock of numerous decentralized applications (dApps), decentralized finance (DeFi) platforms, and non-fungible tokens (NFTs). Ethereum’s robust and versatile infrastructure enables the creation of innovative solutions, driving adoption across industries and shaping the future of blockchain technology. Moreover, Ethereum’s open-source nature fosters collaboration and continuous improvement within its developer community, ensuring its long-term viability and adaptability to evolving market demands.

Disclaimer:This analysis is for informational purposes only and should not be considered investment advice. Cryptocurrency investments are inherently risky, and it is crucial to conduct thorough research and consult with a financial advisor before making any decisions.