Understanding the Ethereum (ETH) Price Dip

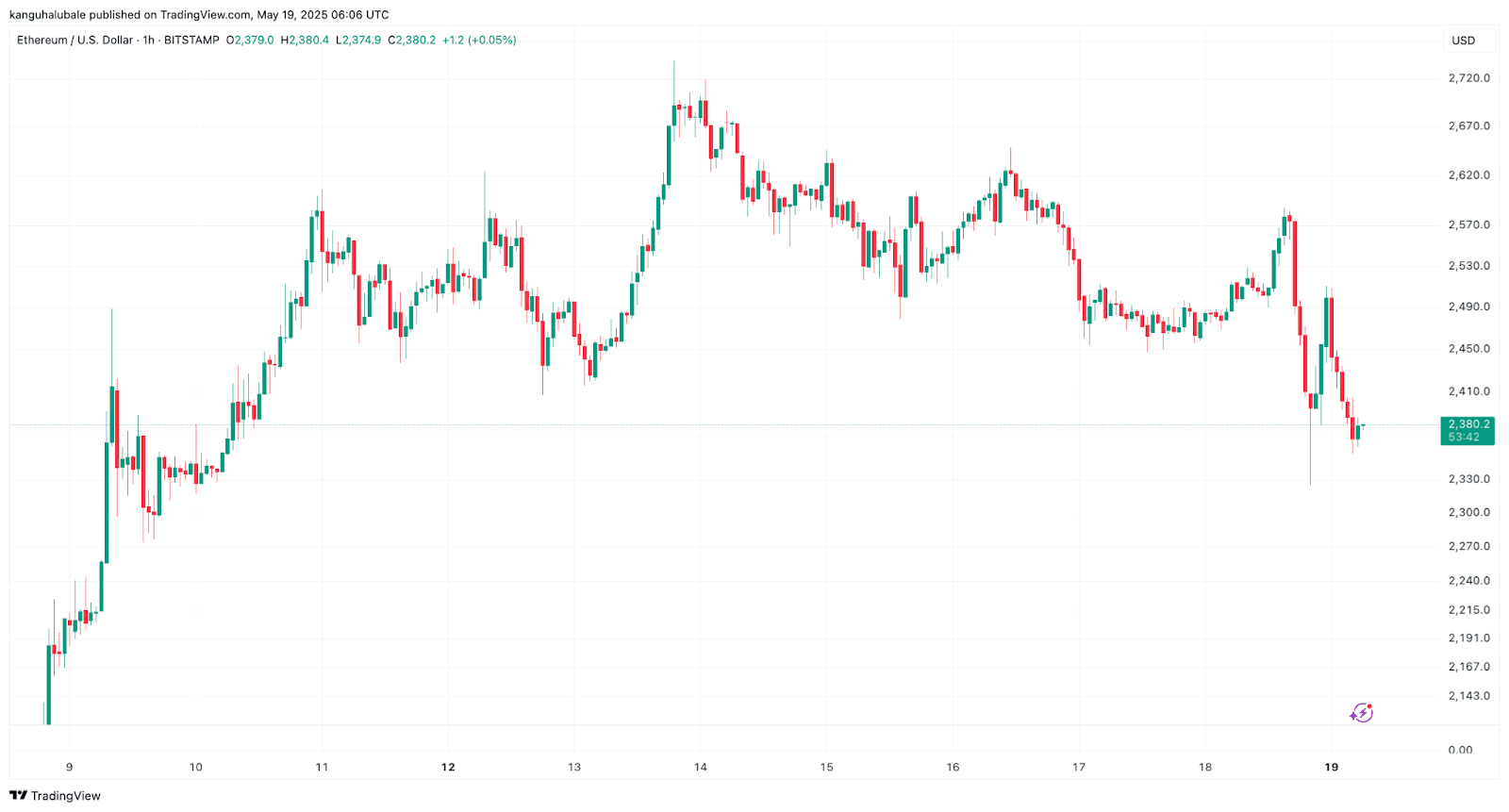

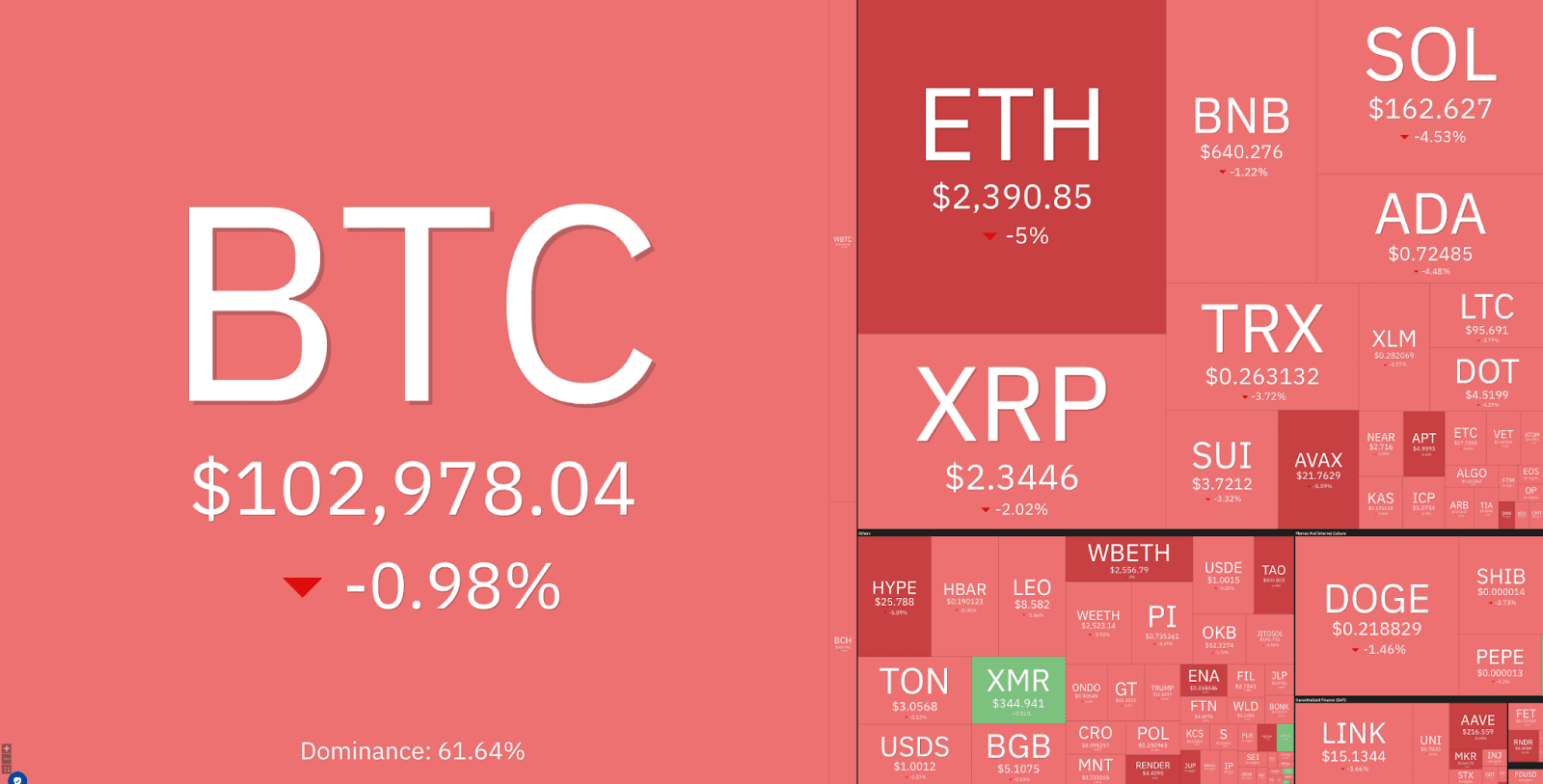

Ethereum (ETH) experienced a significant price drop on May 19th, falling over 5% to around $2,380. This decline mirrors a broader downturn in the cryptocurrency market. Several factors contributed to this price movement, including market-wide sell-offs, macroeconomic concerns, and liquidation events.

Key Factors Behind the ETH Price Drop:

- Market-Wide Sell-Off: The overall cryptocurrency market capitalization decreased, impacting Ethereum along with other major cryptocurrencies.

- US Credit Rating Downgrade: Moody’s downgrade of the United States’ credit rating to Aa1 from Aaa triggered risk-off sentiment in financial markets, leading investors to pull back from speculative assets like crypto.

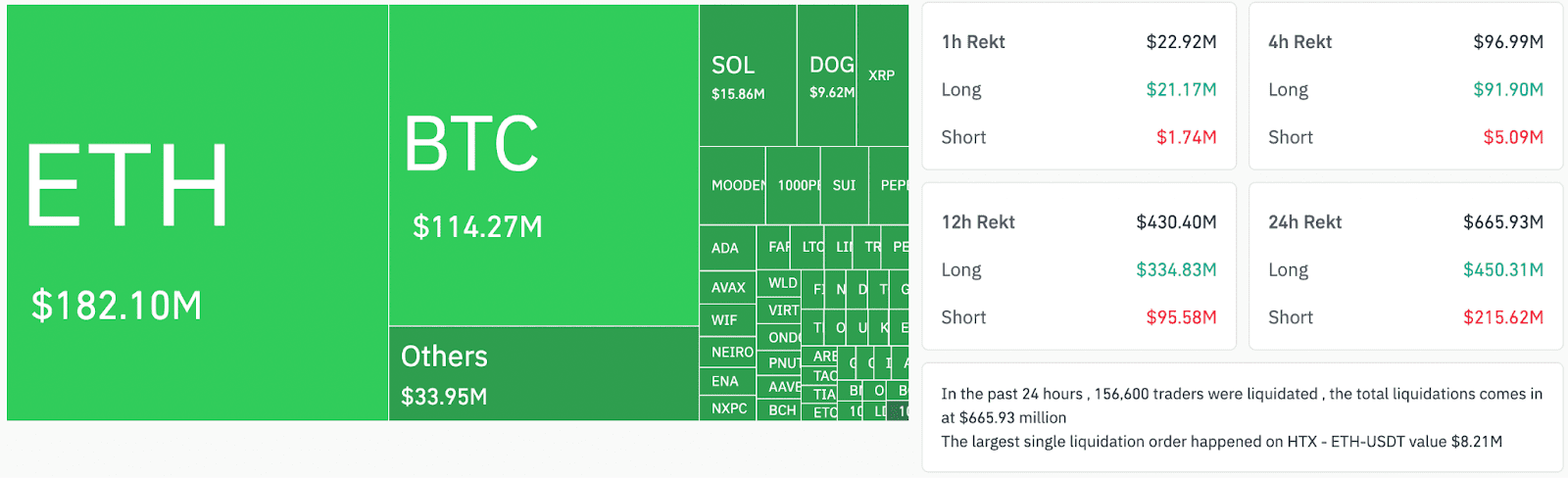

- Long Liquidations: A significant wave of long liquidations occurred, forcing traders to exit their leveraged positions and exacerbating the price decline.

Detailed Analysis of Contributing Factors

1. Cryptocurrency Market Downturn

Ethereum’s decline aligned with a general downturn across the cryptocurrency market. Bitcoin (BTC) also experienced losses, while other altcoins like XRP and Solana (SOL) recorded notable drops. This widespread downward trend suggests a broader market correction or a shift in investor sentiment.

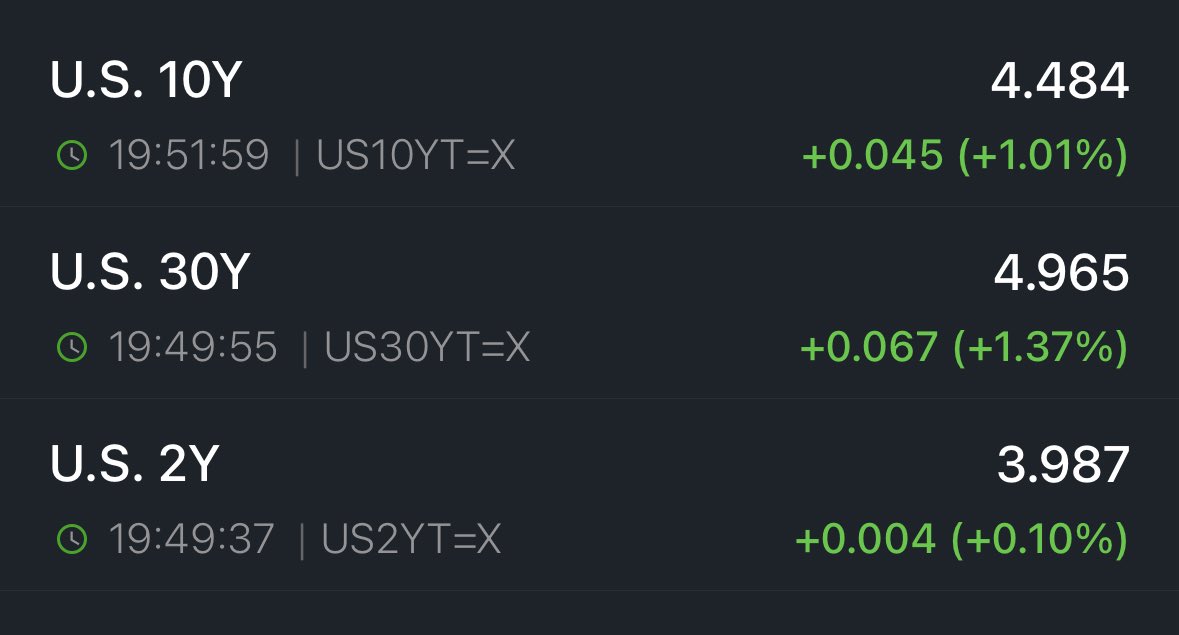

2. Moody’s US Credit Rating Downgrade

Moody’s decision to downgrade the United States’ credit rating due to concerns about the national debt, fiscal deficit, and political gridlock created uncertainty in the financial markets. This downgrade prompted investors to reduce their exposure to riskier assets, including cryptocurrencies. Higher Treasury yields, a consequence of the downgrade, increase borrowing costs and can negatively impact businesses and consumers.

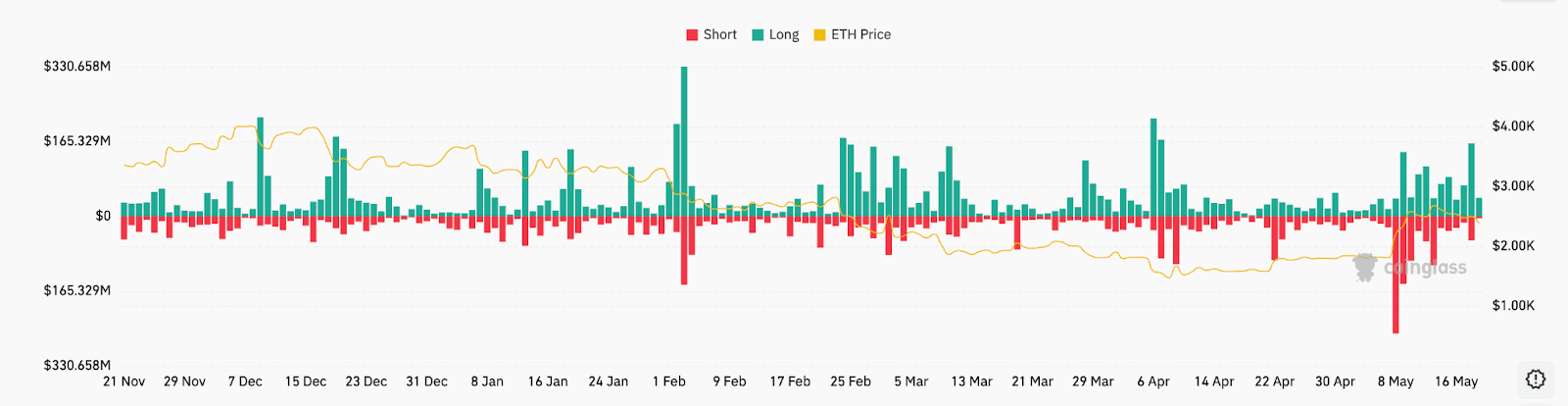

3. Long Liquidations and Market Deleveraging

The Ethereum price drop was intensified by a cascade of long liquidations. Traders who had taken leveraged positions betting on Ethereum’s price increase were forced to exit their positions as the price fell. This liquidation event triggered a domino effect, further accelerating the price decline. Over $200 million in ETH long positions were liquidated, contributing significantly to the overall market deleveraging.

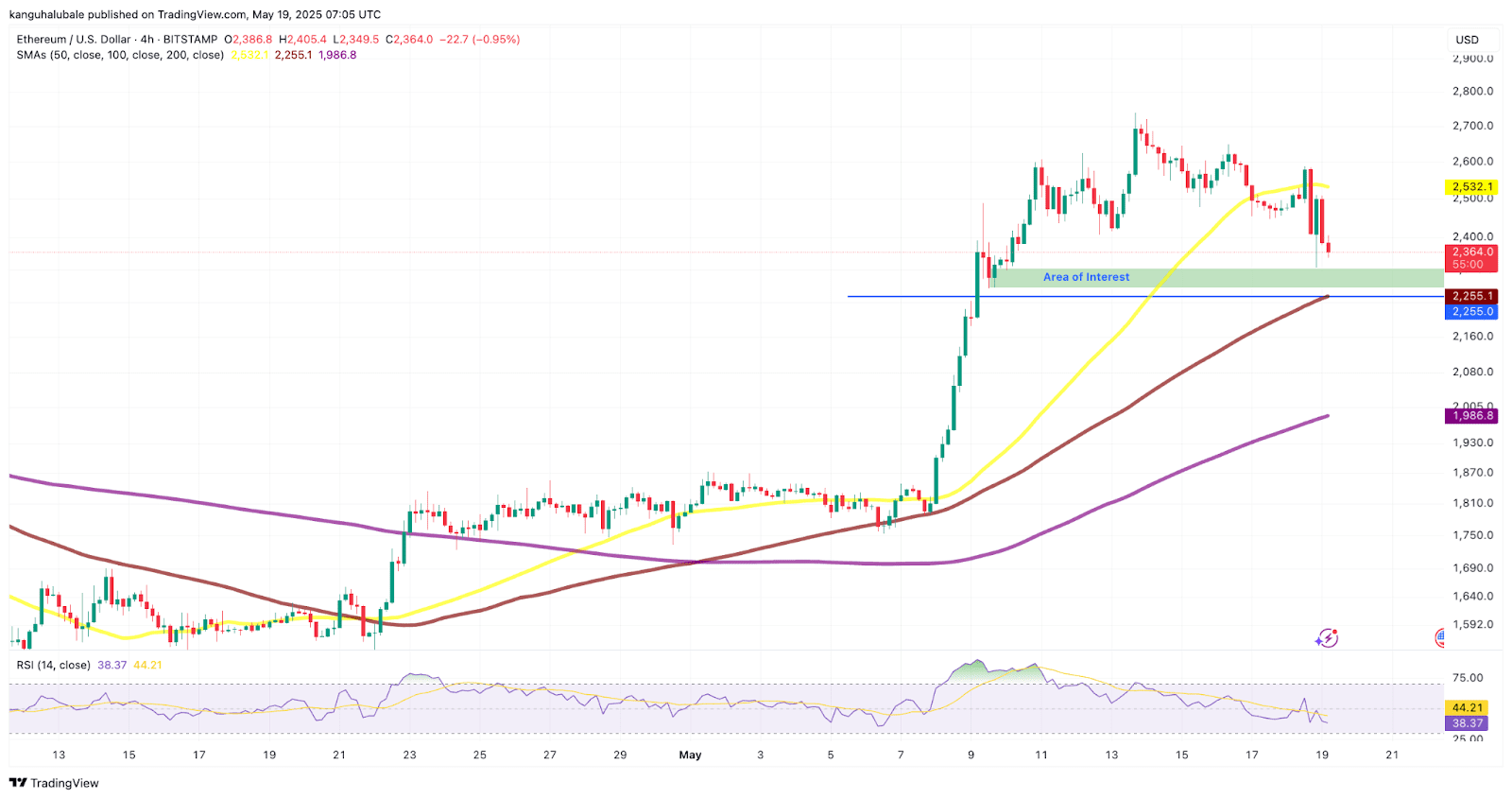

Technical Analysis and Key Support Levels

Ethereum’s price fell below critical support levels, including the 50-day simple moving average (SMA). Bulls are now looking at the $2,330 to $2,274 range as the next area of interest. A break below this support level could lead to a further decline towards the $2,250 zone, coinciding with the 100-day SMA.

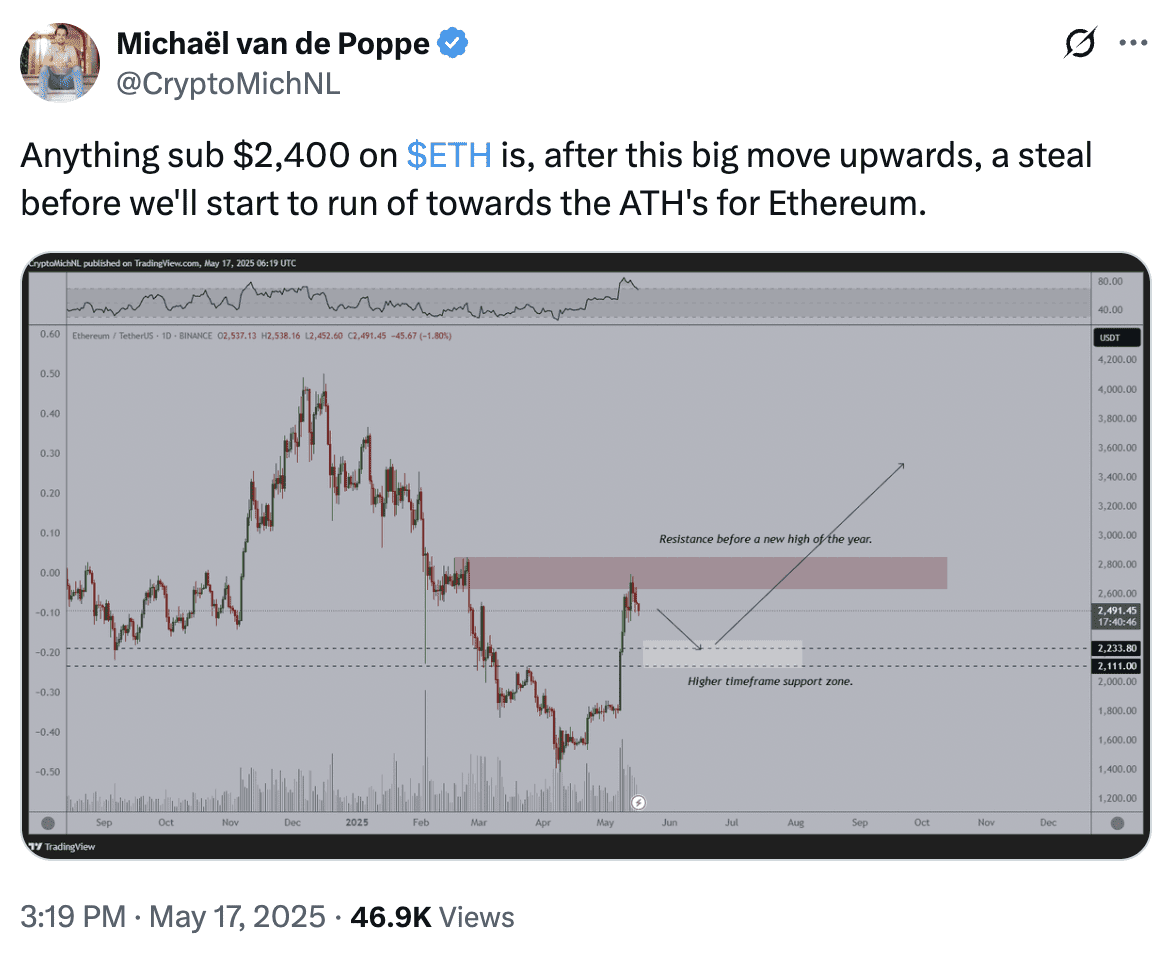

Potential Buy-the-Dip Opportunity

Despite the recent price decline, some analysts view the situation as a potential buy-the-dip opportunity. The argument is that Ethereum’s long-term fundamentals remain strong, and the current price dip could be a temporary correction before a resumption of its upward trend. The Relative Strength Index (RSI) indicates increasing bearish momentum, however, this can also signal that the asset is becoming oversold and may be due for a rebound.

Conclusion

The recent Ethereum (ETH) price drop was driven by a combination of factors, including market-wide trends, macroeconomic concerns, and liquidation events. While the decline may be concerning for some investors, others view it as a potential opportunity to accumulate ETH at a lower price. As always, investors should conduct their own research and consider their risk tolerance before making any investment decisions.