Ethereum (ETH) is showing signs of a potential surge, with analysts pointing to a specific chart pattern that could trigger a substantial rally. This analysis dives into the technical indicators, market sentiment, and expert opinions surrounding Ethereum’s price movements, offering insights into what could drive ETH to new highs.

Key Factors Influencing Ethereum’s Price

Several factors are currently influencing Ethereum’s price, including:

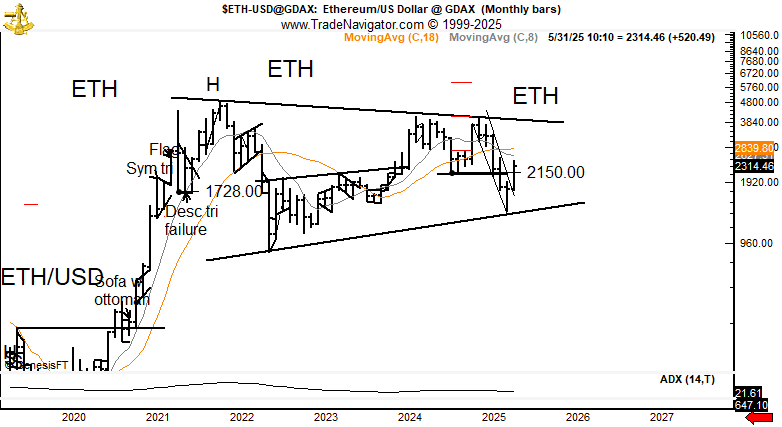

- Rising Wedge Pattern: Veteran trader Peter Brandt has identified a rising wedge formation on Ethereum’s chart. While typically bearish, a breakout above this pattern could propel ETH towards $3,800-$4,800.

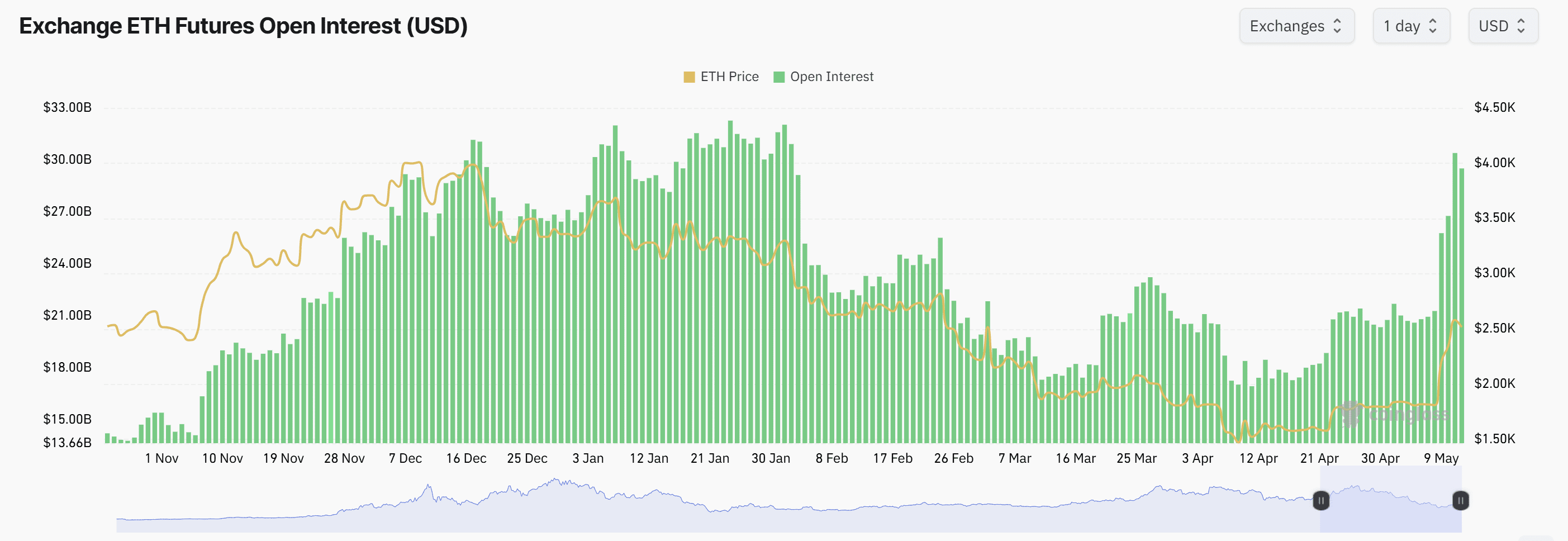

- Open Interest in Futures: Ethereum futures have seen a significant increase in open interest, nearing all-time highs. This indicates strong market activity and growing trader engagement.

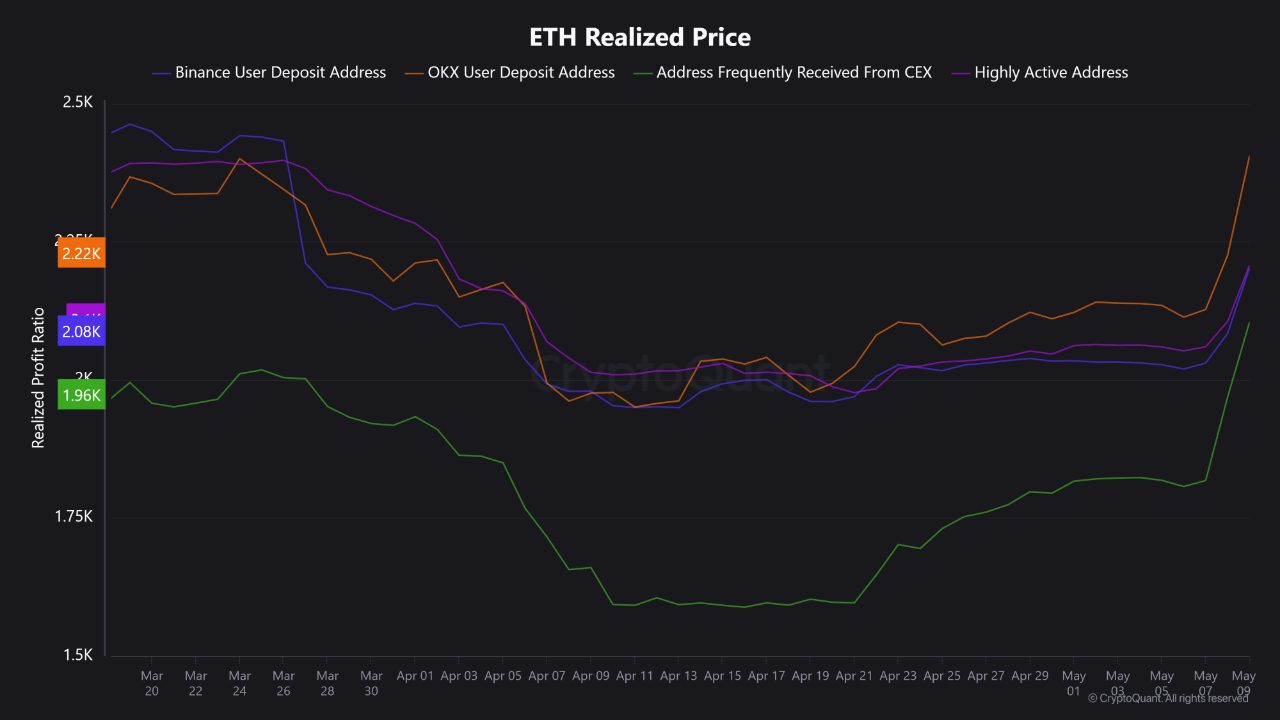

- Realized Price: Ether has surpassed its realized price for accumulating addresses (around $1,900), signaling profitability for holders.

- Exchange Activity: Increased activity on exchanges like Binance suggests strong trader confidence and liquidity.

Analyzing the Chart Patterns

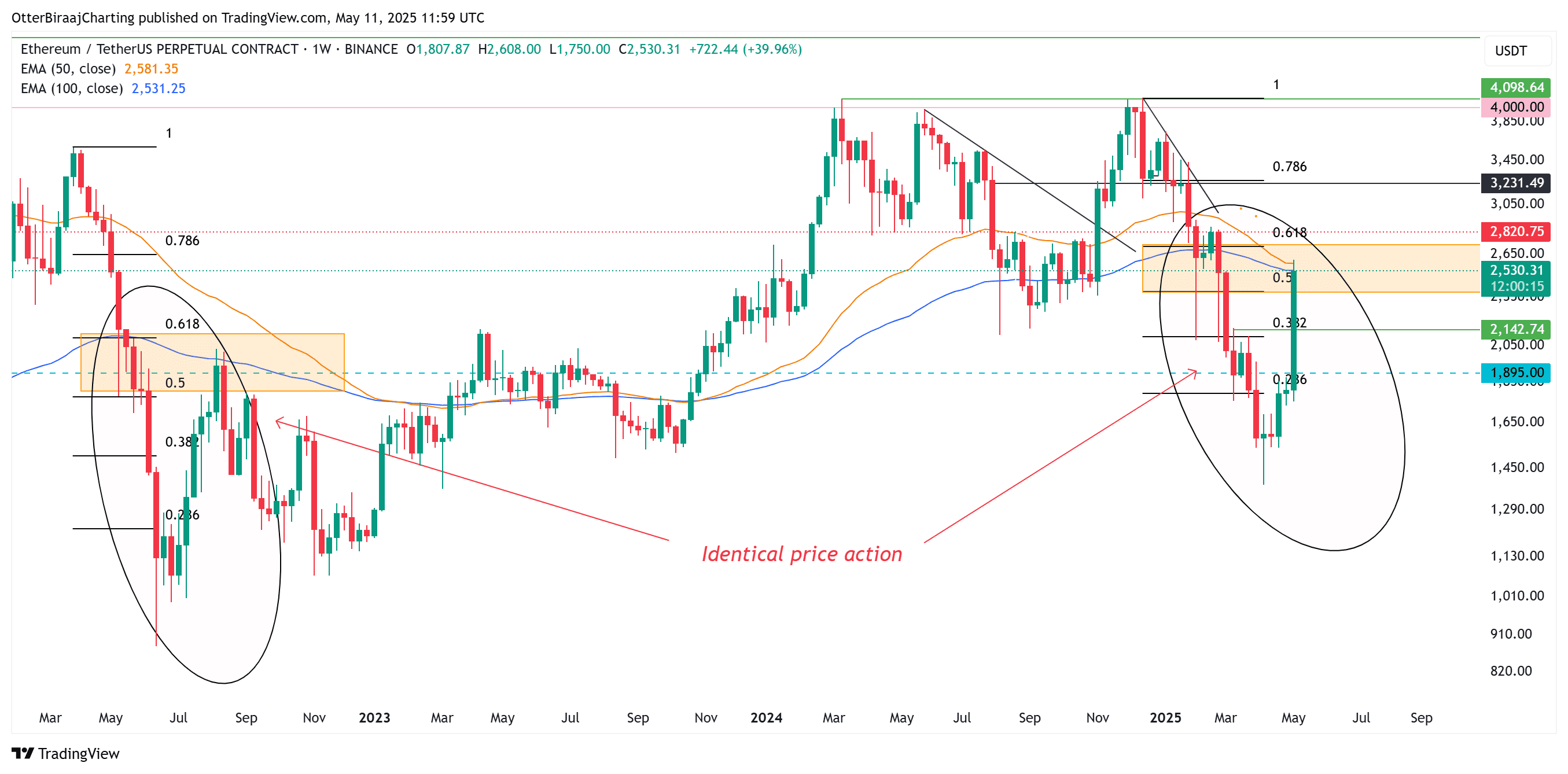

The rising wedge pattern identified by Peter Brandt is a crucial point of analysis. A breakout above the descending resistance line of this wedge could confirm the bullish outlook. Fibonacci retracement levels also indicate a retest of the $2,500 level, representing the first leg of a potential recovery.

Expert Opinion: Peter Brandt’s Analysis

Peter Brandt’s analysis highlights a potential “moonshot” rally if Ethereum breaks through the congestion pattern. His shift in outlook from 2024 aligns with renewed optimism for the altcoin, further reinforcing the bullish sentiment.

Ethereum Futures Market

The Ethereum futures market is experiencing heightened activity. The open interest (OI) surged by 42% between May 8 and May 11, 2025, reflecting increased trader engagement and paving the way for potential price volatility. A rising OI typically suggests that new money is flowing into the market, which can amplify price movements.

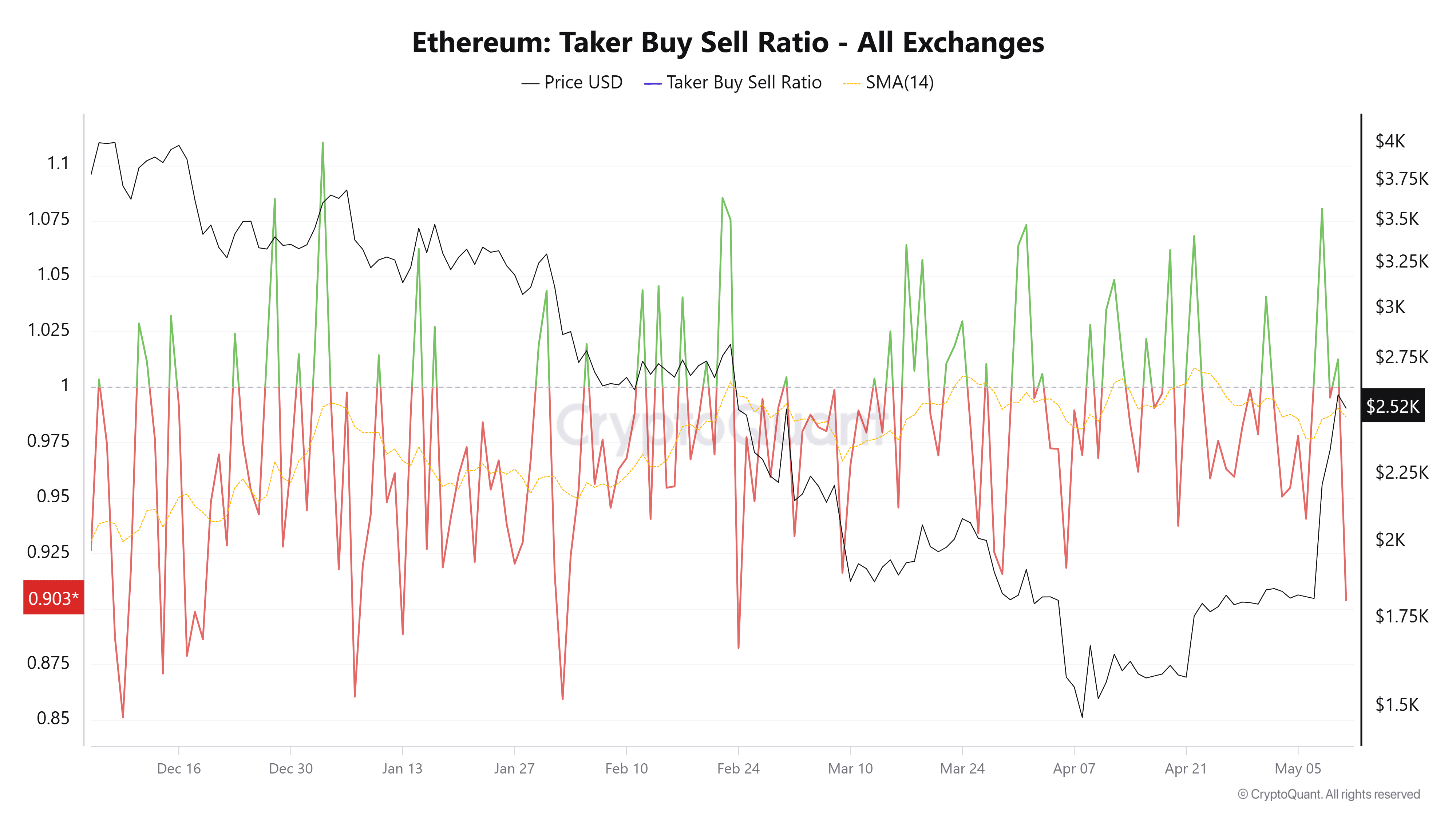

Short-Term Cautionary Signals

While the overall outlook is bullish, there are short-term indicators suggesting caution. The taker buy-sell ratio has dropped below 1, indicating potential short-term bearishness. This suggests that traders might approach the coming days with more caution, potentially leading to a consolidation phase under the $2,500 level.

Ethereum’s Performance Against Moving Averages

Ethereum’s higher-time frame (HTF) chart shows a price rise on the weekly chart, where it has moved toward the 50 and 100-week exponential moving averages (EMAs). Historically, such a recovery marks a price bottom, but it could also signal the beginning of a small correction period after the EMAs are retested.

Key Takeaways for Ethereum Traders

- Potential Rally: A break above the rising wedge pattern could trigger a significant rally towards $3,800-$4,800.

- Monitor Open Interest: Keep an eye on the open interest in Ethereum futures for signs of increased market activity.

- Short-Term Pullback: Be aware of potential short-term pullbacks due to the decreasing taker buy-sell ratio.

- EMA Retest: Watch for potential correction periods after retesting the 50 and 100-week EMAs.

In conclusion, Ethereum’s price analysis suggests a potential for a substantial rally, driven by specific chart patterns, increased market activity, and expert opinions. While short-term caution is advised, the overall outlook remains bullish, with the possibility of ETH reaching new all-time highs.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. Trading cryptocurrencies involves substantial risk, and you should conduct your own research before making any investment decisions.