Ethereum Price Poised for Potential Rally to $3,000: A Comprehensive Analysis

Ethereum (ETH) is showing signs of a potential recovery, with traders eyeing the $3,000 price level. This analysis examines the factors supporting this optimistic outlook, as well as potential headwinds that could hinder its progress.

Key Takeaways:

- Ether has broken a multi-month downtrend, fueling speculation of a move towards $3,000.

- Ethereum’s Total Value Locked (TVL) has surged 41% to $52.8 billion in the last 30 days, indicating increased network activity.

- Daily transactions have also seen a 22% increase, reaching 1.34 million.

- Technical analysis suggests significant resistance between $2,100 and $2,800.

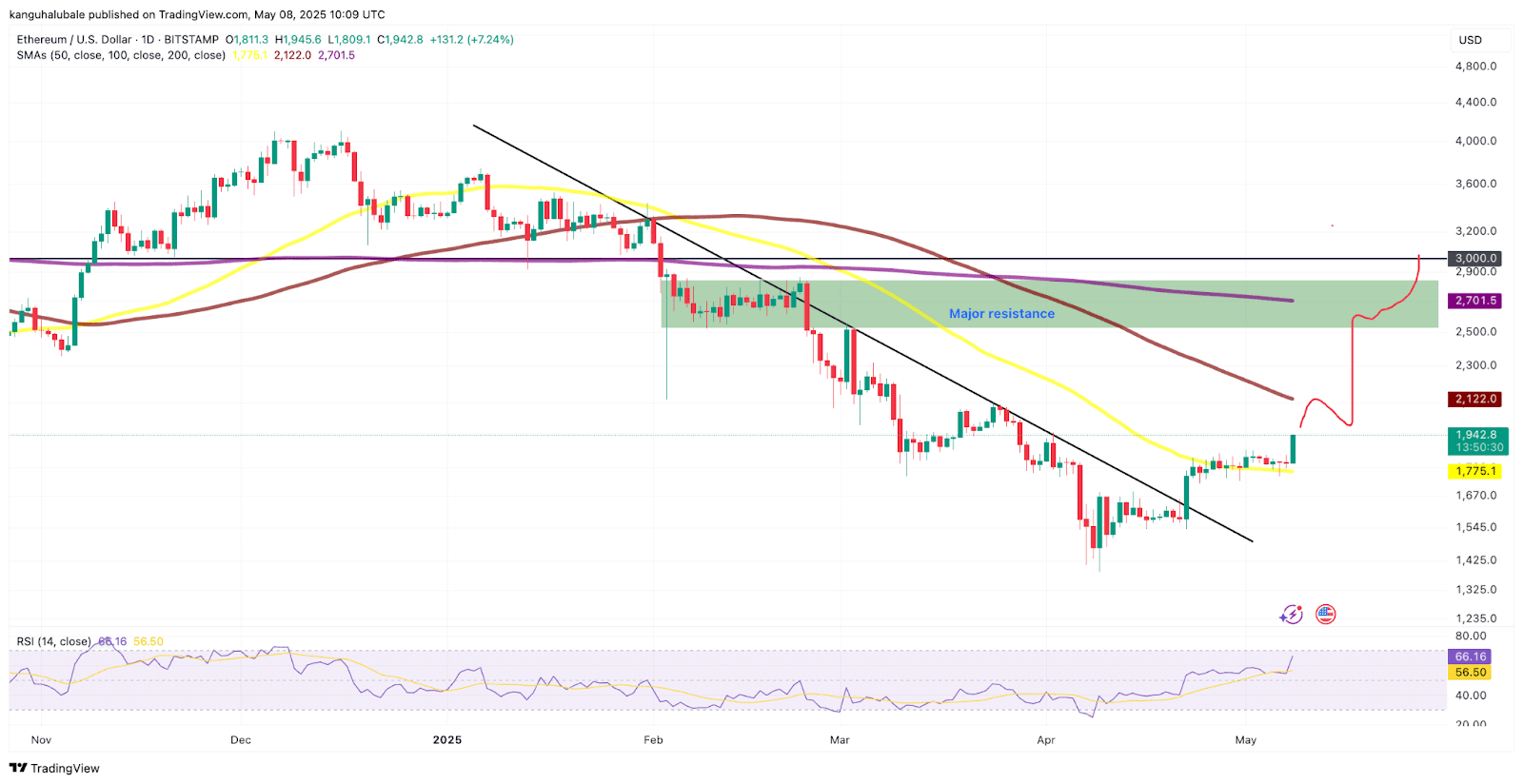

Technical Analysis: Breaking the Downtrend

After facing resistance since mid-December, ETH has seemingly broken its downtrend. Technical analysts are observing key resistance levels at $2,000 and $2,250. The price surpassed the downtrend line at $1,600, spurred by easing macroeconomic concerns that triggered a broader market recovery.

The 50-day Simple Moving Average (SMA) at $1,775 is currently acting as immediate support. The Relative Strength Index (RSI) has also seen a significant increase, suggesting growing bullish momentum.

On the upside, key levels to watch include the 100-day SMA at $2,100 and the $2,500-$2,800 range, where the 200-day SMA resides. Successfully breaching these levels could pave the way for a move towards the $3,000 target.

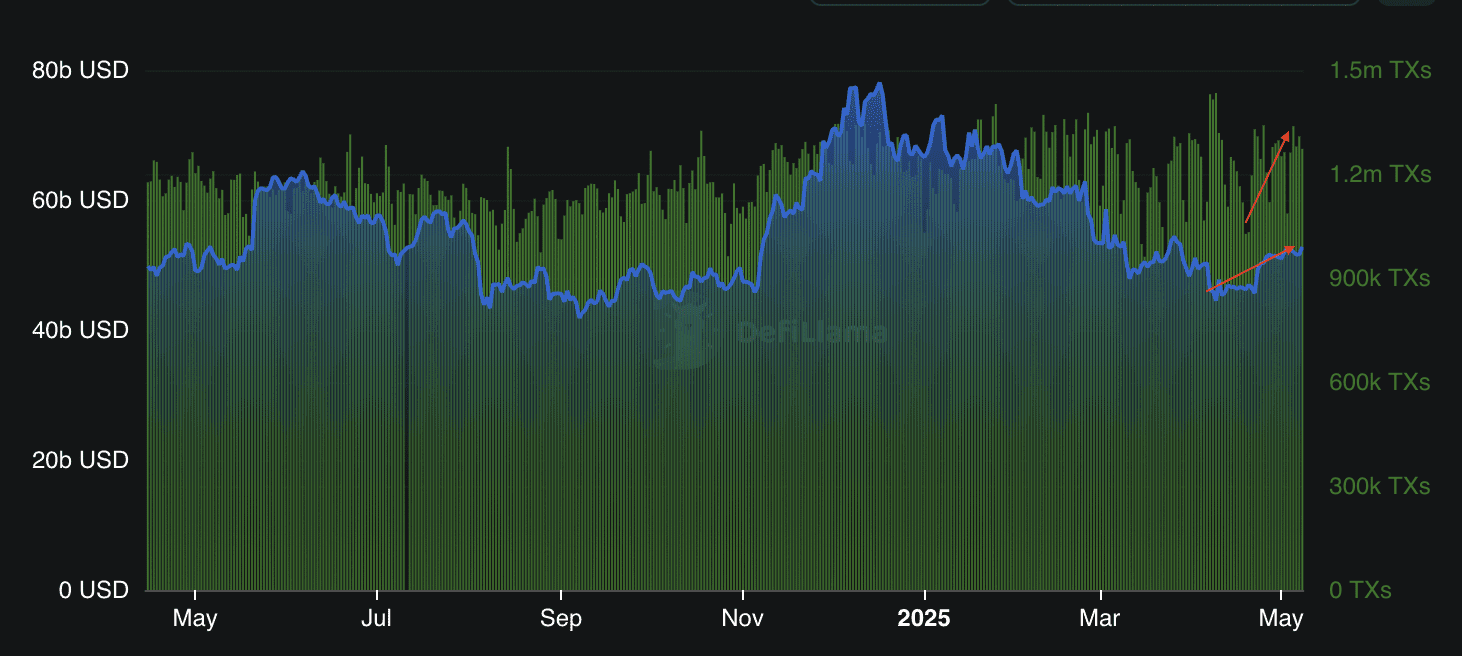

On-Chain Metrics: Strengthening Network Activity

Ethereum’s on-chain data paints a positive picture, with significant growth in TVL. Ethereum remains the dominant layer-1 blockchain in terms of TVL. In the past month, the total value locked has jumped from $44.5 billion to $52.8 billion.

Additionally, BlackRock BUIDL, Spark, and Ether.fi have all experienced significant deposit increases, demonstrating growing interest and investment in the Ethereum ecosystem. Daily transaction counts have also increased by 22%, reaching 1.34 million.

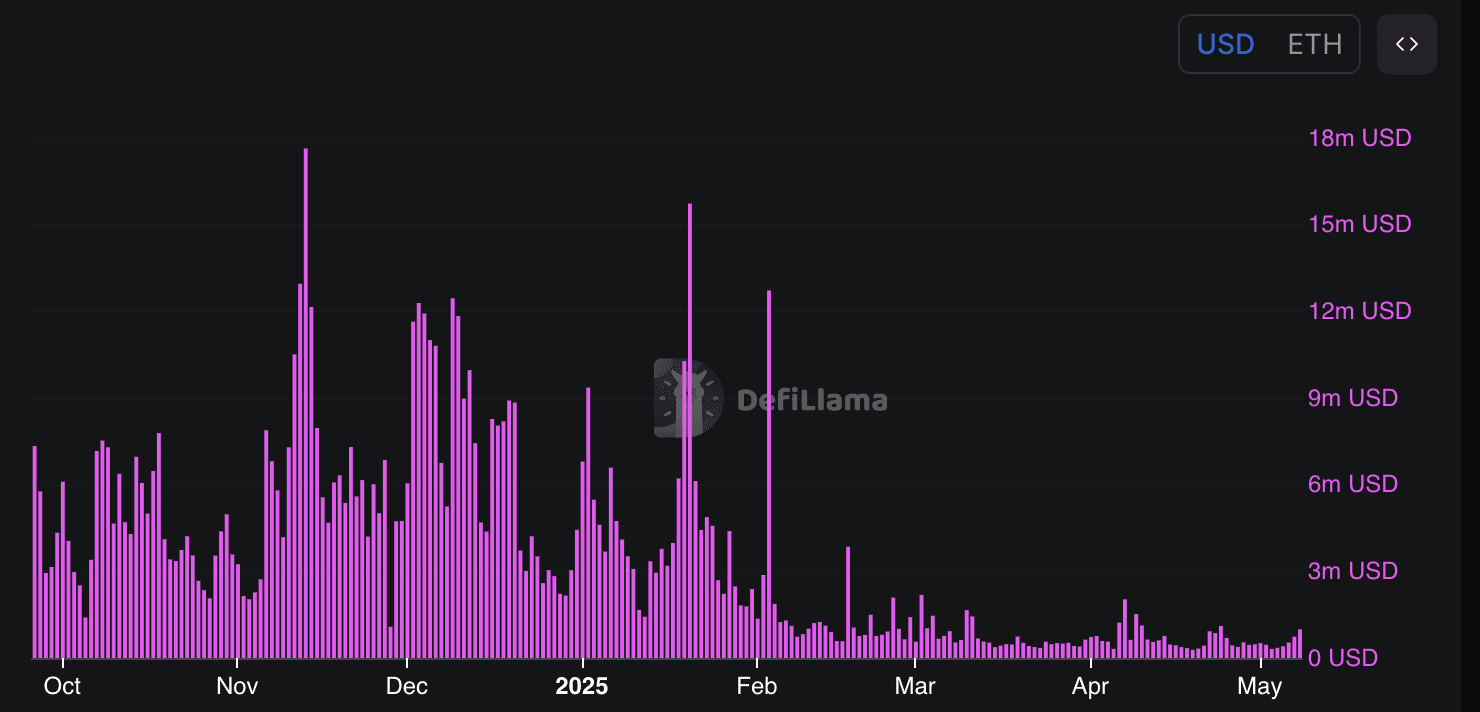

Potential Headwinds: Fees and ETF Flows

Despite the positive indicators, some concerns remain. Ethereum fees have dropped significantly year-to-date. This decline in transaction activity can reduce ETH burning, potentially leading to inflationary pressure as staking rewards outpace the burn mechanism.

Furthermore, US-listed spot Ether ETFs experienced net outflows between May 5 and May 7. This contrasts with the net inflows seen in similar Bitcoin instruments over the same period, adding to concerns about the strength of the potential recovery.

Conclusion: Cautious Optimism for Ethereum’s $3,000 Target

Ethereum is showing promising signs of a potential rally towards $3,000. The break in the downtrend, strong on-chain metrics, and increasing network activity all support this bullish outlook. However, potential headwinds related to declining fees and ETF outflows warrant cautious optimism. Investors and traders should carefully monitor these factors to assess the likelihood of Ethereum achieving its $3,000 target.