Ethereum (ETH) experienced a significant surge, gaining 43.6% between May 7 and May 14. However, the current price of around $2,600 remains below the 2021 peak of $4,868. The question now is: can Ethereum realistically reach $5,000 in 2025? This analysis explores the key factors that could drive ETH’s price higher, focusing on regulatory developments, technological advancements, and adoption trends.

Key Catalysts for an Ethereum Price Rally to $5,000 in 2025

Several factors need to align for Ethereum to achieve a $5,000 price target by 2025:

- SEC Approval of In-Kind ETF Creation and Staking: The approval of spot Ethereum ETFs, particularly those allowing in-kind creation and staking, is crucial for attracting institutional investment.

- Layer-2 Growth and Onchain Activity: Increased activity on Ethereum’s layer-2 networks is essential to boost the network’s deflationary burn mechanism.

- AI Adoption: The integration of Ethereum with AI, particularly for autonomous agents and smart contracts, has the potential to drive significant onchain activity.

Ethereum ETFs: Institutional Interest and Regulatory Hurdles

The success of Ethereum ETFs is vital for attracting institutional investors. While Bitcoin ETFs have seen massive inflows, Ethereum ETFs have lagged behind. Between May 12 and May 13, US-listed Ether ETFs saw net outflows of $4 million, and the Ether ETF market is significantly smaller than Bitcoin’s. However, regulatory clarity and accessibility, potentially achieved through multiple spot ETFs, could change this landscape.

According to X user AdrianoFeria, ETH is “the best candidate for institutional diversification” since professional fund managers appreciate “similar levels of regulatory clarity and accessibility” through multiple spot exchange-traded funds (ETFs), although recent data hasn’t been especially encouraging.

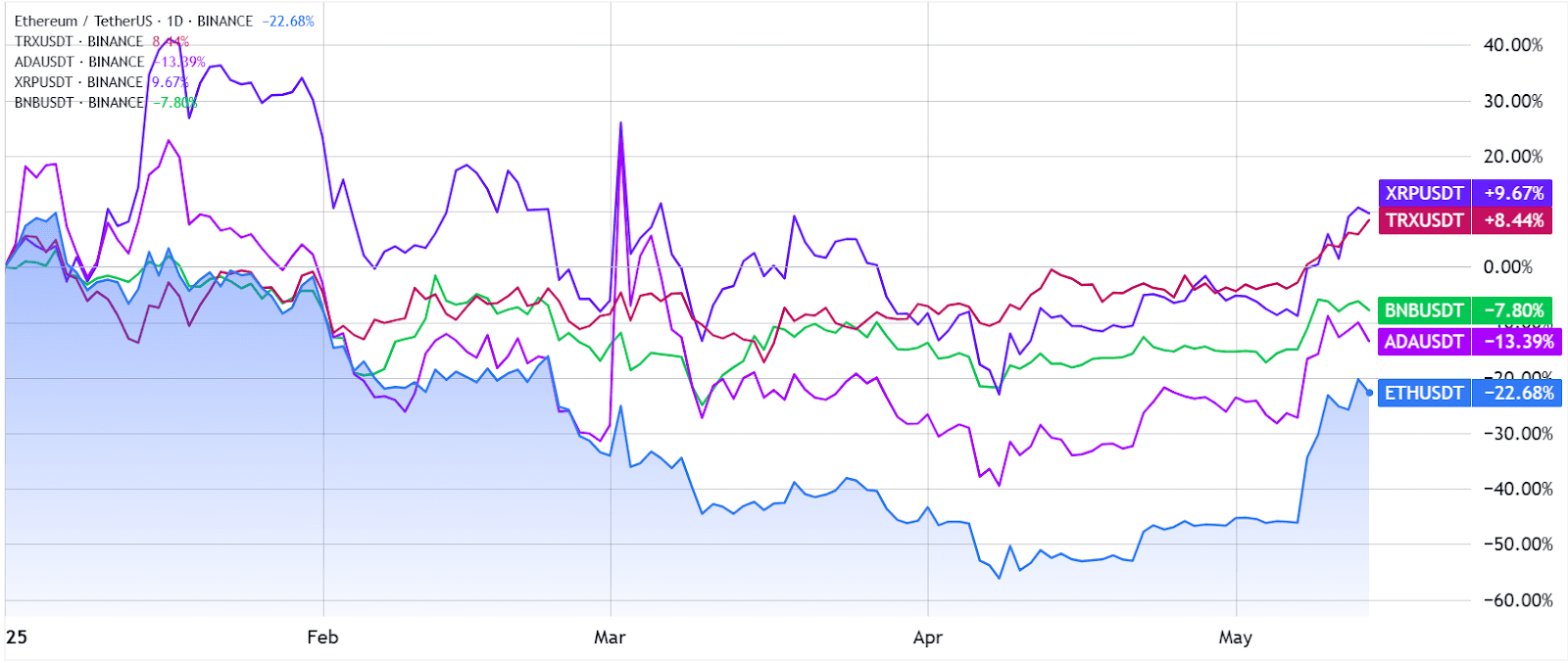

Competitive Landscape: Ethereum vs. Altcoins

While some altcoins have outperformed ETH in 2025, their potential for inclusion in US state-level digital asset reserves has decreased, especially after statements from US President Trump. The focus has largely shifted towards Bitcoin, potentially leaving Ethereum as the primary alternative for institutional investment.

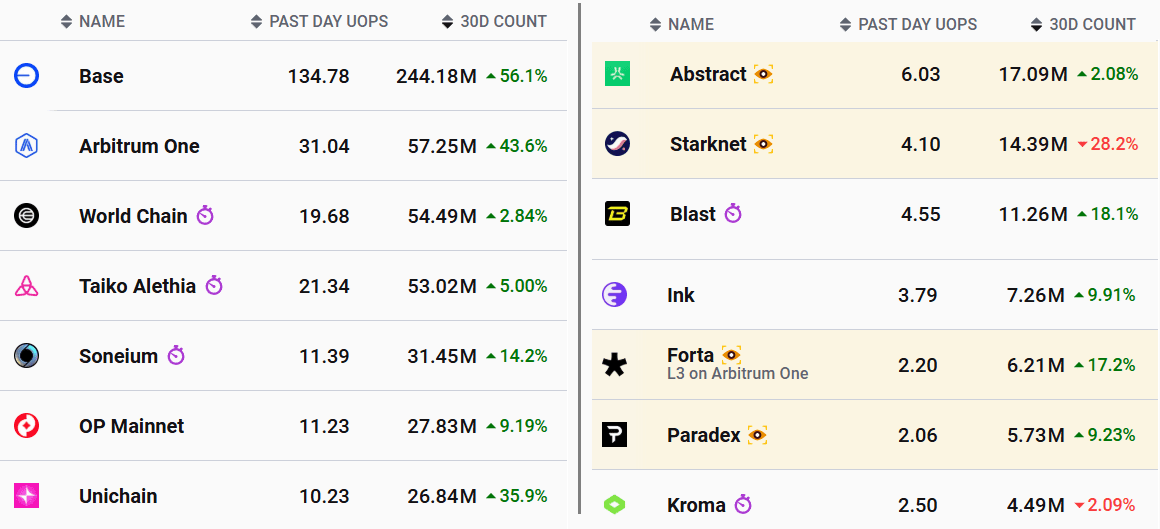

The Pectra Upgrade and Layer-2 Scaling

The Pectra upgrade is a significant step toward improving Ethereum’s scalability. This upgrade has improved data transmission efficiency, which is essential for layer-2 scaling solutions to thrive. Layer-2 networks have seen increased activity, with the Base network leading in transaction volume. This increased activity can drive demand for ETH and further differentiate Ethereum from its competitors.

The built-in burn mechanism introduced in 2021 was designed to reduce supply growth based on network demand. However, the shift in focus toward scalability through rollups has largely offset its deflationary impact. As a result, a significant increase in onchain activity is now required for Ether to become deflationary once more.

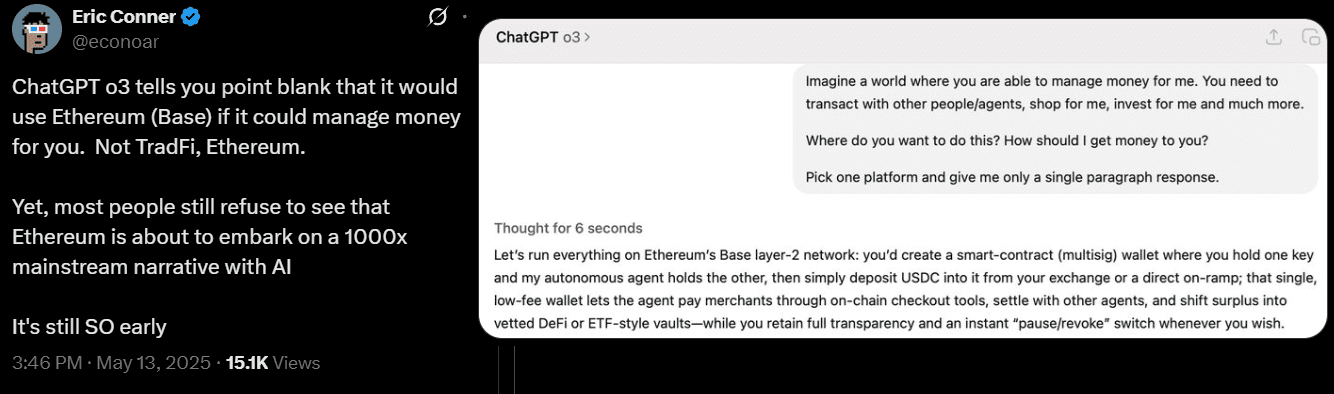

The Role of AI in Ethereum’s Future

Artificial intelligence could be a powerful catalyst for Ethereum’s growth. Ethereum advocate Eric Conner noted that ChatGPT prefers Ethereum’s layer-2 infrastructure for managing funds via multisignature contracts. This allows autonomous agents to manage finances, pay merchants, and allocate surplus funds to DeFi applications. If this trend continues, smart contract activity could increase significantly, potentially driving ETH to new all-time highs.

Risks and Challenges

While the potential for Ethereum to reach $5,000 in 2025 is significant, several risks and challenges remain:

- Regulatory Uncertainty: Unfavorable regulatory decisions could hinder the growth of Ethereum ETFs and the broader crypto market.

- Competition: Other blockchain platforms are competing for developers and users, potentially impacting Ethereum’s market share.

- Scalability Issues: Despite the Pectra upgrade, Ethereum still faces scalability challenges that could limit its ability to handle increased transaction volume.

- Market Volatility: The cryptocurrency market is inherently volatile, and significant price swings could impact investor sentiment.

Conclusion: A Cautiously Optimistic Outlook

Ethereum’s potential to reach $5,000 in 2025 depends on a combination of regulatory approvals, technological advancements, and adoption trends. While challenges remain, the catalysts for growth are in place. The SEC approval of in-kind ETFs and staking, increased layer-2 activity, and the integration of AI could all contribute to a significant price rally. However, investors should carefully consider the risks and challenges before making any investment decisions. The Ethereum ecosystem is evolving rapidly, and staying informed is critical for navigating this dynamic landscape.