Ethereum (ETH) has seen its price climb above $1,700 after a period of selling pressure driven by macroeconomic factors and reduced on-chain activity. While this rebound is welcome news for ETH holders, it’s crucial to examine whether this marks a true turning point or just a temporary reprieve.

Some analysts are touting ETH as a potential “generational” investment, citing its decentralized and permissionless nature. However, a closer look reveals a more nuanced picture. This article dives deep into Ethereum’s current market position, historical performance, and competitive landscape to assess the likelihood of a sustained rally.

One key observation is that Ethereum has underperformed against several other major cryptocurrencies in 2025, failing to reach new all-time highs while competitors like Solana (SOL) and BNB have surged. This raises questions about Ethereum’s relative strength in the current market cycle.

Furthermore, the shift away from proof-of-work mining, while intended to improve energy efficiency and scalability, may have inadvertently removed a competitive edge that Ethereum once possessed.

Ethereum Fee Drop: A Warning Sign?

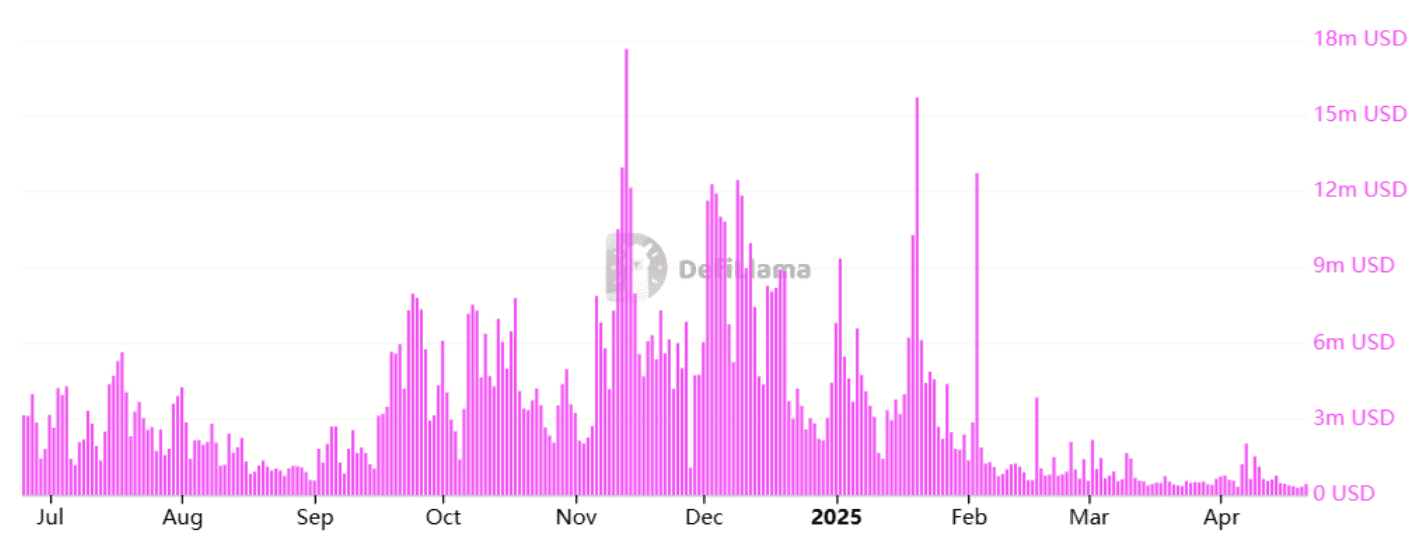

While some influencers are bullish on Ethereum, a significant drop in Ethereum fees (a 95% decrease since January) suggests a lack of strong fundamental support for lasting price growth. Low network fees indicate reduced demand for data processing on the Ethereum network. This, in turn, can lead to inflationary pressures on ETH, as the burning mechanism may not be sufficient to offset the new coins issued as staking rewards.

Although Ethereum remains the leader in Total Value Locked (TVL), this metric alone hasn’t driven increased demand for the network or increased scarcity for ETH. In essence, traders appear less interested in TVL as a primary indicator of Ethereum’s potential.

As a result, optimism among ETH holders is waning, while competitors, particularly Solana (SOL) and XRP investors, are anticipating the approval of spot exchange-traded funds (ETFs) in the US. The introduction of more altcoin ETFs could dilute institutional demand for Ethereum.

The recent net outflows from US-listed spot Ether ETFs, contrasting with the record-breaking inflows into similar Bitcoin instruments, further fuels these concerns.

Historical Performance: A Guide or a Trap?

Ethereum’s historical performance suggests that rallies may not always be sustainable. Examining past market cycles reveals patterns of rapid price increases followed by significant corrections, often leaving investors who bought at the top frustrated.

For example, consider these instances:

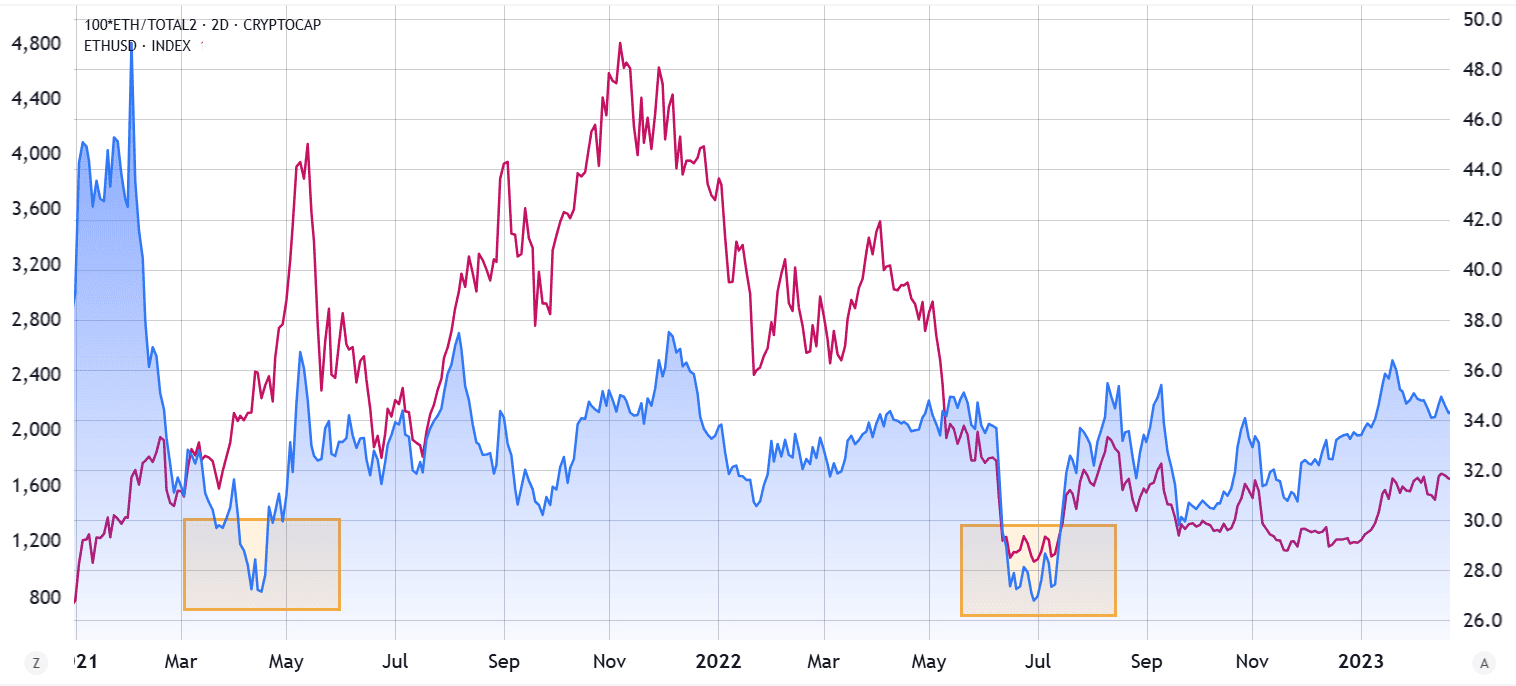

- June 2022: Ethereum’s market share in the altcoin capitalization reached a low of 26.5% before rallying to $2,000. The momentum then faded, and the price fell below $1,200 within three months.

- April 2021: Ethereum’s altcoin market share bottomed out at 26.8%, followed by a price surge to $4,200. However, the price subsequently dropped below $2,000 the following month.

These historical patterns suggest that Ether traders tend to take profits quickly, which can limit the potential for new all-time highs.

The narrative around Ethereum has also shifted over time, from utility tokens to NFT marketplaces, artificial intelligence, memecoins, and, most recently, RWA tokenization. This constant evolution makes it difficult to predict the next catalyst for a sustained bull run.

Some analysts even predict a further decline in Ethereum’s performance relative to Bitcoin.

Key Takeaways:

- Ethereum’s recent price increase may not signal a long-term bull run.

- Decreasing transaction costs show declining demand.

- Historical data shows that rallies are short-lived.

- Spot ETFs have been seeing a reduction in inflows

In conclusion, while Ethereum may have found a short-term bottom, historical trends and current market indicators suggest that a cautious approach is warranted. Investors should carefully consider the risks and potential rewards before making any investment decisions.