Ethereum’s long-held dominance in the layer-1 (L1) blockchain space is diminishing, leading to a competitive landscape where multiple chains are vying for the top spot as the leading Web3 platform. According to Alex Svanevik, CEO of Nansen, this marks a significant shift from just a few years ago when Ethereum’s supremacy seemed assured.

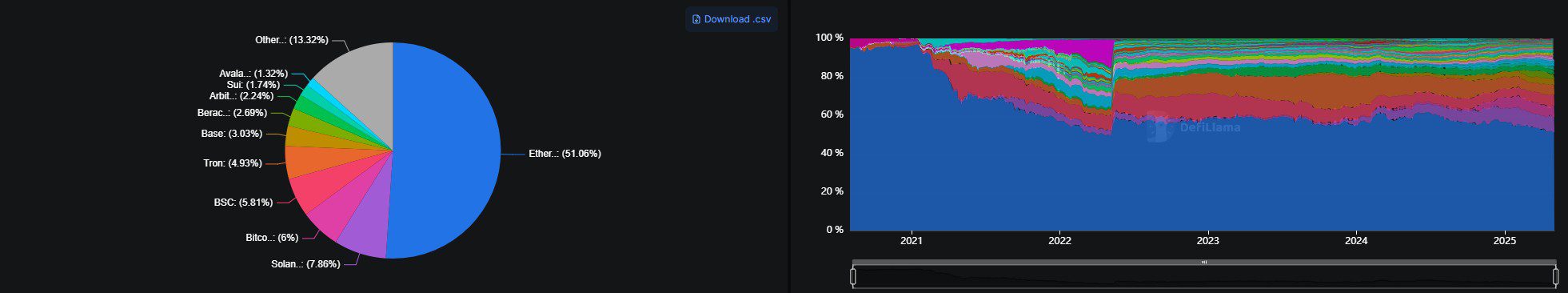

While Ethereum still holds the largest share of the total value locked (TVL) at approximately $52 billion, representing 51% of the cryptocurrency residing on blockchain networks (according to DefiLlama), its dominance has significantly decreased from the 96% it controlled in 2021.

This change was discussed during a panel at the LONGITUDE by Cointelegraph event, where Svanevik highlighted the emergence of several competing L1 networks. He noted that smaller chains are experiencing rapid growth, with a group of five or six emerging as potential leaders.

This indicates an ‘open race’ among multiple L1s aiming to become the primary platform for trading and broader blockchain applications. This competition is fostering innovation and growth across the Web3 ecosystem.

Solana’s Rise as a Contender

Solana (SOL) is emerging as a strong contender for Web3 leadership, known for its faster transaction speeds and lower fees compared to Ethereum. Svanevik suggests that Solana has even surpassed Ethereum in several on-chain metrics.

These metrics include:

- Active addresses

- Transaction volume

- Gas fees

While Ethereum maintains a lead in TVL and stablecoin issuance, Solana’s growth trajectory is undeniable. This growth is attracting developers and users seeking alternatives to Ethereum’s sometimes high costs and slower transaction times.

The Broader L1 Landscape

Beyond Ethereum and Solana, numerous smaller L1 chains are competing for market share. However, not all are achieving sustainable adoption. Vardan Khachatryan, chief legal officer of Fastex, pointed out that some chains gain popularity due to hype, new coins, or airdrops, rather than genuine, long-term usage.

Here’s a breakdown of factors influencing the success of L1 chains:

- Technology: Faster transaction speeds, lower fees, and innovative features.

- Community: Strong developer and user communities are crucial for adoption.

- Ecosystem: A vibrant ecosystem of decentralized applications (dApps) and tools.

- Sustainability: Long-term viability and resilience against market fluctuations.

The future of Web3 will likely be shaped by a multi-chain environment, where different L1 networks cater to specific use cases and user preferences.

Implications for the Future of Web3

The shift away from Ethereum’s dominance has several important implications for the future of Web3:

- Increased Innovation: Competition drives innovation as different chains experiment with new technologies and features.

- Greater User Choice: Users have more options to choose from, allowing them to select the chain that best meets their needs.

- Potential for Scalability: The multi-chain environment could lead to greater overall scalability for Web3 as different chains handle different types of transactions.

- Reduced Centralization: A more decentralized landscape reduces the risk of any single chain becoming a bottleneck or point of failure.

However, this fragmentation also presents challenges, such as increased complexity for users and developers and the potential for interoperability issues. Overcoming these challenges will be crucial for the continued growth and success of Web3.

In conclusion, while Ethereum remains a major player in the blockchain space, its era of undisputed dominance is over. The rise of Solana and other emerging L1 networks is creating a dynamic and competitive landscape that is driving innovation and offering users more choices. The future of Web3 will likely be characterized by a multi-chain environment where different chains coexist and cater to different use cases.