Europol Cracks Down on ‘Mafia Crypto Bank’ Laundering Millions

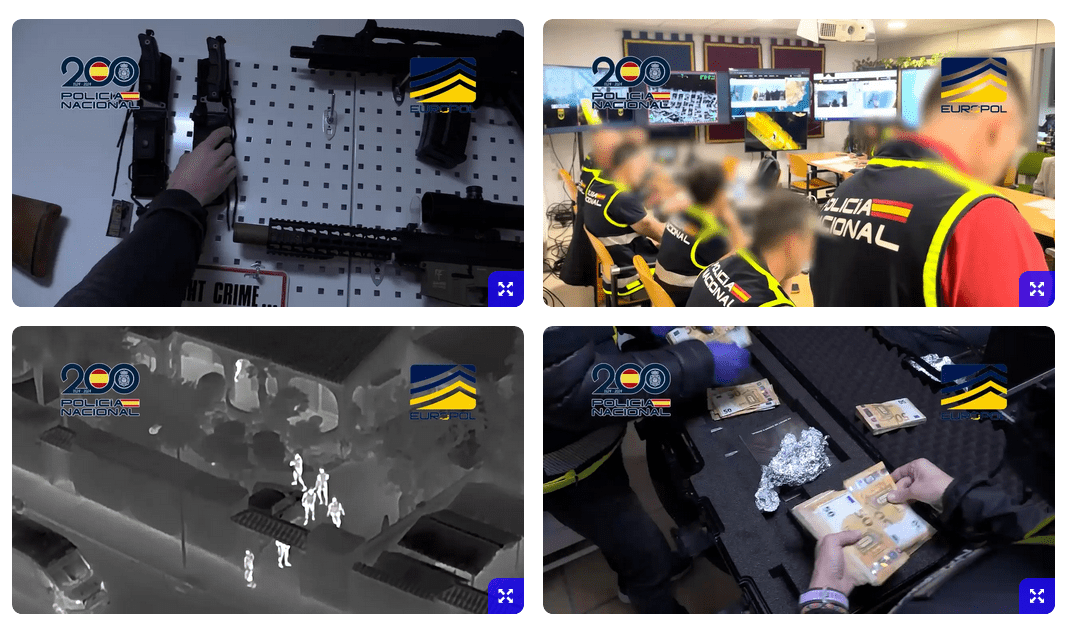

In a major operation, European law enforcement, coordinated by Europol, dismantled a sophisticated money laundering operation dubbed a ‘mafia crypto bank.’ This network is accused of laundering over 21 million euros (approximately $23.5 million) in cryptocurrency for criminal organizations operating in China and the Middle East. The operation, which took place in January 2025, resulted in the arrest of 17 suspects across Spain, Austria, and Belgium.

The ‘mafia crypto bank’ allegedly facilitated the transfer of illicit funds for criminal enterprises involved in migrant smuggling and drug trafficking. This highlights the increasing use of cryptocurrency in facilitating transnational crime. Spanish authorities revealed that the criminal organization operated a hawala-like system, a traditional informal money transfer network, but with cryptocurrency as a primary means of compensation.

Key Details of the Operation:

- Arrests: 17 individuals arrested – 15 in Spain, 1 in Austria, and 1 in Belgium.

- Seized Assets: 4.5 million euros ($5 million) worth of assets seized, including:

- Cash

- Cryptocurrency (183,000 euros or $205,000)

- 18 Vehicles

- 4 Shotguns

- Electronic Devices

- Luxury goods (bags, watches, cigars) worth 876,000 euros ($980,000)

- Bank Accounts: 421,000 euros ($471,000) in cash seized from 77 bank accounts linked to the criminal organization.

- Operation Scale: Over 250 officers involved in the operation.

The Hawala System and Cryptocurrency

The use of the hawala system, combined with cryptocurrency, allowed the criminal network to move large sums of money across borders with minimal oversight. Hawala systems rely on a network of brokers who facilitate money transfers without physically moving the funds. Cryptocurrency adds another layer of anonymity and complexity, making it difficult for authorities to trace the flow of money.

Arrested Individuals and Target Clients

The majority of those arrested were of Chinese and Syrian nationality, indicating that the criminal organization primarily targeted clients within Chinese and Arabic-speaking criminal circles. This suggests a specialized network catering to specific demographics involved in illicit activities.

Camouflaging Money Laundering Activities

To disguise their illicit activities, the criminal organization operated a remittance business and even advertised these services on social media. This is a common tactic used by money launderers to create a legitimate facade for their operations, blending illegal transactions with genuine business activities.

The Role of Europol and International Collaboration

The investigation was led by a court in Almería, Spain, with Europol playing a crucial role in coordinating the efforts of Spanish and Belgian authorities. This highlights the importance of international cooperation in combating transnational crime, especially when it involves complex financial networks spanning multiple countries.

The Broader Context: Cryptocurrency and Illicit Activities

The dismantling of this ‘mafia crypto bank’ underscores the increasing use of cryptocurrency in illicit activities. Blockchain analytics firm Chainalysis estimates that illicit crypto transactions reached $51.3 billion in 2024, an 11.3% increase year-over-year. This rise in crypto-related crime highlights the need for enhanced regulatory frameworks and law enforcement capabilities to combat money laundering and other illegal activities within the cryptocurrency space.

Implications and Future Trends

This case serves as a stark reminder of the evolving methods used by criminals to launder money and finance illegal activities. The combination of traditional money transfer systems like hawala with the anonymity offered by cryptocurrency presents significant challenges for law enforcement agencies worldwide. As cryptocurrency adoption continues to grow, it is crucial to develop effective strategies to detect, prevent, and prosecute crypto-related crime.