The Paris-based Blockchain Group (ALTBG) is making headlines with its strategic move to significantly increase its Bitcoin (BTC) holdings. The company announced a 63.3 million euro ($72 million) bond sale with the primary intention of acquiring an additional 590 Bitcoin.

This acquisition will bring the Blockchain Group’s total Bitcoin treasury to 1,437 BTC, solidifying its position as a notable player in the cryptocurrency investment landscape. The move reflects a growing trend among companies seeking to incorporate Bitcoin into their long-term financial strategies.

Details of the Bond Sale and Investment

The bond sale attracted significant interest from venture capital firms, with Fulgur Ventures leading the investment with 55.3 million euros ($62.9 million). Crypto private investment fund Moonlight Capital also participated, contributing 5 million euros ($5.7 million). The bonds are convertible into shares of the Blockchain Group at a price of 3.809 euros ($4.34) per share.

Strategic Rationale Behind the Bitcoin Acquisition

According to the Blockchain Group, approximately 95% of the bond sale proceeds will be directly allocated to purchasing Bitcoin. The remaining 5% is earmarked for operational expenses and management fees. The company’s core strategy revolves around increasing the number of Bitcoin per share over time, leveraging excess cash and strategic financing instruments.

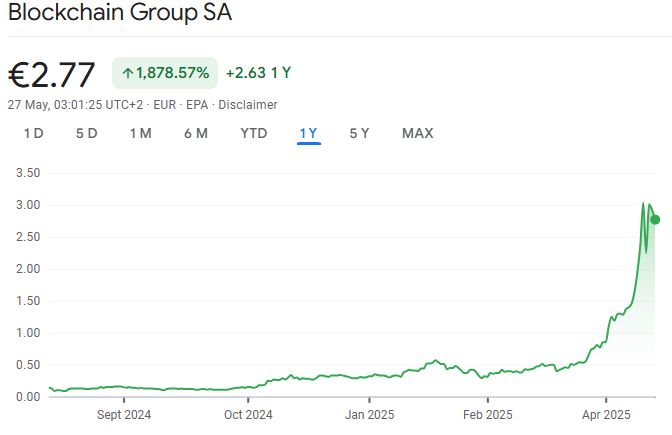

The Blockchain Group’s stock (ALTBG), listed on Euronext Paris, has experienced substantial gains since the company began accumulating Bitcoin. Following its initial Bitcoin purchase in November, the stock price surged by 225%. While the stock closed down slightly on May 26, it has demonstrated impressive year-to-date growth of nearly 766%.

Blockchain Group’s Financial Performance and Bitcoin Strategy

In its 2024 financial year results, the Blockchain Group reported a significant yield from its Bitcoin holdings, exceeding 709%. While the company’s total consolidated revenue decreased by 32.1% compared to the previous fiscal year, its commitment to Bitcoin remains a central pillar of its long-term strategy.

The company has set an ambitious goal of acquiring 1% of the total Bitcoin supply over the next eight years, targeting a total of over 170 BTC by 2032. This aggressive strategy underscores the Blockchain Group’s confidence in the long-term value and potential of Bitcoin.

The Growing Trend of Corporate Bitcoin Adoption

The Blockchain Group’s move is part of a broader trend of companies adding Bitcoin to their balance sheets as a strategic asset. Several factors are driving this trend:

- Hedge against Inflation: Bitcoin is increasingly viewed as a hedge against inflation, offering a potential store of value in times of economic uncertainty.

- Long-Term Price Appreciation: Many companies believe in Bitcoin’s long-term price appreciation potential, viewing it as a valuable investment for the future.

- Diversification: Bitcoin can serve as a diversifier for corporate treasuries, potentially reducing correlation with traditional equity markets.

Other companies, such as MicroStrategy and H100 Group AB, have also made significant investments in Bitcoin, signaling a growing acceptance of cryptocurrency as a legitimate corporate asset.

Potential Benefits and Risks of Corporate Bitcoin Holdings

While there are potential benefits to holding Bitcoin on corporate balance sheets, there are also risks to consider:

- Volatility: Bitcoin’s price can be highly volatile, which can impact a company’s financial performance and reporting.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrency is still evolving, which can create uncertainty for companies holding Bitcoin.

- Security Risks: Storing Bitcoin securely requires robust security measures to protect against theft and hacking.

Companies considering adding Bitcoin to their balance sheets should carefully weigh the potential benefits and risks before making a decision.

Conclusion

The Blockchain Group’s decision to increase its Bitcoin holdings through a $72 million bond sale highlights the growing interest in cryptocurrency as a corporate asset. While the risks associated with Bitcoin volatility and regulatory uncertainty should not be ignored, the potential benefits of diversification, inflation hedging, and long-term price appreciation continue to attract companies looking to stay ahead of the curve in the rapidly evolving financial landscape.