Global Ledger, a company providing crypto Anti-Money Laundering (AML) tools, has identified over $15 million in active reserves from crypto exchange Garantex, with some funds actively being moved.

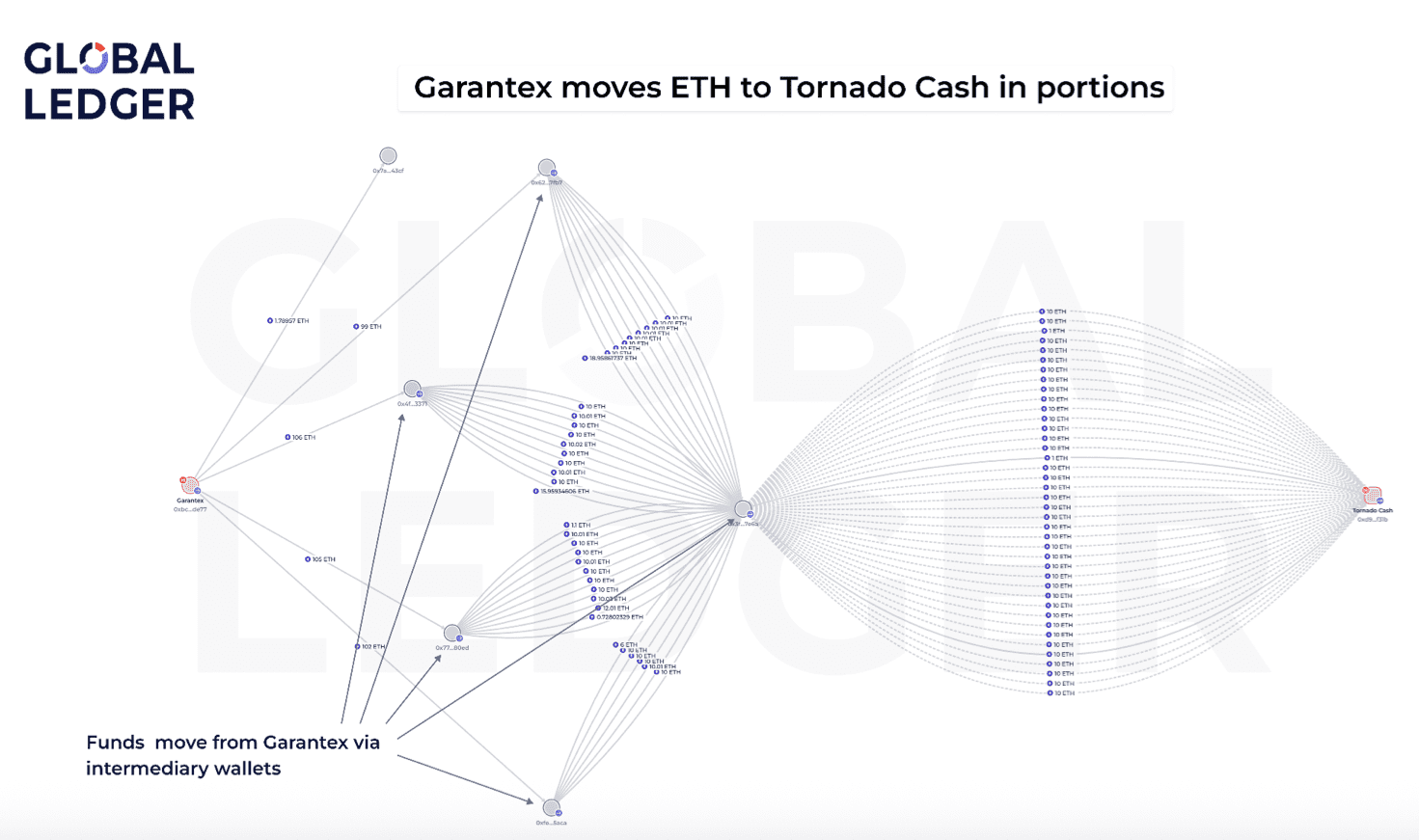

According to Global Ledger’s report, a dormant Garantex Ethereum wallet began accumulating Ether (ETH) on March 6, eventually funneling $2.3 million in ETH to Tornado Cash. That wallet still holds $6.1 million in ETH, remaining stagnant.

The report indicates a similar pattern for Bitcoin (BTC) holdings, with approximately 2.2 BTC bridged to the Tron network and partially transferred to Grinex.

“The Garantex case undermines the illusion of control that many still cling to,” Lex Fisun, co-founder and CEO of Global Ledger, told Cointelegraph. “$15 million moving freely through obscure chains and mixers isn’t a failure of law — it’s a failure of sanction enforcement.”

On March 6, Tether froze $27 million USDT on Garantex. The exchange halted operations that same day, claiming Tether had “entered the war against the Russian crypto market and blocked our wallets worth more than 2.5 billion rubles [$27 million].”

In April 2022, the US Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned Garantex for disregarding AML requirements. The European Union followed with sanctions on Feb. 24, 2025.

On March 12, Garantex founder Aleksej Bešciokov was arrested while vacationing in India. He faces potential extradition to the United States on conspiracy charges, including money laundering.

Russia responds to Tether freeze

On April 17, a Russian finance ministry official, Osman Kabaloev, reportedly suggested that the country should develop its stablecoin following Tether’s freeze on USDT linked to Garantex.

“We do not impose restrictions on the use of stablecoins within the experimental legal regime,” Kabaloev told TASS. “Recent developments have shown that this instrument can pose risks for us.”

On April 24, the Russian finance ministry and central bank reportedly revealed plans to launch a cryptocurrency exchange for “super-qualified” investors.