Singapore-based AI firm Genius Group has resumed Bitcoin (BTC) purchases, increasing its corporate Bitcoin treasury after overcoming a temporary legal obstacle.

The company announced a 40% increase to its Bitcoin holdings, adding 24.5 BTC, valued at approximately $2.7 million. This brings Genius Group’s total Bitcoin holdings to 85.5 BTC, acquired for $8.5 million at an average price of $99,700 per coin.

CEO Roger Hamilton stated that this move aims to rebuild shareholder value and deliver on the company’s 2025 strategic plan.

The Legal Hurdle and Subsequent Resumption

Previously, Genius Group faced a court order that restricted the company from selling shares, raising funds, and using investor capital to acquire more Bitcoin. This restriction was lifted after a favorable ruling by the US Court of Appeals, allowing Genius Group to resume its Bitcoin accumulation strategy.

Genius Group’s Commitment to Bitcoin and the Digital Economy

Hamilton emphasizes Genius Group’s dedication to educating individuals on AI, Bitcoin, and community building, viewing these elements as crucial for the future workforce and digital economy. The company sees its Bitcoin treasury as a fundamental aspect of this long-term vision.

“Building our Bitcoin Treasury is a key part of that plan,” Hamilton stated, highlighting the company’s belief in the long-term value of Bitcoin.

Stock Market Performance

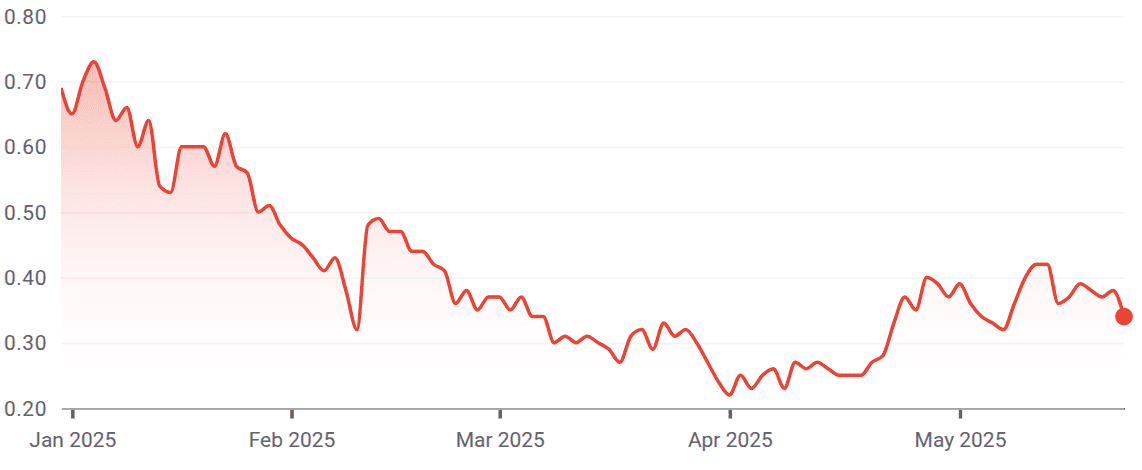

Genius Group is listed on the New York Stock Exchange (NYSE: GNS). The company’s stock price has experienced volatility, trading at $0.34, which is under half of its value at the beginning of the year. The stock also dropped over 8% in the last trading day.

Following MicroStrategy’s Lead: Corporate Bitcoin Treasuries

Genius Group joins a growing number of companies adopting Bitcoin treasury strategies, following the example set by MicroStrategy (now Strategy). MicroStrategy holds a significant percentage of the total Bitcoin supply and continues to expand its holdings.

Other Companies Embracing Bitcoin Treasuries

Several other companies have recently integrated Bitcoin into their financial strategies:

- Al Abraaj: A Bahrain-based catering company partnered with 10X Capital to adopt a Bitcoin treasury strategy.

- Top Win/AsiaStrategy: This luxury watchmaker pivoted to a Bitcoin accumulation strategy, renaming itself AsiaStrategy, which led to a surge in its stock price.

Why are companies adding Bitcoin to their treasuries?

Companies are adding Bitcoin to their treasuries for a variety of reasons, including:

- Inflation Hedge: Bitcoin is seen by many as a hedge against inflation, as its supply is capped at 21 million coins.

- Diversification: Adding Bitcoin to a company’s treasury can diversify its assets and reduce its overall risk.

- Potential for Appreciation: Many believe that the price of Bitcoin will continue to rise over the long term, making it an attractive investment.

- Innovation and Technology: It can be viewed as a forward-thinking approach, aligning the company with innovative technologies.

The Future of Corporate Bitcoin Adoption

The trend of companies adding Bitcoin to their treasuries is likely to continue as more businesses become aware of the potential benefits. As the regulatory landscape becomes clearer and institutional adoption grows, expect to see more publicly traded companies allocating a portion of their reserves to Bitcoin.