Hyperliquid’s native token, HYPE, is drawing comparisons to Solana’s (SOL) early 2021 breakout, which preceded a significant rally. This article explores the potential for HYPE to replicate Solana’s success, examining chart patterns, analyst perspectives, and the underlying fundamentals of the Hyperliquid platform.

HYPE Chart Fractal Suggests Bullish Momentum

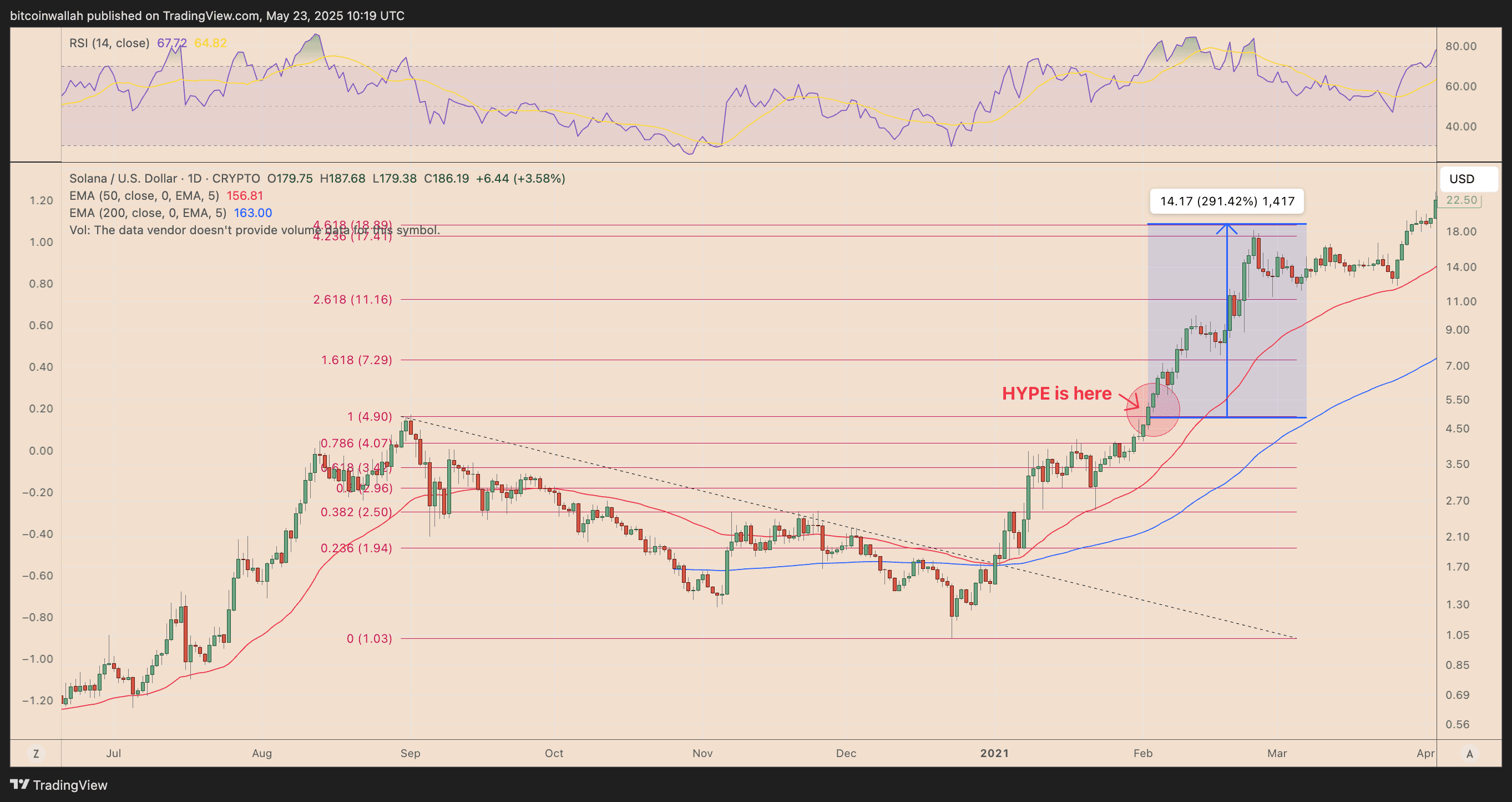

Technical analysis reveals a striking similarity between HYPE’s current price action and Solana’s breakout in January 2021. Solana emerged from a consolidation phase, breaking above key Fibonacci retracement levels and triggering a surge of nearly 300% in under two months.

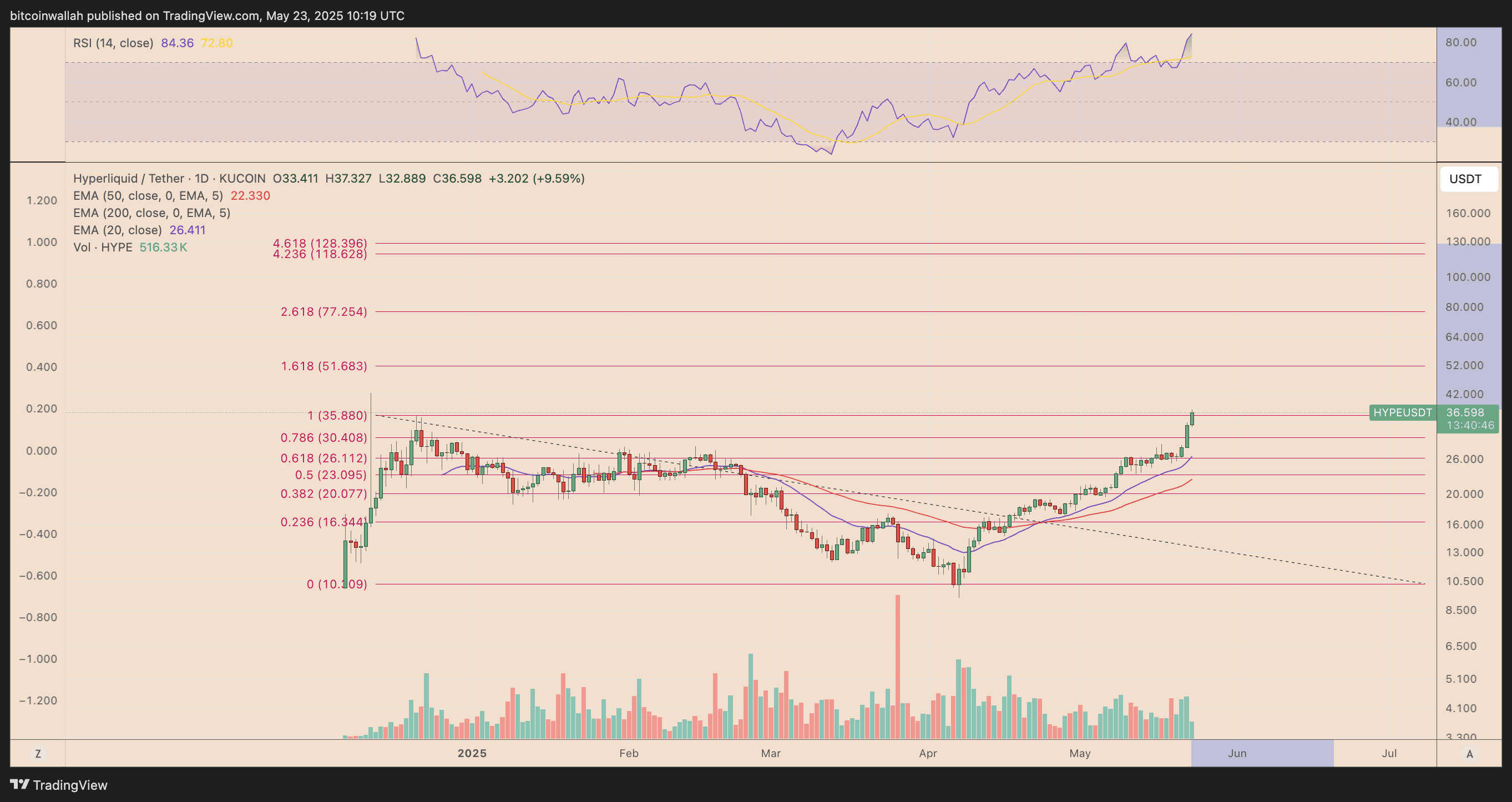

Fast forward to May 2025, HYPE’s daily chart exhibits a similar bullish structure after a 270% rebound from April lows. The token recently broke above its 1.0 Fibonacci retracement level, echoing the early stages of Solana’s explosive run.

The relative strength index (RSI) for HYPE has entered overbought territory, indicating strong momentum, reminiscent of Solana’s RSI profile during its 2021 breakout. If HYPE continues to follow this fractal, the 1.618 Fibonacci extension level near $51.68 is the immediate target. A further rally could see HYPE reach the 4.618 level at around $128, marking a potential 240% increase from its recent breakout zone.

Analyst Highlights Hyperliquid’s Potential

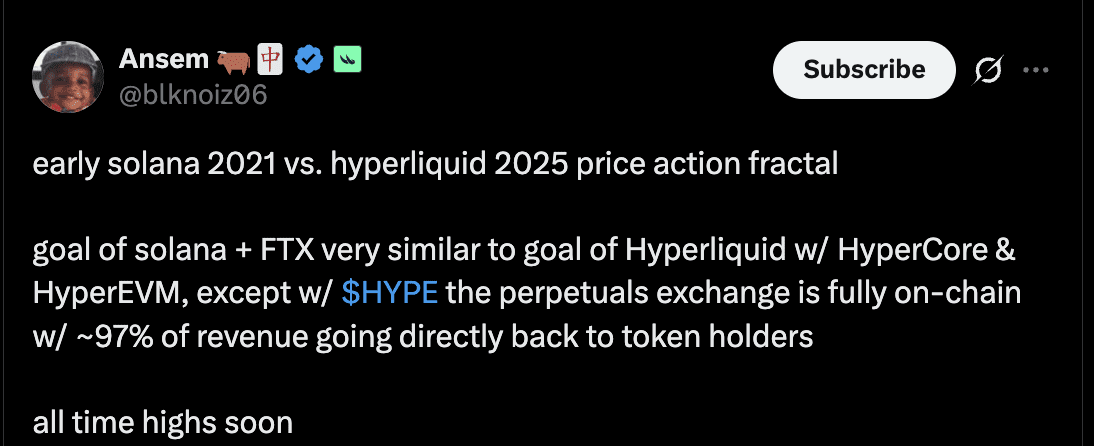

Popular analyst Ansem draws parallels between Hyperliquid’s vision and the early partnership of Solana and FTX, aiming for a high-performance, low-cost crypto trading experience. However, Hyperliquid distinguishes itself by being fully on-chain, unlike FTX’s centralized model.

Ansem also notes that a significant portion of trading revenue (97%) is returned to HYPE tokenholders, suggesting strong fundamentals that could propel the token to all-time highs.

The Power of Crypto Fractals: Why History Often Repeats

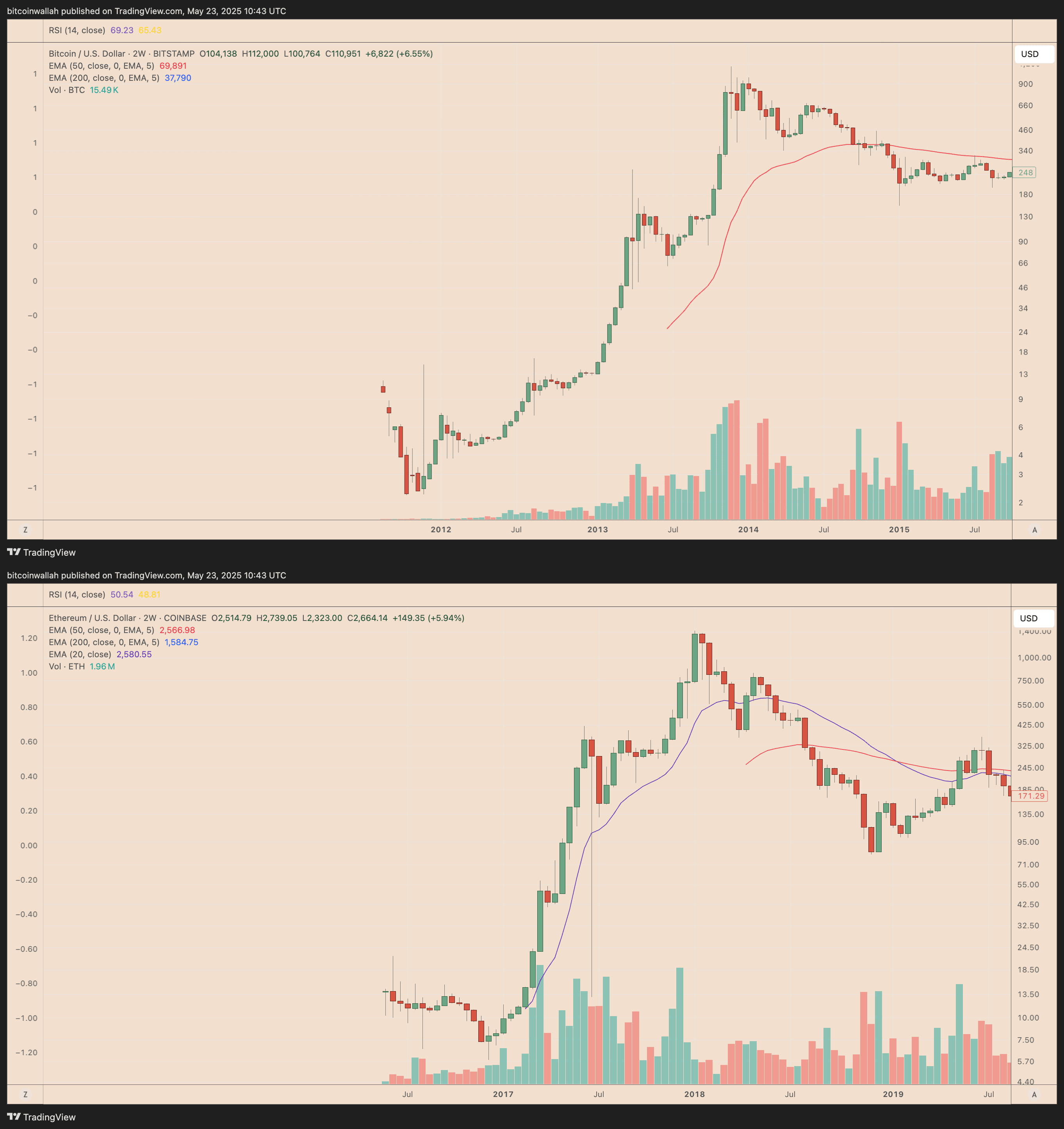

Crypto market participants often rely on historical patterns, known as fractals, to inform their investment decisions. The psychology behind this is rooted in the idea that market participants tend to react similarly to recurring price structures. For example, Ether (ETH) in 2017 mirrored Bitcoin’s (BTC) 2013 arc, exhibiting similar parabolic blow-off tops and retracement phases.

The recognition of HYPE potentially repeating Solana’s 2021 trajectory could bolster bullish sentiment and attract speculators seeking the next high-growth opportunity.

Understanding Hyperliquid: More Than Just a Token

To fully appreciate the potential of HYPE, it’s crucial to understand the Hyperliquid platform itself. Hyperliquid is a decentralized exchange (DEX) focused on providing a fast and efficient trading experience for derivatives. Its key features include:

- High Throughput: Hyperliquid aims to handle a large volume of transactions with minimal latency, crucial for efficient trading.

- Cross-Margin: Allows traders to leverage their entire account balance across multiple positions, increasing capital efficiency.

- On-Chain Transparency: Being fully on-chain ensures transparency and reduces counterparty risk.

- Focus on Derivatives: Hyperliquid specializes in derivatives trading, offering a range of perpetual futures contracts.

Potential Risks and Considerations

While the comparisons to Solana and the bullish chart patterns are encouraging, it’s important to acknowledge the risks associated with investing in HYPE and the broader cryptocurrency market:

- Market Volatility: Cryptocurrencies are inherently volatile, and HYPE is no exception. Price swings can be significant and unpredictable.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is constantly evolving, and future regulations could impact the Hyperliquid platform and the value of HYPE.

- Smart Contract Risk: As a decentralized platform, Hyperliquid relies on smart contracts, which are susceptible to bugs and vulnerabilities.

- Competition: The DEX landscape is competitive, and Hyperliquid faces competition from established and emerging platforms.

Conclusion: Is HYPE Worth the Hype?

The technical analysis, coupled with analyst perspectives highlighting Hyperliquid’s potential, paints a potentially bullish picture for HYPE. The comparison to Solana’s 2021 breakout is compelling, and the platform’s focus on high-performance derivatives trading positions it well in the evolving DeFi landscape.

However, potential investors should carefully consider the inherent risks associated with cryptocurrencies and conduct thorough due diligence before investing in HYPE. While the potential for a 240% rally is enticing, remember that past performance is not indicative of future results.