Hyperliquid, a decentralized perpetuals exchange operating on its own layer-1 blockchain, has made a significant move by submitting formal comments to the United States Commodity Futures Trading Commission (CFTC) regarding 24/7 derivatives trading. This action signals a strong endorsement for continuous trading in the cryptocurrency space and aligns with ongoing discussions about regulatory frameworks for digital assets.

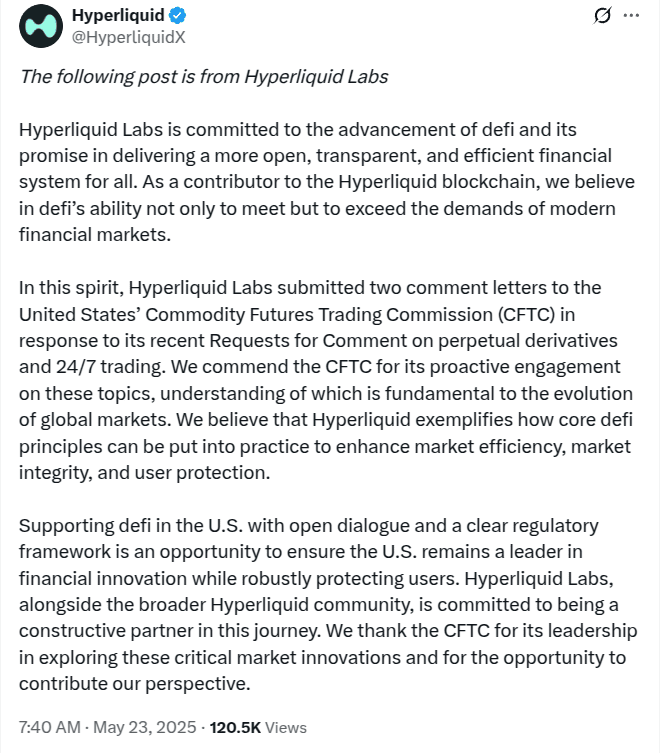

In a May 23 X post, Hyperliquid Labs announced that it has “submitted two comment letters to the [CFTC] in response to its recent Requests for Comment on perpetual derivatives and 24/7 trading.” The team behind the decentralized exchange (DEX) added that it commends the CFTC for its proactive engagement on these topics, understanding of which is fundamental to the evolution of global markets.

Hyperliquid has expressed its commitment to advancing the decentralized finance (DeFi) space. The team also claimed that its implementation exemplifies how core DeFi principles can be put into practice to enhance market efficiency, market integrity, and user protection.

CFTC’s Consideration of 24/7 Derivatives Trading

Hyperliquid’s input follows CFTC Commissioner Summer Mersinger’s recent statement that crypto perpetual futures contracts could soon receive regulatory approval in the US. Mersinger highlighted that the CFTC is reviewing applications and anticipates these products trading live in the near future, bringing trading back onshore to the United States. The potential approval would be a major step forward for the crypto derivatives market in the US.

Mersinger stated, “We’re seeing some applications, and I believe we’ll see some of those products trading live very soon.”

What are Perpetual Futures Contracts?

Perpetual futures contracts are a type of derivative that allows traders to speculate on the price of a crypto asset without owning it. These contracts differ from traditional futures as they have no expiration date, remaining open indefinitely. They are kept in line with the spot market price through a funding rate mechanism, which involves payments exchanged between long and short positions at regular intervals.

The Growing Crypto Derivatives Market

The crypto derivatives market is experiencing significant growth and activity, marked by product launches, acquisitions, and regulatory developments. Coinbase CEO Brian Armstrong has indicated that the exchange will continue exploring merger and acquisition opportunities following its acquisition of crypto derivatives platform Deribit.

Coinbase’s agreement to acquire Deribit, one of the world’s largest crypto derivatives trading platforms, underscores the increasing interest and investment in this sector. The European market is also witnessing substantial activity, with major crypto exchanges like Gemini receiving regulatory approval to expand crypto derivatives trading across Europe. Similarly, DeFi platform Synthetix plans to re-acquire the crypto options platform Derive, further venturing into crypto derivatives.

Why is 24/7 Trading Important?

The push for 24/7 crypto derivatives trading reflects the unique nature of the cryptocurrency market, which operates continuously without the traditional trading hours of conventional financial markets. Enabling round-the-clock trading can:

- Increase Market Efficiency: By allowing traders to react to market movements at any time, the market can adjust more quickly to new information.

- Improve Liquidity: Continuous trading can lead to higher trading volumes and tighter bid-ask spreads, making it easier for traders to enter and exit positions.

- Meet Global Demand: The cryptocurrency market has a global presence, with traders and investors located in different time zones. 24/7 trading ensures that everyone can participate in the market at their convenience.

Challenges and Considerations

While 24/7 trading offers numerous benefits, it also presents challenges that regulators like the CFTC must address. These challenges include:

- Risk Management: Continuous trading requires robust risk management systems to monitor and mitigate potential risks, such as flash crashes and market manipulation.

- Regulatory Oversight: Regulators need to develop frameworks that can effectively oversee the market and ensure compliance with applicable laws and regulations.

- Investor Protection: Measures must be in place to protect investors from fraud and other forms of misconduct, especially in the decentralized finance (DeFi) space.

The Future of Crypto Derivatives

Hyperliquid’s support for 24/7 crypto derivatives trading, combined with the CFTC’s ongoing evaluation, highlights the growing importance of this market segment. As regulatory frameworks evolve and the market matures, crypto derivatives are likely to play an increasingly significant role in the broader financial ecosystem. The continuous trading environment not only aligns with the inherent nature of cryptocurrencies but also offers opportunities for greater efficiency, liquidity, and global accessibility.

The developments in the crypto derivatives market, including product launches, acquisitions, and regulatory considerations, signify a dynamic and rapidly evolving landscape. As more institutions and retail investors participate in this market, the demand for continuous trading and innovative financial products is expected to increase, further shaping the future of crypto finance.