James Wynn, a prominent trader on the Hyperliquid platform, has made headlines by significantly increasing his leveraged Bitcoin (BTC) position. This article provides a comprehensive overview of Wynn’s trading activities, the factors influencing his decisions, and the potential consequences of his high-stakes strategy.

Wynn’s Massive Bitcoin Long Position

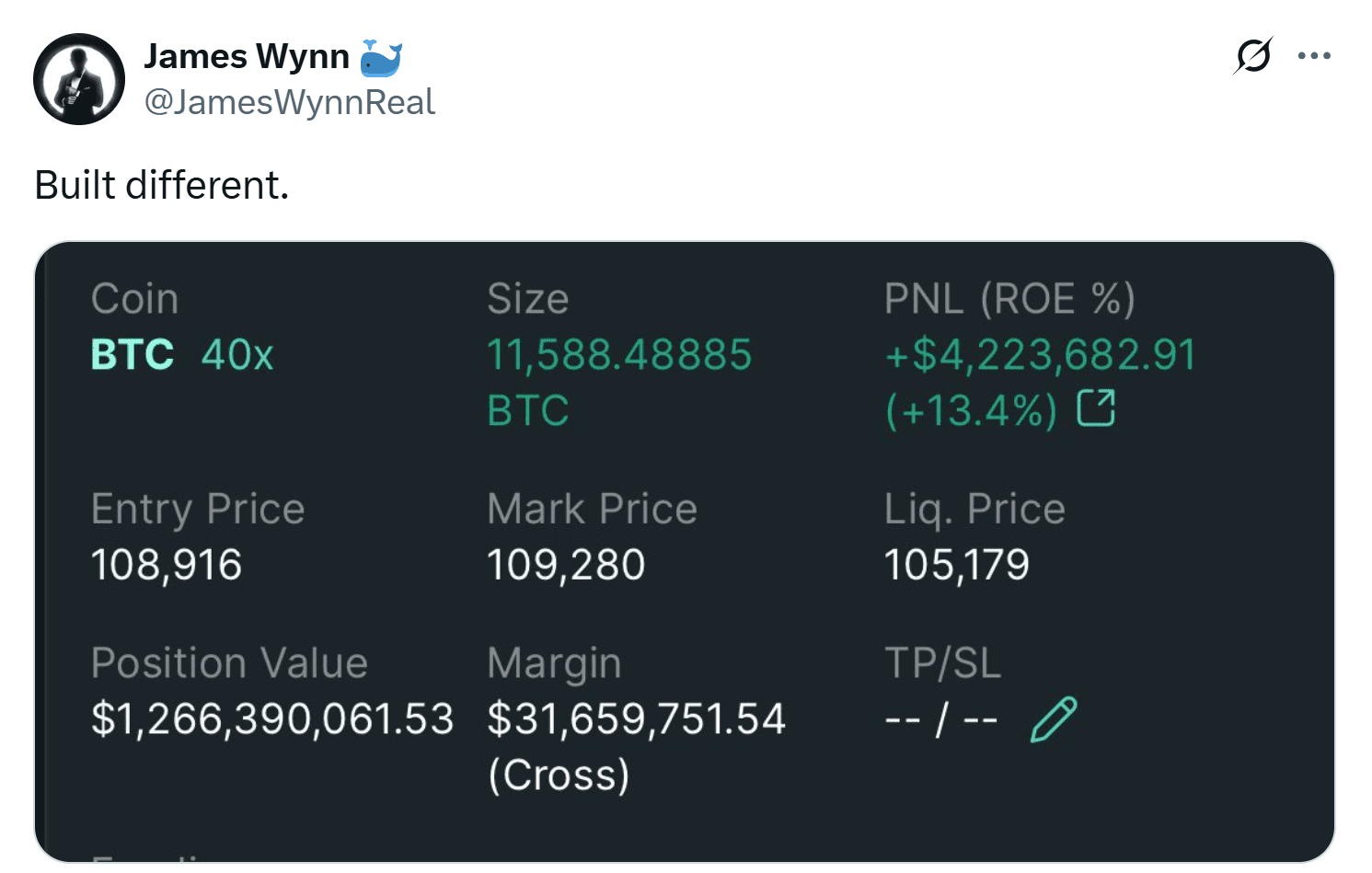

Wynn initially established a substantial Bitcoin long position, leveraging his capital to control a significantly larger amount of BTC. According to data from Lookonchain, Wynn’s position reached 11,588 BTC, with an average entry price of $108,243 and a liquidation level of $105,180. This aggressive move reflects a strong bullish sentiment towards Bitcoin, despite the inherent risks of high-leverage trading.

Prior to increasing his Bitcoin holdings, Wynn closed his position in PEPE, a memecoin, realizing a profit of $25.2 million. He also exited Ether (ETH) and Sui (SUI) positions at a $5.3 million loss, redirecting the proceeds to further bolster his Bitcoin investment. This strategic reallocation of capital underscores Wynn’s conviction in Bitcoin’s potential for future gains.

Wynn’s initial Bitcoin long position started with $830 million. He briefly trimmed $400 million in profits but quickly ramped up the position again to $1.1 billion. He also secured a $1.5 million profit selling 540 BTC for $60 million.

Impact of Trump’s Tariff Threat

Wynn’s position faced a significant challenge when former President Donald Trump announced a 50% tariff on all European Union imports. This unexpected news triggered a market downturn, causing Bitcoin to plummet below $107,000. The decline impacted both traditional and crypto markets, with Ether also experiencing a sharp drop. Memecoins were particularly affected by the market-wide sell-off.

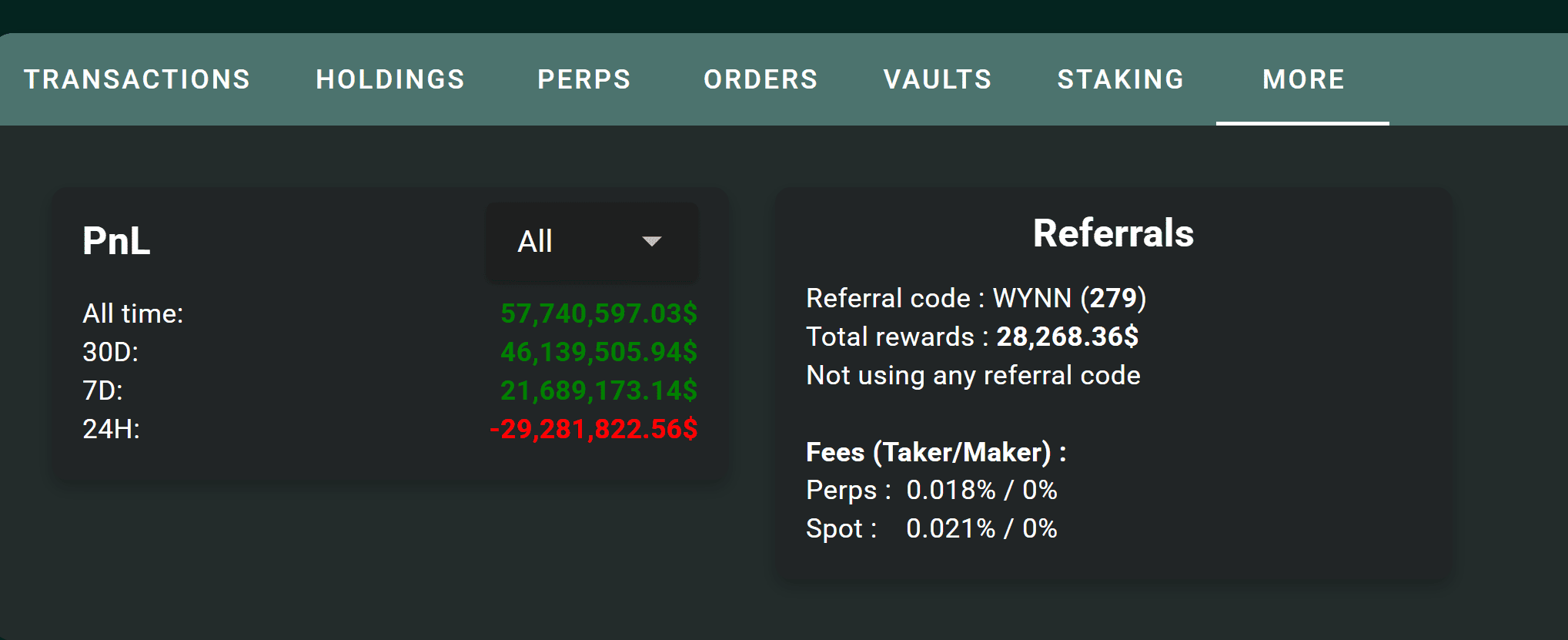

Data from HypurrScan indicates that Wynn suffered losses exceeding $29 million in a single day due to the market volatility. Despite these losses, Wynn remains profitable overall, with more than $57 million in all-time trading gains and $46 million in profits over the past month.

Who is James Wynn?

James Wynn identifies himself as a high-risk leverage trader and memecoin enthusiast. He is known for making bold predictions, including his claim of identifying Pepe (PEPE) as a buying opportunity when its market capitalization was just $600,000. Wynn’s use of Hyperliquid began two months prior to this activity, with an initial deposit of $4.65 million in USDC.

Understanding Hyperliquid

Hyperliquid is a decentralized exchange (DEX) operating on its own layer 1 blockchain. It provides various trading services, including spot trading, borrowing, and lending. Hyperliquid’s platform facilitates high-leverage trading, which amplifies both potential profits and potential losses.

Key Takeaways

- High-Leverage Trading: Wynn’s strategy highlights the potential for significant gains but also exposes him to substantial risk.

- Market Volatility: External events, such as Trump’s tariff announcement, can have a significant impact on cryptocurrency prices and trading positions.

- Strategic Decision-Making: Wynn’s decision to reallocate capital from other cryptocurrencies to Bitcoin reflects his evolving market outlook.

- Platform Choice: Hyperliquid’s platform enables high-leverage trading, attracting traders with a high-risk appetite.

The Risks and Rewards of High-Leverage Bitcoin Trading

James Wynn’s recent trading activities serve as a compelling case study for understanding the complexities and potential pitfalls of high-leverage Bitcoin trading. While the allure of magnified profits is undeniable, the inherent risks associated with such strategies cannot be ignored.

Potential Upsides

- Amplified Profits: High leverage allows traders to control a significantly larger position than their initial capital would otherwise permit. This can result in substantial profits if the market moves in the trader’s favor.

- Capital Efficiency: Leverage enables traders to generate returns on a smaller amount of capital, freeing up funds for other investments or opportunities.

- Short-Term Gains: Skilled traders can capitalize on short-term market fluctuations to generate quick profits through leveraged trading.

Downsides and Risks

- Liquidation Risk: The most significant risk of high-leverage trading is the potential for liquidation. If the market moves against the trader’s position, their losses can quickly exceed their initial capital, leading to the forced closure of their position.

- Increased Volatility: Leverage amplifies the impact of market volatility. Even small price swings can result in substantial gains or losses, making it crucial to manage risk effectively.

- Emotional Trading: The pressure of managing a large, leveraged position can lead to emotional decision-making, increasing the likelihood of errors.

- Funding Costs: Traders using leverage often incur funding costs, which can erode their profits over time.

Ultimately, the decision to engage in high-leverage Bitcoin trading should be based on a thorough understanding of the associated risks and rewards, as well as a well-defined risk management strategy. It is essential to approach such strategies with caution and to only risk capital that one can afford to lose.