A Hyperliquid trader known as James Wynn has seen his Bitcoin long bets on the platform liquidated for almost $100 million after Bitcoin dipped below $105,000.

Wynn had made two significant long leveraged positions on Bitcoin (BTC), betting that the cryptocurrency’s price would rise, but onchain data shows those positions were liquidated to the tune of $99.3 million on May 30 as BTC fell to a 10-day low.

The first position of 527.29 BTC worth $55.3 million was liquidated as Bitcoin hit $104,950, and the second position of 421.8 BTC worth $43.9 million was closed after Bitcoin sank to $104,150, according to the Hyperliquid analytics platform Hypurrscan.

On May 29, another of Wynn’s positions of 94 BTC worth $10 million was liquidated at $106,330.

In total, the positions saw 949 BTC liquidated, and Arkham Intelligence and Lookonchain both noted that Wynn has lost almost $100 million over the past week.

Bitcoin prices wicked down to $104,630 on Coinbase during early trading on May 30, according to TradingView, but its price has dropped lower on other trading platforms.

Wynn increased his 40x leverage long Bitcoin bet to $1.25 billion on May 24, but took a hit when the asset tumbled following more talk of tariffs from US President Donald Trump.

Wynn reacted to the liquidation with a cryptic post on X, sharing a screenshot from the 1999 sci-fi classic The Matrix, where the main character Neo, played by Keanu Reeves, stops bullets in mid-air.

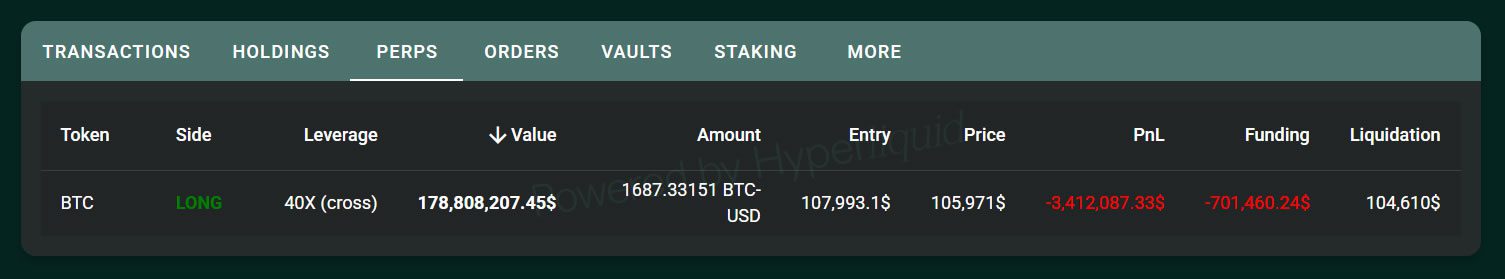

He still has the 40x leveraged long position open in a perpetual contract, according to Hypurrscan. The long bet was opened when Bitcoin was at $107,993 and is currently at an unrealized loss of $3.4 million.

An “extreme degenerate”

James Wynn first gained widespread attention for his memecoin picks, particularly with his investment in the Pepe (PEPE) memecoin, which garnered him millions in gains.

On May 29, before the big liquidation, he described himself as an “extreme degenerate” taking on high-risk leverage trades, adding that he stands to lose everything.

“I do not follow proper risk management, nor do I claim to be a professional; if anything, I claim to be lucky. I’m effectively gambling. And I stand to lose everything. I strongly advise people against what I’m doing!”

Quick Summary of the News

- Hyperliquid trader James Wynn liquidated for nearly $100 million.

- Liquidation occurred after Bitcoin dipped below $105,000 on May 30.

- Wynn held two large leveraged long positions on Bitcoin.

- He previously gained fame for successful memecoin investments.

- Wynn himself acknowledged his high-risk trading strategy.

Why It Matters

This event serves as a stark reminder of the extreme risks associated with high-leverage trading in the cryptocurrency market. While leverage can amplify gains, it can also magnify losses just as quickly. The liquidation of such a large position can contribute to market volatility, even if temporarily. It also highlights the importance of risk management, especially for those participating in decentralized finance (DeFi) platforms like Hyperliquid.

Market Impact

While the broader market impact of a single liquidation is usually limited, it can trigger cascading effects, especially in a fragile market. Dips like the one that triggered Wynn’s liquidation can scare other leveraged traders, leading to further sell-offs. The price movement in the last few days is as follows:

Expert Take or Personal Insight

Wynn’s case is a classic example of overconfidence and the dangers of not respecting risk management principles. While his previous success with memecoins might have fueled his conviction, Bitcoin requires a different level of strategic and cautious approach. His self-description as an “extreme degenerate” trader unfortunately proved accurate. It’s crucial to remember that the crypto market is inherently volatile, and even experienced traders can be caught off guard. Leverage is a powerful tool, but it should be used with extreme caution and a well-defined risk management strategy.

Actionable Insight

- Risk Management is Key: Always use stop-loss orders to limit potential losses.

- Be Cautious with Leverage: Understand the risks involved before using high leverage. Start with smaller positions.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversification can mitigate risk.

- Stay Informed: Keep up-to-date with market news and trends, but don’t let emotions drive your decisions.

Conclusion

The James Wynn liquidation is a cautionary tale for all crypto traders. It underscores the importance of responsible trading practices, especially when using leverage. As the crypto market matures, risk management will become increasingly critical for long-term success. The future favors informed, strategic investors who prioritize capital preservation over chasing quick gains.