Update May 16, 11:24 am UTC: This article has been updated to add comments from Ran Goldi, senior vice president of payments and network at Fireblocks.

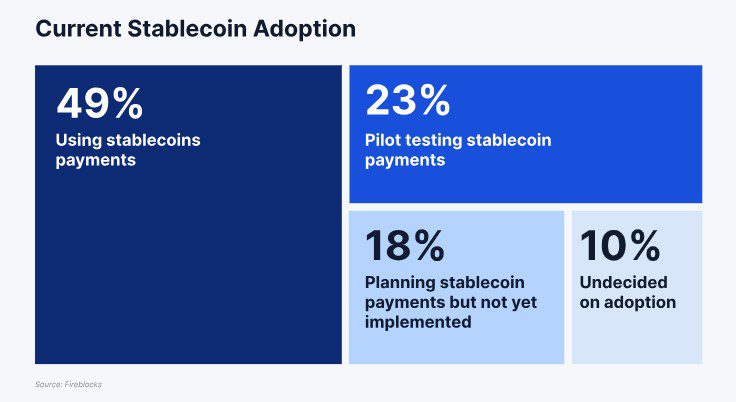

Stablecoins are rapidly gaining traction within institutional finance, with a new report from Fireblocks indicating widespread adoption and exploration. The survey of 295 executives across traditional banks, financial institutions, fintech companies, and payment gateways, shows that 90% are either using or actively planning to integrate stablecoins into their operations. This surge in interest reflects the growing recognition of stablecoins as a strategic tool for enhancing payment efficiency, reducing costs, and unlocking new revenue opportunities.

Key findings from the Fireblocks report include:

- Widespread Adoption: 49% of respondents are already using stablecoins for payments.

- Active Planning: 23% are conducting pilot tests, and 18% are in the planning stages.

- Minimal Hesitation: Only 10% remain undecided about stablecoin adoption.

“The stablecoin race has become a matter of avoiding obsolescence as customer demand accelerates and use cases mature,” Fireblocks stated in the report.

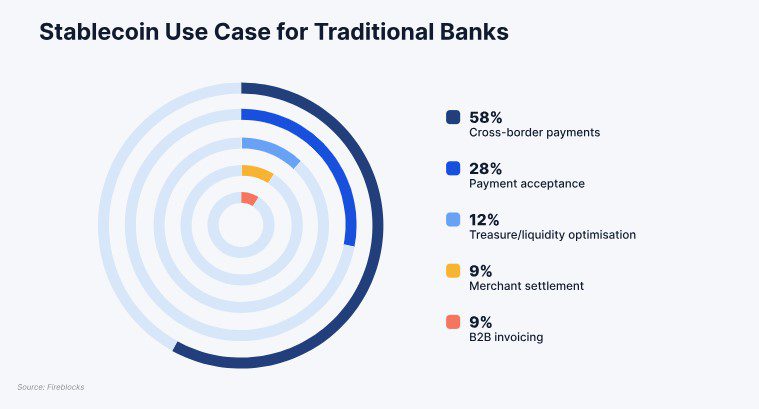

Cross-Border Payments: A Primary Driver for Traditional Banks

Traditional banks are particularly interested in leveraging stablecoins for cross-border payments. The inefficiencies and high costs associated with traditional systems make stablecoins an attractive alternative, especially in business-to-business (B2B) settings within emerging markets. By utilizing stablecoins, banks aim to reduce friction, meet evolving customer expectations, and gain a competitive edge.

According to the report:

- 58% of traditional banks use stablecoins for cross-border payments.

- 28% use stablecoins to accept payments.

- 12% use stablecoins to optimize liquidity.

- 9% use stablecoins in merchant settlements and B2B invoicing.

Fireblocks emphasizes that banks view stablecoins as a “path to modernization,” offering a seamless integration into existing treasury workflows due to their fiat-pegged nature. This integration enables banks to reclaim market share from fintech companies and minimize capital lock-up.

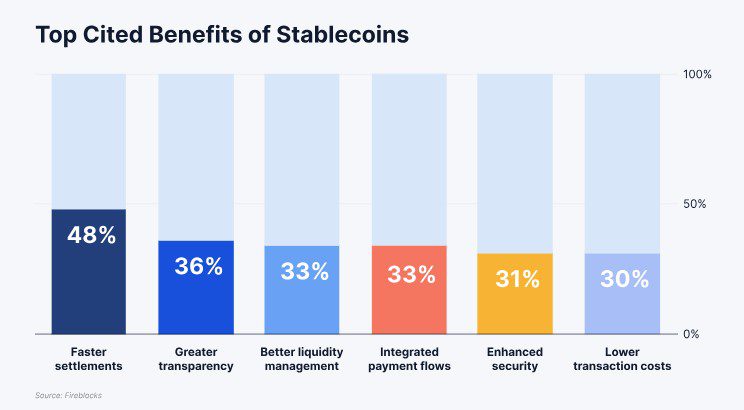

Speed and Efficiency: Top Benefits of Stablecoin Adoption

The survey highlights that banks are utilizing stablecoins to regain cross-border volume while maintaining their current infrastructure. Financial technology firms and payment gateways are employing digital assets to increase margins and revenue. The primary benefit cited by respondents is faster settlement times, with 48% of participants emphasizing this advantage.

Other key benefits include:

- Greater transparency

- Improved liquidity management

- Integrated payment flows

- Enhanced security

- Lower transaction costs

Ran Goldi, senior vice president of payments and network at Fireblocks, notes that stablecoin adoption has moved beyond cost savings and is now considered a strategic driver for growth. “Our research shows that 90% of firms are moving forward with stablecoin implementations because they see it as a key lever for growth,” Goldi told Cointelegraph.

The top motivators for stablecoin adoption include expanding into new markets, responding to direct customer demand, and unlocking new revenue opportunities. “Stablecoins have become an enabler of business innovation, not just an efficiency play,” he added.

Understanding Stablecoins: A Brief Overview

To fully grasp the significance of this institutional shift, it’s essential to understand what stablecoins are and how they function. Stablecoins are a type of cryptocurrency designed to maintain a stable value, typically pegged to a fiat currency like the US dollar. This stability distinguishes them from more volatile cryptocurrencies like Bitcoin and Ethereum, making them suitable for everyday transactions and institutional use cases.

Types of Stablecoins

Stablecoins can be broadly categorized into:

- Fiat-Collateralized Stablecoins: These are backed by reserves of fiat currency held in custody. For example, Tether (USDT) and USD Coin (USDC) claim to hold reserves equivalent to the value of the stablecoins in circulation.

- Crypto-Collateralized Stablecoins: These are backed by other cryptocurrencies. Because cryptocurrency values are volatile, these stablecoins are typically over-collateralized to maintain their peg. An example is DAI, which is backed by Ethereum and other cryptocurrencies.

- Algorithmic Stablecoins: These use algorithms and smart contracts to maintain their peg. They often rely on mechanisms to adjust the supply of the stablecoin in response to market demand. These are generally considered riskier due to their reliance on complex mechanisms.

The Future of Stablecoins in Institutional Finance

The Fireblocks report underscores a fundamental shift in how institutions perceive and utilize stablecoins. No longer just a niche technology, stablecoins are emerging as a core component of the modern financial landscape. As regulatory frameworks evolve and stablecoin infrastructure matures, we can expect even greater institutional adoption and innovation in this space. The benefits of speed, efficiency, and transparency will continue to drive demand, positioning stablecoins as a critical tool for financial institutions looking to stay competitive in a rapidly changing world.