K33 Capital Raises $6.2M to Accumulate Bitcoin: A Strategic Move or Risky Bet?

Norwegian crypto brokerage firm K33 plans to join the growing number of public companies buying up Bitcoin after raising 60 million Swedish krona ($6.2 million) to buy and hold the cryptocurrency.

K33 said on May 28 that it secured financing through convertible loans and a new issue of shares and warrants, which “will be used in full to acquire Bitcoin in order to establish the Bitcoin Treasury Strategy.”

Warrants are zero-interest securities that investors can later convert into equity at the same price. K33 could purchase up to 57 Bitcoin (BTC) at BTC’s current price of just over $108,000.

K33 CEO Bull Jenssen posted to X on May 28 that he thinks Bitcoin will be the “best-performing asset in the coming decade,” and his company will “accumulate as many as possible while unlocking powerful operational synergies with our brokerage operation.”

“Why wait for the government to build a Bitcoin reserve when you can build you own? Initial financing is secured and we are ready to accelerate from here!” he added in another post.

The convertible loans total 45 million Swedish krona ($4.6 million), are interest-free and mature on June 30, 2028. The remaining 15 million Swedish krona ($1.5 million) will come through a new share issuance and warrants, according to K33.

If investors convert their warrants before March 2026, they are entitled to additional free warrants at the same conversion rate. If fully exercised, K33 could raise up to 75 million Swedish krona ($7.7 million) for its Bitcoin buy.

Bitcoin treasury part of expansion plans

In K33’s interim report for the first quarter, released May 28, Jenssen said K33 is working with other Bitcoin treasury companies in the Nordics and hopes to use its treasury as a foundation to offer new services, such as BTC-backed lending.

“For K33, Bitcoin is not only a high-conviction asset — it’s also a strategic enabler. With a sizable BTC reserve, we will be able to strengthen our financial position while unlocking new revenue streams, product capabilities, and partnerships,” he said.

Quick Summary of the News

- K33, a Norwegian crypto brokerage, raised $6.2 million to purchase Bitcoin.

- The funding comes from convertible loans and a new issue of shares and warrants.

- K33 aims to establish a “Bitcoin Treasury Strategy” and potentially offer BTC-backed lending services.

- CEO Bull Jenssen believes Bitcoin will be the best-performing asset in the coming decade.

- The company could purchase up to 57 BTC with the raised capital.

Why It Matters

K33’s decision to allocate a significant portion of its capital to Bitcoin highlights a growing trend of institutional adoption. This move signals confidence in Bitcoin’s long-term value and potential as a treasury asset. It also demonstrates a shift in perception, with companies increasingly viewing Bitcoin not just as a speculative investment but as a strategic component of their balance sheets.

Market Impact

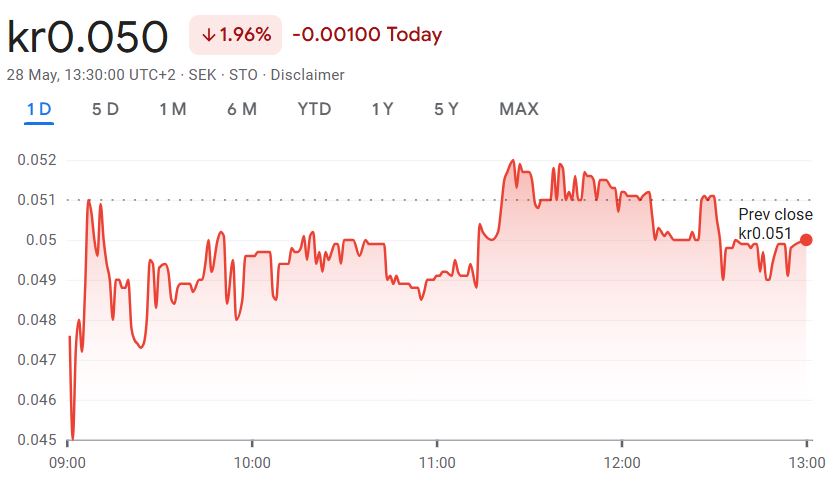

While K33’s stock price didn’t immediately react positively, the overall market impact could be significant. Increased institutional demand for Bitcoin can drive up its price and reduce its volatility in the long run. Other companies may follow suit, further legitimizing Bitcoin as a mainstream asset.

Expert Take or Personal Insight

K33’s move, while bold, seems well-reasoned. CEO Jenssen’s conviction in Bitcoin’s future potential aligns with the growing sentiment among crypto proponents. The key to success will be K33’s ability to integrate its Bitcoin treasury into its core business operations, unlocking the synergies Jenssen envisions. However, it’s crucial to remember that Bitcoin is a volatile asset, and K33’s strategy carries inherent risks. If Bitcoin’s price were to crash significantly, K33’s financial position could be negatively impacted.

Actionable Insight

For traders and investors, this news serves as a reminder of the ongoing institutional interest in Bitcoin. Keep an eye on companies like K33 that are actively building Bitcoin treasuries. Their actions can provide valuable insights into the evolving landscape of crypto adoption. Monitor Bitcoin’s price movements in relation to news about institutional investments.

Conclusion

K33’s decision to invest heavily in Bitcoin is a significant development in the crypto space. It reflects a growing belief in Bitcoin’s long-term value and potential as a treasury asset. While risks remain, this move could pave the way for further institutional adoption and further legitimize Bitcoin. The coming months will reveal whether K33’s bet pays off and whether other companies will follow suit.