Ledn Shifts to Bitcoin-Only Lending: A Full Custody Model Explained

Digital asset lender Ledn is making a significant shift in its business model by transitioning to fully collateralized Bitcoin (BTC) lending and discontinuing support for Ethereum (ETH). This strategic move aims to consolidate its Bitcoin-focused operations and enhance the security of client assets against credit risks. Understanding the implications of this change is crucial for anyone involved in or considering digital asset lending.

What is Ledn’s New Lending Model?

Ledn’s new approach involves a full custody structure for Bitcoin loans. This means the Bitcoin collateral provided by borrowers will remain under the direct custody of Ledn or its designated funding partners. Unlike traditional lending practices where assets are often rehypothecated or loaned out to generate yield, Ledn’s model ensures that client assets are not reused or re-lent.

According to Ledn co-founder and CEO Adam Reeds, this shift reflects a return to Bitcoin’s original principles: “Bitcoin was created as a direct response to the risks of fractional reserve banking and unchecked use of client assets to generate interest. Traditional finance relies on constantly reusing client assets to create leverage and, ultimately, inflation. Bitcoiners instinctively reject that model. That’s why we’ve moved away from this approach entirely.”

Why the Focus on Bitcoin?

Ledn’s decision to discontinue Ethereum support is driven by the fact that Bitcoin represents over 99% of the company’s client activity. By focusing solely on Bitcoin, Ledn aims to streamline its platform and better serve its client base.

“Rather than fragmenting the platform to chase marginal volume, we’re going all-in on Bitcoin and simplifying our stack to reflect what our clients actually value,” Reeds explained.

Key Benefits of the Full Custody Bitcoin Lending Model

This new model offers several potential benefits:

- Enhanced Security: By keeping Bitcoin collateral in full custody, Ledn minimizes the risk of asset loss due to rehypothecation or other lending activities.

- Transparency: The full custody model provides greater transparency into how client assets are managed.

- Alignment with Bitcoin Principles: The move aligns with Bitcoin’s core ethos of sound money and financial independence.

- Simplified Platform: Focusing solely on Bitcoin allows Ledn to streamline its operations and improve its service offering.

How Does Bitcoin Lending Work?

Ledn facilitates Bitcoin lending by allowing Bitcoin holders to borrow against their assets. This enables them to access liquidity without selling their Bitcoin holdings or triggering a taxable event. This approach is similar to how wealthy investors borrow against stocks, real estate, or other assets to access cash.

Bitcoin’s Growing Role in Traditional Finance

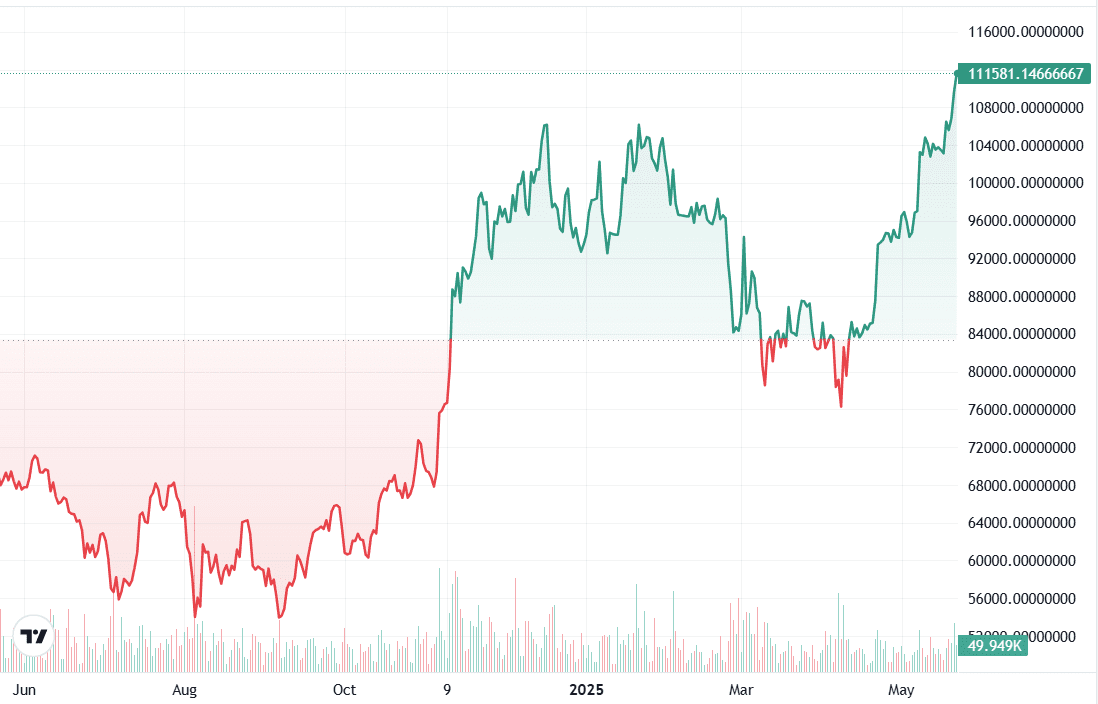

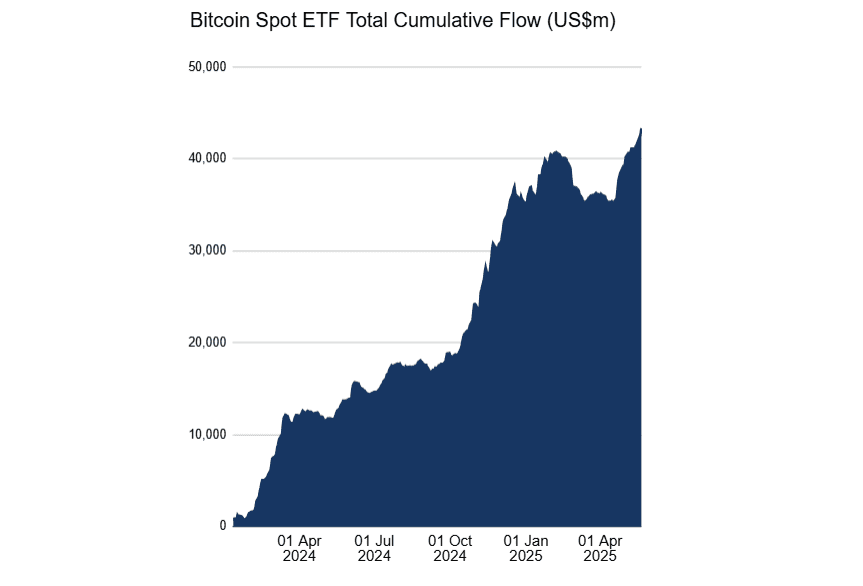

Bitcoin’s integration into traditional finance has accelerated in recent years. The successful launch of spot Bitcoin exchange-traded funds (ETFs) in 2024 marked a significant milestone, providing institutional investors with a regulated and accessible way to gain exposure to Bitcoin.

These ETFs have witnessed substantial inflows, demonstrating growing institutional interest in Bitcoin as an asset class.

The Future of Digital Asset Lending

Ledn’s move towards a Bitcoin-only, full custody model could signal a broader trend in the digital asset lending space. As the industry matures, there is increasing emphasis on security, transparency, and alignment with the core principles of decentralized finance.

While some financial institutions remain wary of blockchain innovations, the growing adoption of Bitcoin and the emergence of yield-bearing stablecoins suggest that digital assets are poised to disrupt traditional finance in significant ways.

Concerns about Traditional Finance

Some experts, like New York University professor Austin Campbell, argue that the banking lobby is concerned about yield-bearing stablecoins because they offer higher interest rates than traditional banks, which rely on fractional reserves to maximize profits while offering depositors minimal interest.

Ledn’s decision to focus on Bitcoin and implement a full custody model reflects a commitment to a more secure and transparent approach to digital asset lending, potentially setting a new standard for the industry.