Lido DAO Responds to Oracle Compromise with Emergency Vote: A Comprehensive Analysis

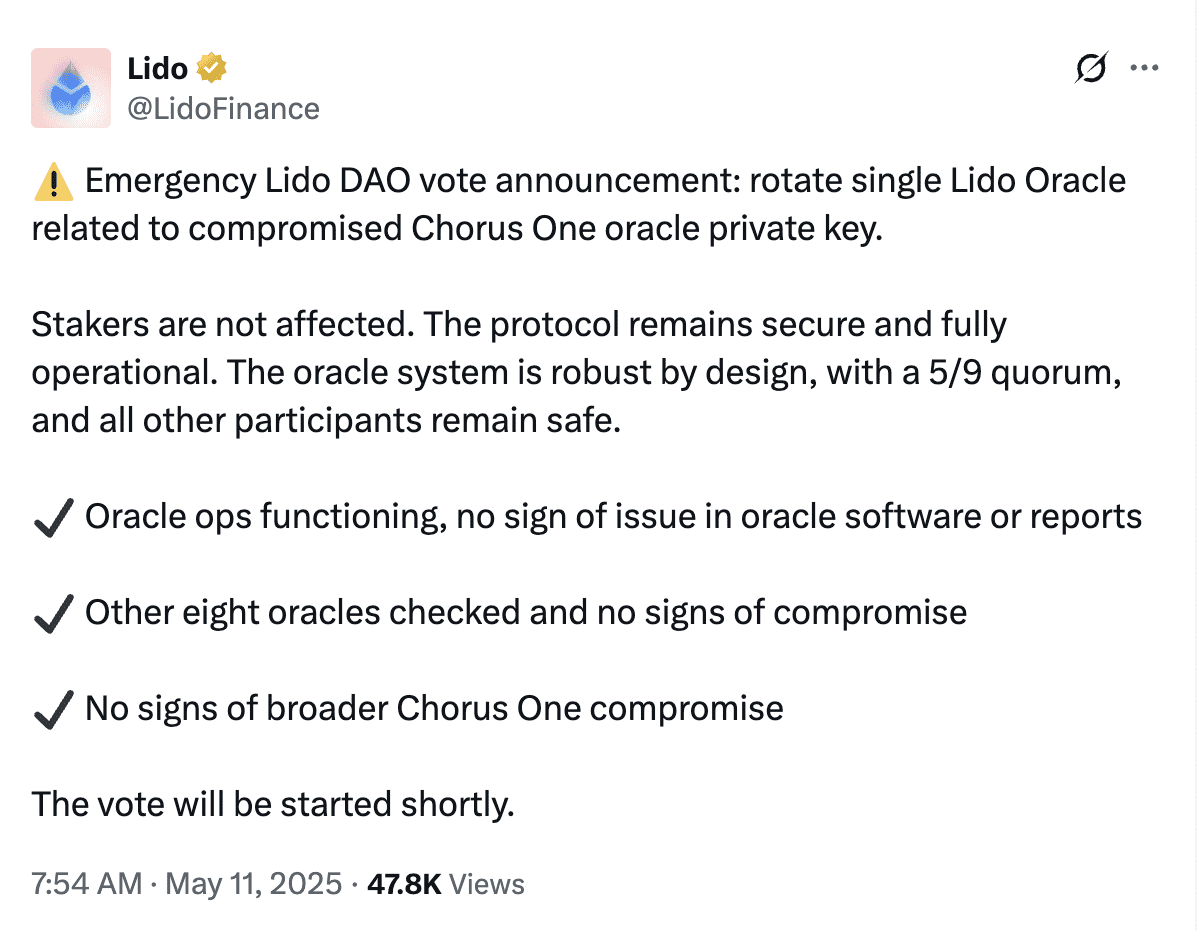

The Lido Decentralized Autonomous Organization (DAO), responsible for governing the popular Lido liquid staking protocol, has launched an emergency vote to rotate a compromised oracle. This action follows a security incident where an address associated with the Chorus One oracle was compromised, leading to the drainage of its Ether (ETH) balance. This article delves into the specifics of the event, the measures being taken, and the wider context of cybersecurity in the DeFi space.

What Happened?

According to reports from the Lido DAO, an address linked to the Chorus One oracle suffered a security breach. As a result, the ETH held by this oracle was stolen. An investigation is currently underway to determine the exact cause and scope of the compromise.

Lido Finance has emphasized that the issue is isolated to the Chorus One oracle and does not represent a system-wide vulnerability. The team also clarified that the incident was not caused by a coding flaw in the oracle software itself.

Chorus One has stated that the exploit was likely the result of a hot wallet private key leak. They are implementing additional security measures, including setting up a new machine, to prevent future occurrences.

Lido DAO’s Response: Emergency Vote

In response to the breach, the Lido DAO has initiated an emergency vote to rotate the compromised oracle. This is a critical step to ensure the continued security and reliability of the Lido protocol. The rotation involves replacing the compromised oracle with a new, secure one.

The emergency vote demonstrates the DAO’s ability to quickly respond to security threats and take decisive action to protect its users and assets. The quick response is a testament to the decentralized governance structure of Lido.

Why Oracles Are Important

Oracles play a vital role in blockchain and decentralized finance (DeFi) ecosystems. They act as bridges, connecting on-chain smart contracts with real-world data. This data can include price feeds, weather information, and other external information necessary for smart contracts to function correctly. Without reliable oracles, smart contracts cannot accurately execute, which can lead to significant financial losses.

The Growing Threat of Cybersecurity in DeFi

The Lido DAO incident highlights the ever-present and growing threat of cybersecurity in the decentralized finance (DeFi) sector. As DeFi platforms become more sophisticated and manage larger amounts of assets, they become increasingly attractive targets for malicious actors.

Here are some key cybersecurity challenges facing the DeFi space:

- Smart Contract Vulnerabilities: Flaws in smart contract code can be exploited by hackers to drain funds or manipulate the contract’s behavior.

- Oracle Manipulation: Compromising or manipulating oracles can lead to incorrect data being fed to smart contracts, resulting in financial losses.

- Private Key Compromises: Loss or theft of private keys can grant attackers complete control over user accounts and assets.

- Flash Loan Attacks: Hackers can use flash loans to exploit vulnerabilities in DeFi protocols and manipulate markets.

- Phishing Attacks: Users can be tricked into giving away their private keys or other sensitive information through phishing scams.

Cybersecurity Statistics in Crypto

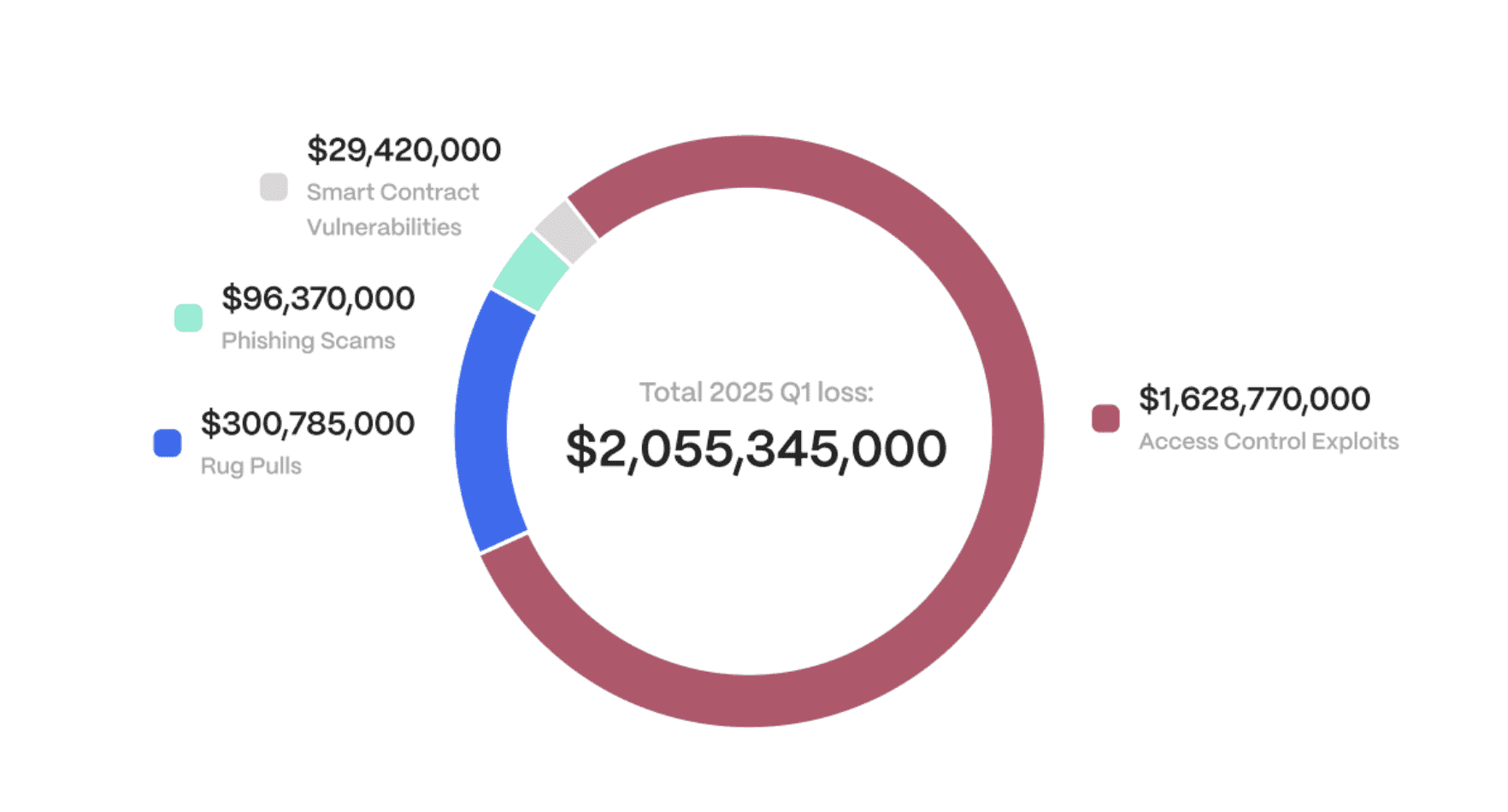

Cybersecurity exploits have been a growing problem in crypto in recent years. Hacks, scams, and exploits continue to plague the digital finance sector, resulting in billions of dollars lost. According to Cybersecurity firm Hacken, over $2 billion in crypto was lost due to malicious activity in Q1 2025.

Additionally, $357 million in losses occurred in April 2025 alone.

Best Practices for DeFi Security

To mitigate cybersecurity risks in DeFi, users and protocols should adopt the following best practices:

- Code Audits: Regularly audit smart contracts to identify and fix vulnerabilities.

- Multi-Sig Wallets: Use multi-signature wallets to require multiple approvals for transactions, reducing the risk of unauthorized access.

- Hardware Wallets: Store private keys on hardware wallets to protect them from online attacks.

- Security Awareness Training: Educate users about phishing scams and other security threats.

- Insurance: Consider purchasing insurance to protect against potential losses due to hacks and exploits.

Conclusion

The Lido DAO’s emergency vote to rotate a compromised oracle demonstrates the importance of robust cybersecurity measures in the DeFi space. As the DeFi ecosystem continues to grow, it is crucial for protocols and users to prioritize security to protect against the increasing threat of hacks and exploits. By adopting best practices and staying informed about the latest security threats, the DeFi community can work together to create a safer and more secure environment for everyone.