Marathon Digital Holdings (MARA), a leading publicly traded Bitcoin mining company in the United States, has announced a substantial increase in its Bitcoin (BTC) production for May, despite the increasingly challenging mining environment.

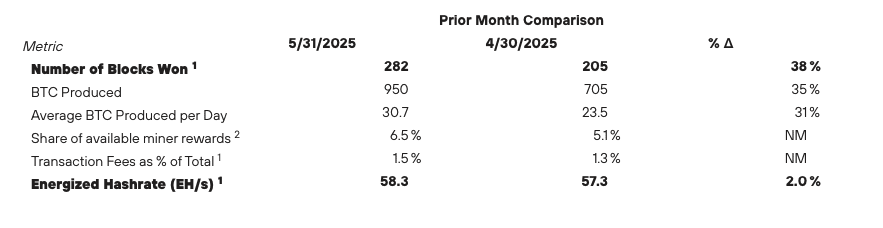

The company produced 950 Bitcoin in May, marking a 35% increase compared to the previous month, according to its unaudited BTC production update released on June 3.

In addition to the increased production, Marathon also reported earning a record high of 282 blocks last month, a 38% increase month-over-month.

Quick Summary of the News:

- Increased Production: MARA produced 950 BTC in May, a 35% MoM increase.

- Record Blocks Earned: The company earned a record 282 blocks, up 38% MoM.

- Bitcoin Holdings: MARA’s Bitcoin holdings now stand at 49,179 BTC, valued at approximately $5.2 billion.

- Zero BTC Sold: Marathon has not sold any Bitcoin.

- Mining Pool Advantage: MARA highlights its self-owned and operated mining pool as a key advantage.

Why It Matters

Marathon’s ability to significantly increase its Bitcoin production in the face of rising hashrate and difficulty is noteworthy. It suggests that the company’s investments in efficient mining infrastructure and its strategy of operating its own mining pool are paying off. This performance sets it apart from competitors and could signal strong future growth potential.

The company’s decision to hold onto all of its mined Bitcoin further demonstrates its bullish outlook on the cryptocurrency’s long-term value. This strategy aligns with many crypto advocates but also introduces potential risk if the price of Bitcoin were to decline significantly.

Market Impact

The news has had a positive, albeit potentially short-lived, impact on MARA’s stock price. More broadly, it reinforces the narrative that well-managed Bitcoin mining companies can thrive even in a competitive environment. This can attract further investment into the sector.

Here’s a quick comparison of MARA’s performance versus the Bitcoin price:

Expert Take or Personal Insight

Marathon Digital’s success highlights the increasing importance of operational efficiency and strategic decision-making in the Bitcoin mining industry. The fact that they control their own mining pool gives them a distinct advantage. It allows them to avoid fees and retain the full value of block rewards. The rising hashrate confirms ongoing interest in mining. But it also means miners need to either scale or find an edge. MARA seems to be doing the latter.

Actionable Insight

Investors should closely monitor MARA’s future production reports and financial statements to assess whether this growth is sustainable. Keep an eye on Bitcoin’s hashrate and mining difficulty to understand the broader market dynamics. Look for other mining companies that are innovating and improving their efficiency.

Conclusion

Marathon Digital’s impressive Bitcoin production numbers demonstrate the potential for mining companies to succeed even amidst increasing competition and difficulty. By prioritizing efficiency, controlling their own mining pool, and holding onto their Bitcoin, MARA has positioned itself for continued growth in the evolving crypto landscape. The coming months will reveal whether they can sustain this momentum and continue to outperform their peers.