Key Takeaways

- Automated Orders: Utilize stop-loss and take-profit orders on trading platforms to automatically limit losses and secure gains.

- Risk Management: Implement these tools to manage Bitcoin’s volatility and prevent emotional trading decisions.

- Continuous Monitoring: Regularly monitor the market and adjust your strategies to adapt to changing conditions.

Stop-loss and take-profit orders are essential tools for Bitcoin (BTC) traders, helping to manage risk and secure profits in the volatile cryptocurrency market. These automated orders instruct a trading platform to close a position when the price reaches a specified level, either to limit potential losses (stop-loss) or to lock in gains (take-profit). Mastering these strategies can significantly improve trading outcomes.

What are Stop-Loss and Take-Profit Orders?

Stop-loss and take-profit orders are pre-set instructions to automatically close a trading position at a specified price. They are critical for managing risk and securing profits without constant monitoring of the market.

- Stop-Loss Order: An order to sell an asset when its price falls to a certain level, limiting potential losses.

- Take-Profit Order: An order to sell an asset when its price rises to a certain level, securing profits.

Bitcoin Stop-Loss Orders: Limiting Your Losses

A stop-loss order is designed to limit potential losses by automatically selling an asset when its price drops to a predetermined level. This is especially useful in the highly volatile Bitcoin market. For instance, if you buy BTC at $65,000 and set a stop-loss at $60,000, your position will be automatically sold if the price falls to $60,000, capping your loss at $5,000.

Benefits of Using Stop-Loss Orders:

- Volatility Protection: Bitcoin’s price can fluctuate rapidly, and a stop-loss order can protect against sudden drops.

- 24/7 Market: The crypto market operates around the clock, and stop-loss orders ensure you’re protected even when you can’t monitor the market.

- Emotional Control: Prevents emotional decisions by automatically executing a trade when the price hits your predetermined level.

Bitcoin Take-Profit Orders: Securing Your Gains

A take-profit order is used to secure gains by automatically selling an asset when its price rises to a predetermined level. For example, if you buy BTC at $65,000 and set a take-profit at $70,000, your position will be sold when the price reaches $70,000, securing a $5,000 profit.

Benefits of Using Take-Profit Orders:

- Profit Locking: Ensures you capture gains before potential price reversals.

- Greed Control: Prevents holding onto a position for too long in hopes of higher profits, which can lead to losses.

- Round-the-Clock Security: Similar to stop-loss orders, take-profit orders work 24/7, ensuring you don’t miss out on gains while you’re away.

Setting Up Stop-Loss and Take-Profit Orders

The process for setting up stop-loss and take-profit orders varies slightly depending on the trading platform, but the general steps are similar:

- Choose a Trading Platform: Select a platform with a good reputation, reasonable fees, and the necessary trading tools.

- Open a Trading Position: Log in, navigate to the trading section, and choose a BTC pair (e.g., BTC/USD). Place a buy or sell order.

- Set the Stop-Loss Price: Determine the maximum amount you’re willing to lose and set the stop-loss order accordingly.

- Set the Take-Profit Price: Determine your desired profit level and set the take-profit order accordingly.

- Confirm and Monitor: Double-check the details, activate the orders, and monitor their status.

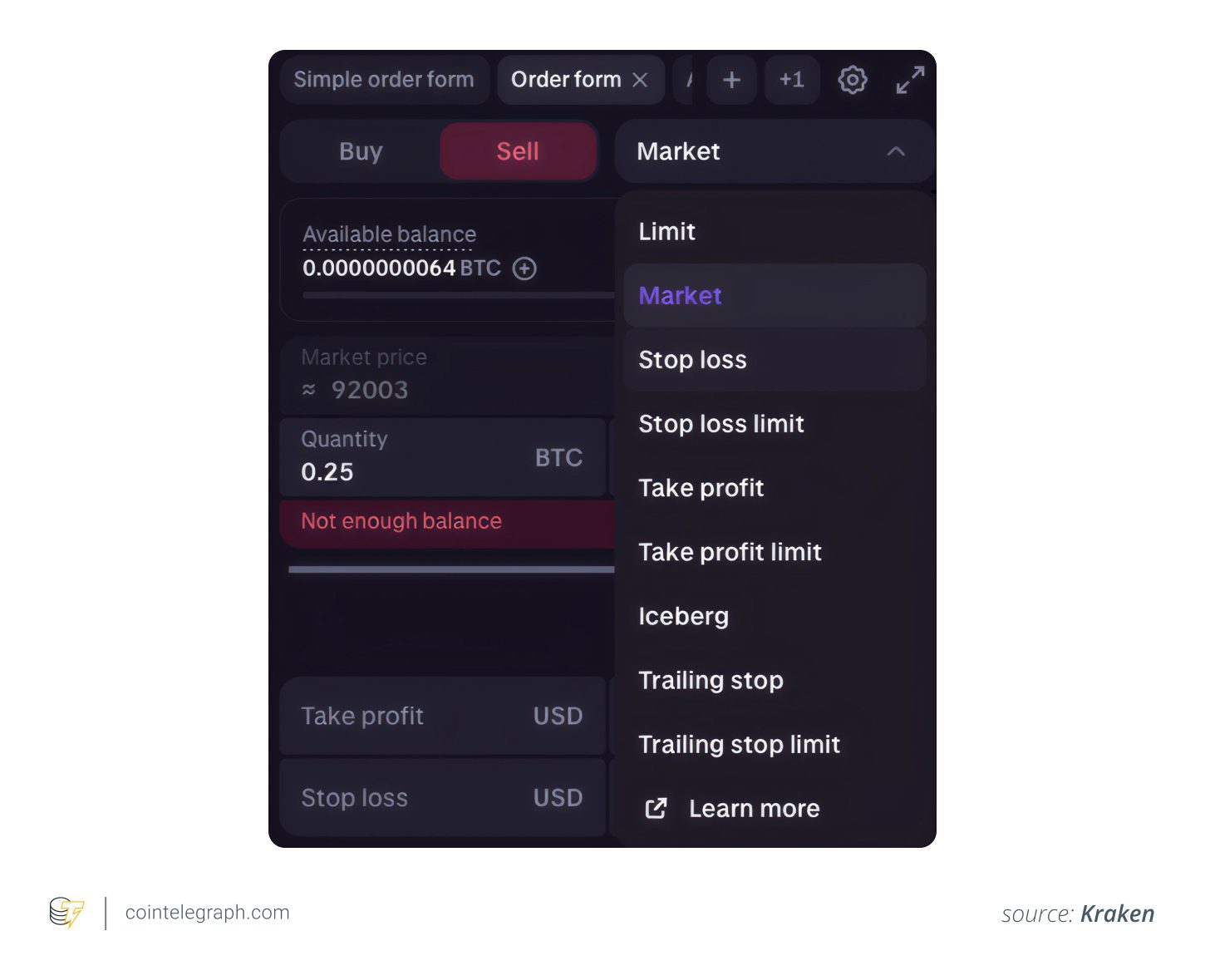

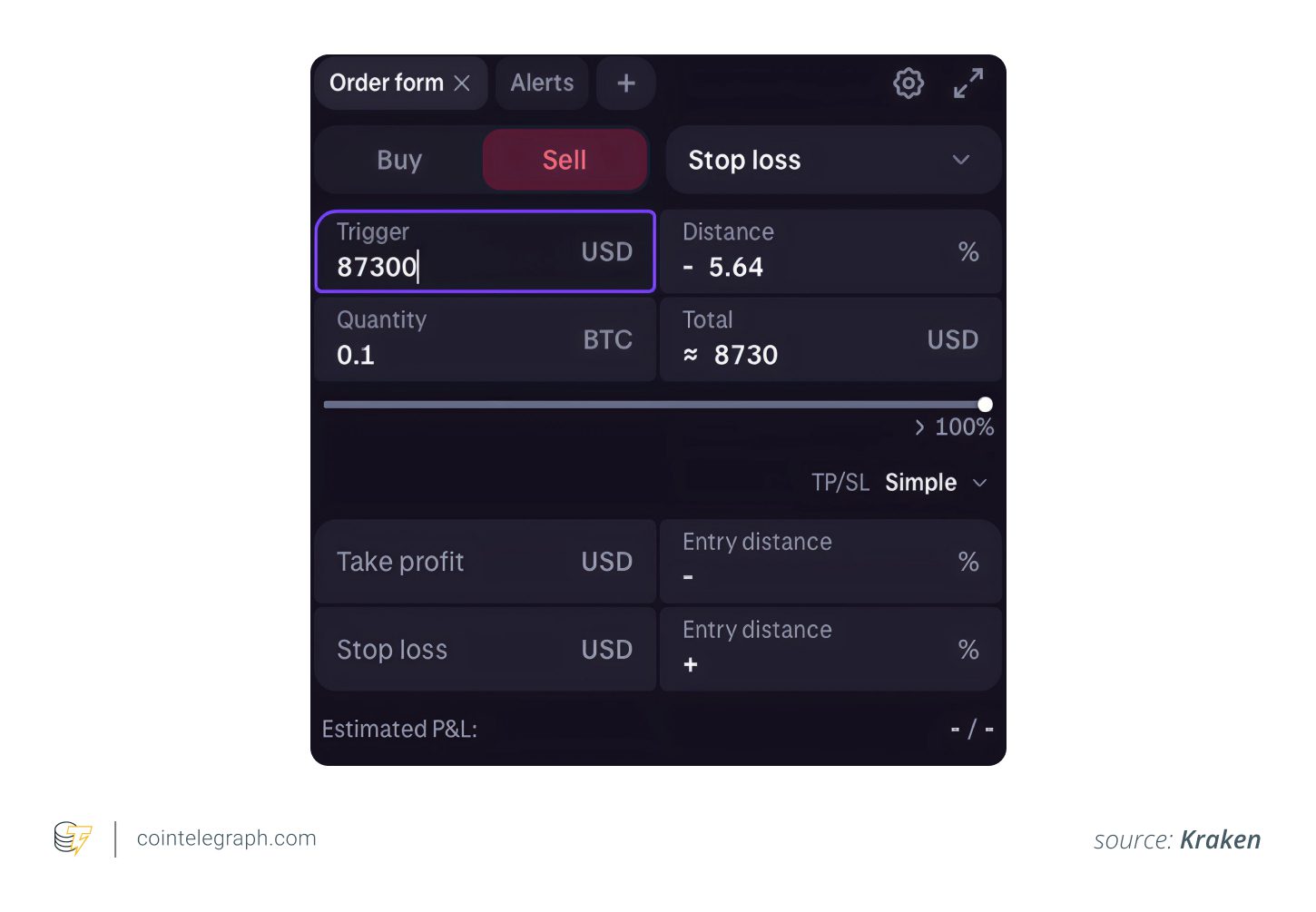

Example using Kraken

Here’s an example of how to set up a stop-loss order on Kraken:

- From the order menu, select the stop-loss option.

- Set the stop-loss price based on your risk tolerance. For example, if you bought BTC at $92,500, you can set the stop loss at $87,300, limiting your loss to approximately 5.62%.

Best Practices for Stop-Loss Placement

- Consider Volatility: Use tools like Average True Range (ATR) to gauge volatility and set your stop-loss accordingly.

- Align with Support Levels: Place your stop-loss just below a key support level to provide a buffer against temporary price dips.

- Avoid Obvious Levels: Steer clear of round numbers, as these are often targeted by large traders.

Trailing Stop-Loss

A trailing stop-loss order automatically adjusts as the price moves in your favor, locking in profits while still protecting against losses. This type of order is particularly useful in a trending market.

Account for Slippage

Slippage is the difference between the expected price and the actual execution price, which can occur during high volatility. To mitigate slippage, consider widening your stop-loss slightly.

Adjusting Stop-Loss and Take-Profit Orders

Adjusting your orders is crucial for adapting to changing market conditions. Most platforms allow you to modify these orders easily.

When to Adjust Stop-Loss Orders:

- After a Favorable Move: Move the stop-loss to reduce risk or lock in profits.

- During a Trend: Use a trailing stop-loss to capture more of the upside.

- During Consolidation: Widen the stop-loss to avoid being triggered by short-term fluctuations.

- Before Major Events: Adjust your stop-loss based on the expected volatility.

When to Adjust Take-Profit Orders:

- During Strong Momentum: Extend the take-profit to avoid missing out on gains.

- At Key Levels: Take partial profits at resistance levels.

- Near Resistance Levels: Tighten the take-profit to secure gains.

- After a Pullback: Reset the take-profit order for a moderate win.

Common Mistakes to Avoid

- Setting Stops Too Tightly: Account for Bitcoin’s volatility.

- Ignoring Slippage: Be aware of potential price differences during execution.

- Chasing Round Numbers: Avoid setting orders at obvious levels.

- Forgetting to Adjust: Regularly monitor and adjust your orders.

- Misjudging Market Context: Align your orders with market trends and events.

- Not Accounting for Fees: Factor in trading fees when setting targets.

- Panic-Canceling Orders: Stick to your initial plan and avoid emotional decisions.

Conclusion

Mastering stop-loss and take-profit orders is vital for successful Bitcoin trading. By understanding and implementing these strategies, you can effectively manage risk, secure profits, and avoid common trading mistakes. Always stay informed about market conditions and adjust your strategies accordingly.