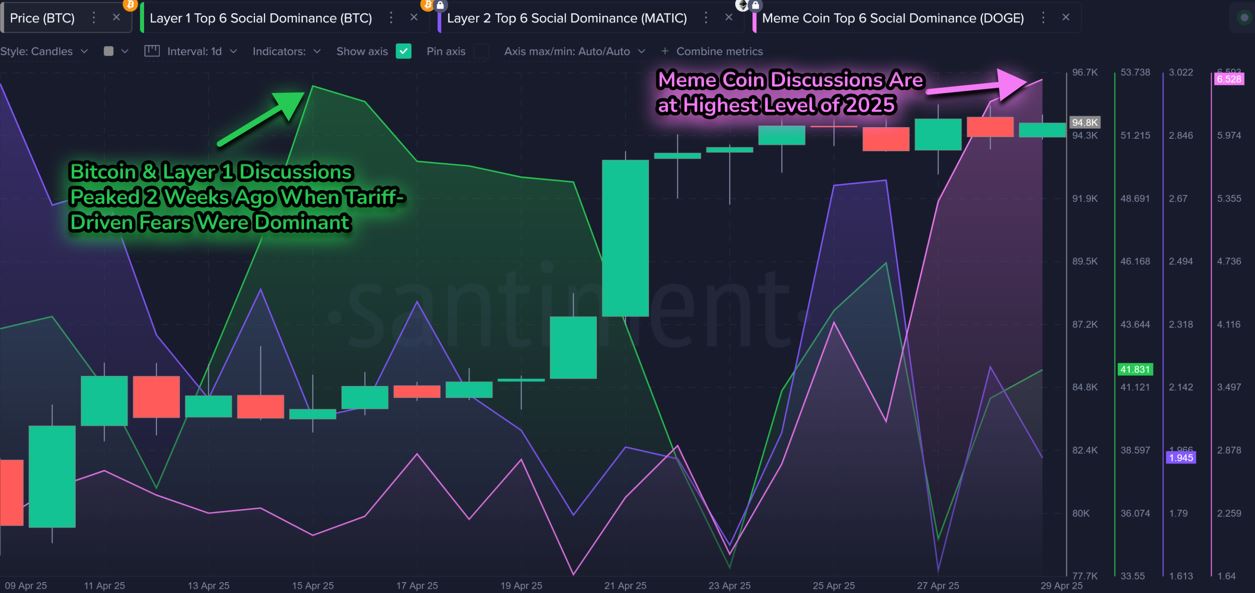

The crypto market is buzzing with memecoin activity, signaling a potential shift towards a ‘gamble mindset’ among traders. According to onchain analytics platform Santiment, online discussions surrounding memecoins have reached a year-to-date high, surpassing earlier levels of interest. This surge in memecoin mania suggests a change in investment strategy, where speculation and the pursuit of quick profits take precedence over calculated, long-term investments.

The Rise of Memecoin Discussions

Santiment’s marketing director, Brian Quinlivan, highlighted this trend in a recent blog post, noting that discussions around high market cap memecoins have gained significant traction. This shift comes after a period where Bitcoin and layer-1 protocols dominated crypto conversations. Quinlivan suggests that traders are increasingly drawn to these high-risk tokens, driven by the allure of substantial returns.

“Online discussions about these high-risk tokens have proliferated as traders embrace a gamble mindset, rather than a calculated investment approach,” Quinlivan stated. This indicates that investment decisions are based on speculation and the hope for short-term gains rather than thorough analysis and strategic planning.

The overall crypto market has seen a 10% increase in the past eight days; however, Bitcoin’s growth has been limited to 7%. This disparity further indicates that traders are venturing into more speculative assets, hoping to outperform the leading cryptocurrency.

“Any time Bitcoin leads an initial rally and then begins to move sideways, investors generally start taking bigger risks in hopes of scoring even higher returns through more speculative and riskier purchases,” Quinlivan explained.

Dogecoin’s Resurgence Amid ETF Hopes

Dogecoin (DOGE) has emerged as a frontrunner in this memecoin frenzy, experiencing a significant spike in positive crowd sentiment. This resurgence follows a decline in interest during April, fueled by the anticipation surrounding various applications for Dogecoin exchange-traded funds (ETFs) in the United States.

Despite the Securities and Exchange Commission (SEC) delaying its decision on these filings until mid-June, traders remain cautiously optimistic. This anticipation has reinvigorated discussions and interest in Dogecoin.

“Until late April, DOGE had been on a major decline in terms of crowd interest. But its social dominance has spiked to its highest level in nearly three months, as the conversations and filings surrounding Nasdaq’s ETF listings have risen,” Quinlivan noted.

The Memecoin Ecosystem: Pump.Fun and PumpSwap

The broader memecoin ecosystem is thriving, with decentralized exchanges and launch platforms experiencing significant growth. DefiLlama data reveals that PumpSwap, the decentralized exchange of the memecoin launch platform Pump.Fun, witnessed a surge to $11 billion in monthly trading volume in April, a substantial increase from $1.7 billion in March.

Similarly, Pump.Fun’s monthly trading volume rose to $3.3 billion in April, up from $2.5 billion in March, indicating a robust and expanding market for memecoin trading and launches.

The Trump Effect and Market Dynamics

The memecoin surge gained momentum after the launch of former US President Donald Trump’s memecoin on January 18. This event significantly impacted Pump.fun usage, resulting in a peak of $3.3 billion in weekly trading volume.

However, the initial excitement surrounding memecoins eventually cooled down. CoinGecko founder Bobby Ong noted a decline in investor interest following a series of unsuccessful launches, citing the Libra (LIBRA) token launch in February as a catalyst for market caution.

Understanding the Risks and Rewards of Memecoin Trading

The current memecoin market presents both opportunities and risks for traders. While the potential for high returns is enticing, it’s essential to approach these investments with caution. The speculative nature of memecoins means that prices can fluctuate rapidly and unpredictably.

Here are some key considerations for navigating the memecoin market:

- Do Your Research: Before investing in any memecoin, thoroughly research its fundamentals, community support, and potential use cases.

- Manage Risk: Allocate only a small percentage of your portfolio to memecoins, and be prepared to lose your investment.

- Stay Informed: Keep up-to-date with the latest market trends, news, and developments in the memecoin space.

- Consider Long-Term Potential: While short-term gains are tempting, evaluate the potential for long-term growth and sustainability.

The surge in memecoin activity reflects a shift towards higher-risk investments in the crypto market. While opportunities exist, traders must exercise caution and make informed decisions to mitigate potential losses.