MEXC Launches $100 Million User Protection Fund: A New Standard for Exchange Security?

Crypto exchange MEXC has rolled out a $100 million user protection fund aimed at shielding its users from major platform breaches, technical failures or other serious security threats.

The fund is structured to compensate users in the event of major security incidents, including breaches of the platform’s infrastructure, critical system vulnerabilities or large-scale targeted hacks, the exchange told Cointelegraph.

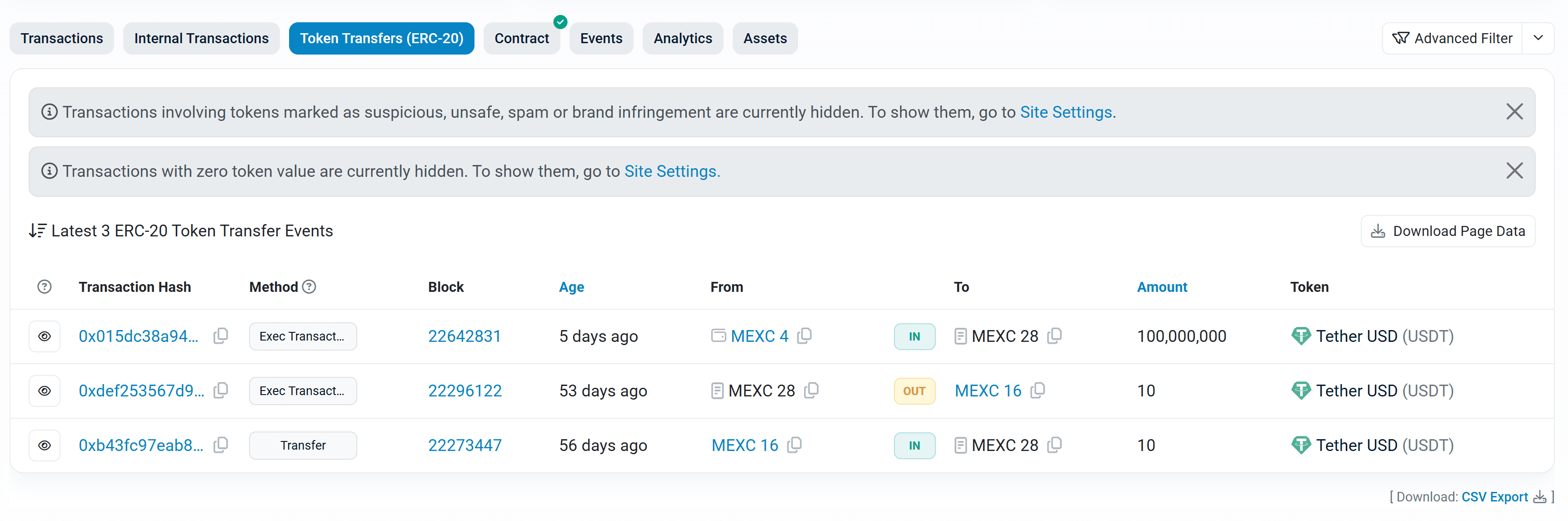

MEXC has also published wallet addresses linked to the fund on its website, allowing users to verify balances and monitor fund activity in real-time. A dedicated web portal will also provide information about the fund’s structure, covered scenarios and ongoing compensation cases.

According to the company, the fund will offer coverage in cases where MEXC systems are directly compromised or affected by serious vulnerabilities.

“This isn’t just about promises, it’s about accountability and delivering visible safeguards when they matter most,” said Tracy Jin, MEXC’s chief operating officer.

Quick Summary of the News:

- MEXC launches a $100 million user protection fund.

- The fund aims to compensate users for losses due to security breaches and technical failures.

- MEXC provides wallet addresses for transparency and real-time monitoring.

- Compensation decisions are reviewed by MEXC’s internal risk control, compliance, and security teams.

- The fund represents approximately 2.5% of MEXC’s daily trading volume.

Why It Matters

In an industry plagued by hacks and exploits, MEXC’s initiative is a significant step towards building trust and confidence among users. The crypto community has long called for exchanges to take more responsibility for user safety, and this fund addresses those concerns directly. By providing a financial safety net, MEXC aims to attract and retain users who may be hesitant to use exchanges due to security risks. Furthermore, this move could pressure other exchanges to follow suit, leading to a higher standard of security across the industry.

Market Impact

The launch of this fund could have several positive effects on MEXC’s market position:

- Increased User Trust: A tangible commitment to user safety can boost confidence in the platform.

- Higher Trading Volume: Increased trust can lead to more users and higher trading volumes.

- Positive Reputation: Being seen as a secure exchange can attract new users and partnerships.

While difficult to quantify precisely, the potential impact on trading volume and user acquisition could be substantial. For example, if MEXC sees a 10% increase in trading volume due to increased user trust, that translates to roughly $398 million in additional daily trading volume, based on current figures.

Expert Take or Personal Insight

MEXC’s move is commendable, but the devil is in the details. The effectiveness of this fund will depend on how quickly and fairly claims are processed. The fact that the fund management is currently handled in-house raises questions about potential conflicts of interest. While MEXC plans to partner with third-party auditors, this should be implemented swiftly to ensure true transparency and accountability. Ultimately, the success of this initiative hinges on MEXC’s commitment to user safety and its ability to demonstrate that the fund is genuinely used to protect users in the event of a breach.

Actionable Insight

For traders and investors, this news is cautiously positive. If you are a MEXC user, monitor the wallet addresses provided to verify the fund’s balance. More importantly, pay close attention to how MEXC handles any future security incidents and compensation claims. This will be the true test of their commitment. Also, consider diversifying your holdings across multiple exchanges to mitigate risk.

Conclusion

MEXC’s $100 million user protection fund is a welcome development in the crypto space. It’s a step in the right direction towards greater user security and accountability. Whether it becomes a new industry standard remains to be seen, but it certainly raises the bar for crypto exchange security. The industry will be watching closely to see how MEXC manages and utilizes this fund in the future.