Apple, a tech giant with immense market capitalization, is facing criticism regarding its stock buyback program. Michael Saylor, executive chairman of MicroStrategy, suggests a bold move: Apple should buy Bitcoin.

“Apple should buy Bitcoin,” Saylor stated in a recent post on X, responding to concerns raised about the effectiveness of Apple’s current buyback strategy.

Jim Cramer, a well-known financial commentator, had earlier expressed his doubts about Apple’s buyback program, saying, “The Apple buyback is not working right now.”

Saylor’s perspective highlights a potential shift in corporate treasury strategies, advocating for Bitcoin as a viable alternative investment.

Quick Summary of the News:

- Michael Saylor advises Apple to invest in Bitcoin.

- Criticism surrounds Apple’s current stock buyback program.

- Bitcoin’s performance has significantly outpaced Apple’s stock growth.

- More corporations are adding Bitcoin to their balance sheets.

- Spot Bitcoin ETFs are seeing positive inflows again.

Why It Matters:

Saylor’s suggestion carries weight due to his company’s significant Bitcoin holdings. Apple adopting Bitcoin would signal a major shift in corporate acceptance and could legitimize Bitcoin as a treasury asset. This could lead to increased institutional investment and further price appreciation for Bitcoin.

Market Impact:

Consider the comparative performance:

- Year-to-date, Apple’s stock is down over 17%.

- Year-to-date, Bitcoin is up over 17%.

- Over the past five years, Bitcoin has surged over 1,000%, while Apple shares have increased by 137%.

This stark contrast illustrates the potential gains Apple could realize by diversifying into Bitcoin.

Expert Take or Personal Insight:

While Apple adopting Bitcoin seems unlikely in the short term due to regulatory hurdles and corporate risk aversion, the idea itself is compelling. Apple’s vast cash reserves could significantly impact Bitcoin’s price. More importantly, it could trigger a domino effect, encouraging other corporations to follow suit. This move would undoubtedly accelerate Bitcoin’s journey toward mainstream adoption.

Actionable Insight:

Traders and investors should closely monitor institutional sentiment towards Bitcoin. Any indication that major corporations are considering or initiating Bitcoin investments could trigger significant market rallies. Keep an eye on regulatory developments regarding cryptocurrency adoption by public companies.

Growing Corporate Adoption of Bitcoin

Several companies are already embracing Bitcoin. GameStop recently invested in 4,710 BTC, while Metaplanet is aggressively acquiring Bitcoin in Asia. In Europe, The Blockchain Group is raising capital to expand its Bitcoin treasury.

These developments indicate a growing trend of corporate Bitcoin adoption, further validating its potential as a store of value.

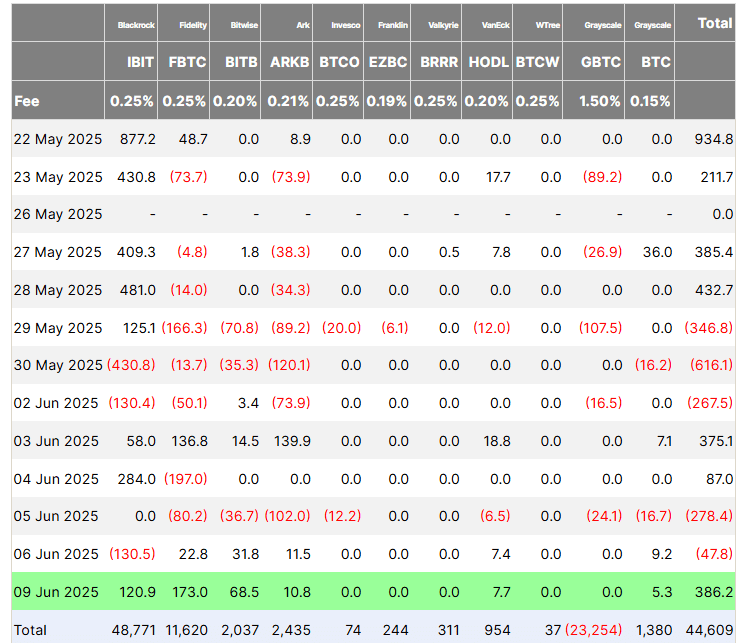

Furthermore, after a brief sell-off, spot Bitcoin ETFs have rebounded, demonstrating continued investor interest and confidence in the asset.

Conclusion:

Michael Saylor’s suggestion may seem audacious, but it highlights the growing recognition of Bitcoin as a legitimate investment asset. Whether Apple takes the plunge remains to be seen, but the conversation itself underscores the evolving landscape of corporate finance and the increasing allure of cryptocurrency.