Bitcoin is experiencing renewed accumulation from both corporate entities and large-scale investors, commonly known as ‘whales.’ This surge in buying activity coincides with positive developments in the market, hinting at a potential bullish phase for the cryptocurrency.

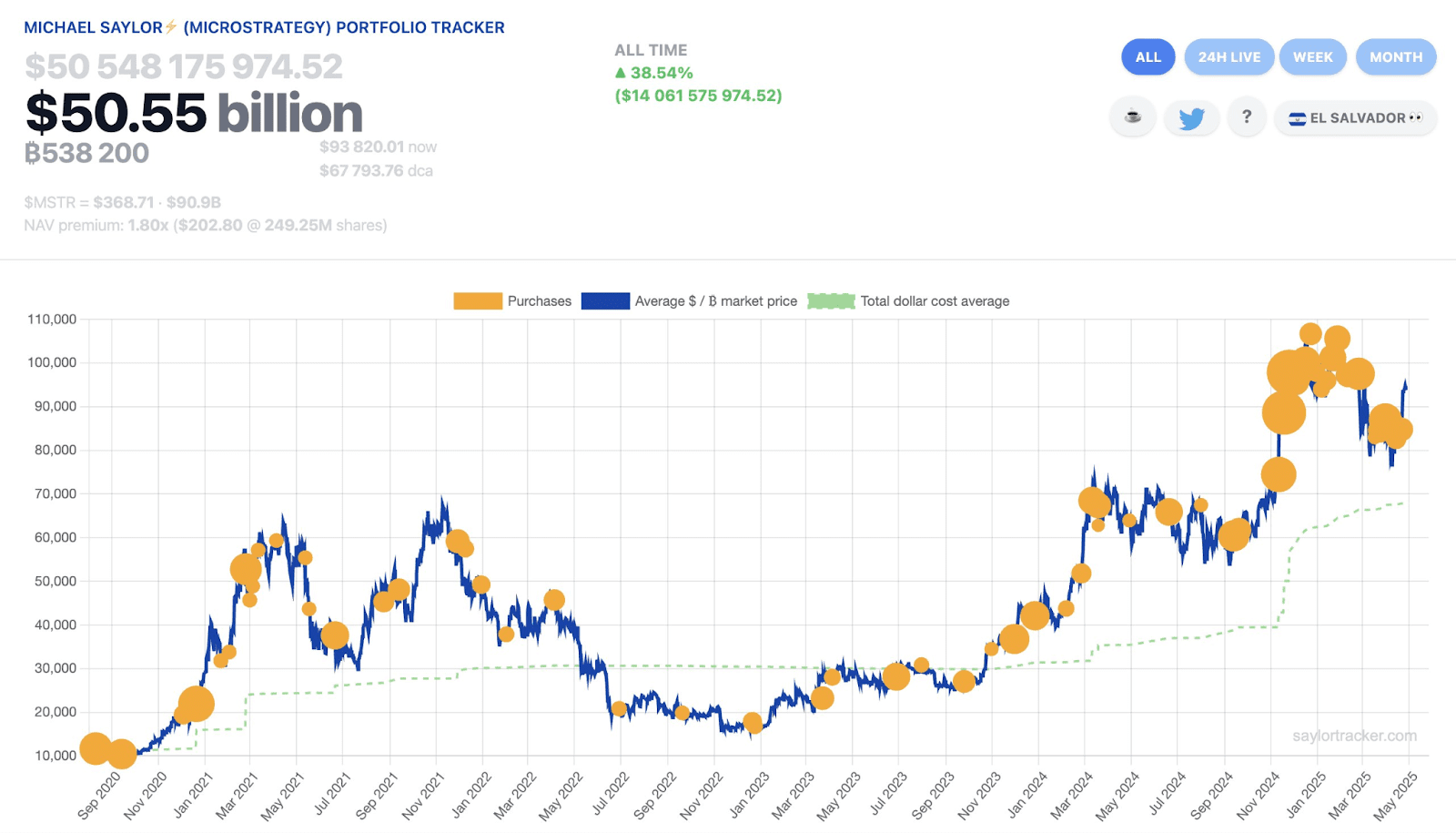

MicroStrategy’s Potential Bitcoin Investment

Michael Saylor, co-founder of MicroStrategy, recently suggested an imminent Bitcoin investment. This news follows MicroStrategy’s prior acquisition of $555 million worth of Bitcoin at an average price of $84,785 per coin. Investors are speculating on the size of the firm’s next investment, with some analysts predicting a substantial increase.

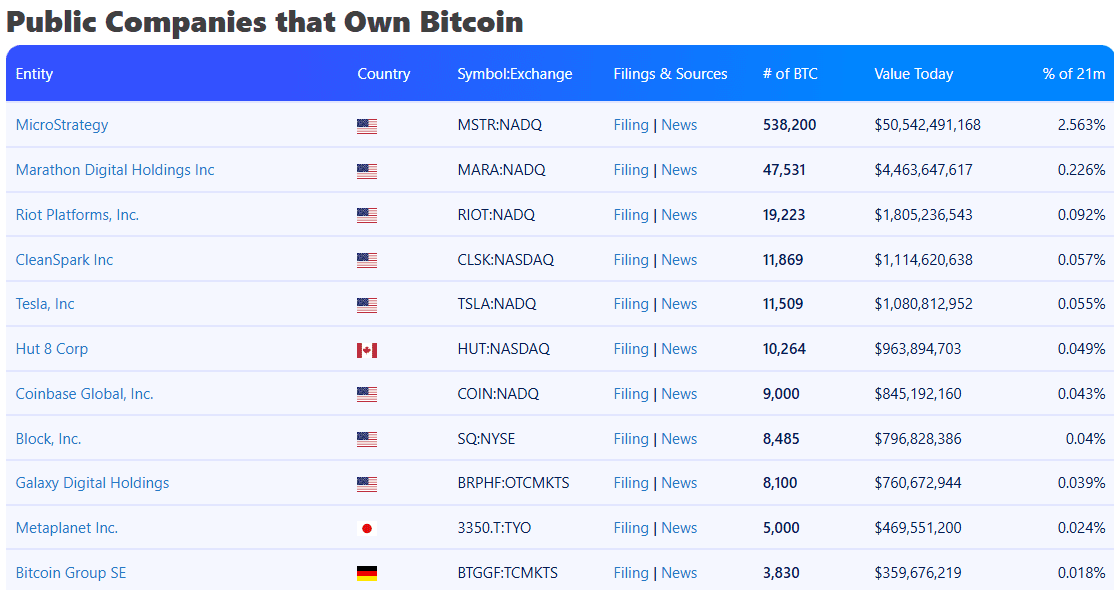

MicroStrategy currently holds over 538,200 Bitcoin, valued at over $50.5 billion, making them the largest corporate Bitcoin holder globally.

Other Companies Following Suit

MicroStrategy’s commitment to Bitcoin has inspired other companies to adopt the cryptocurrency. Metaplanet, a Japanese investment firm, has accumulated over 5,000 BTC as part of its strategy to promote Bitcoin adoption in Asia.

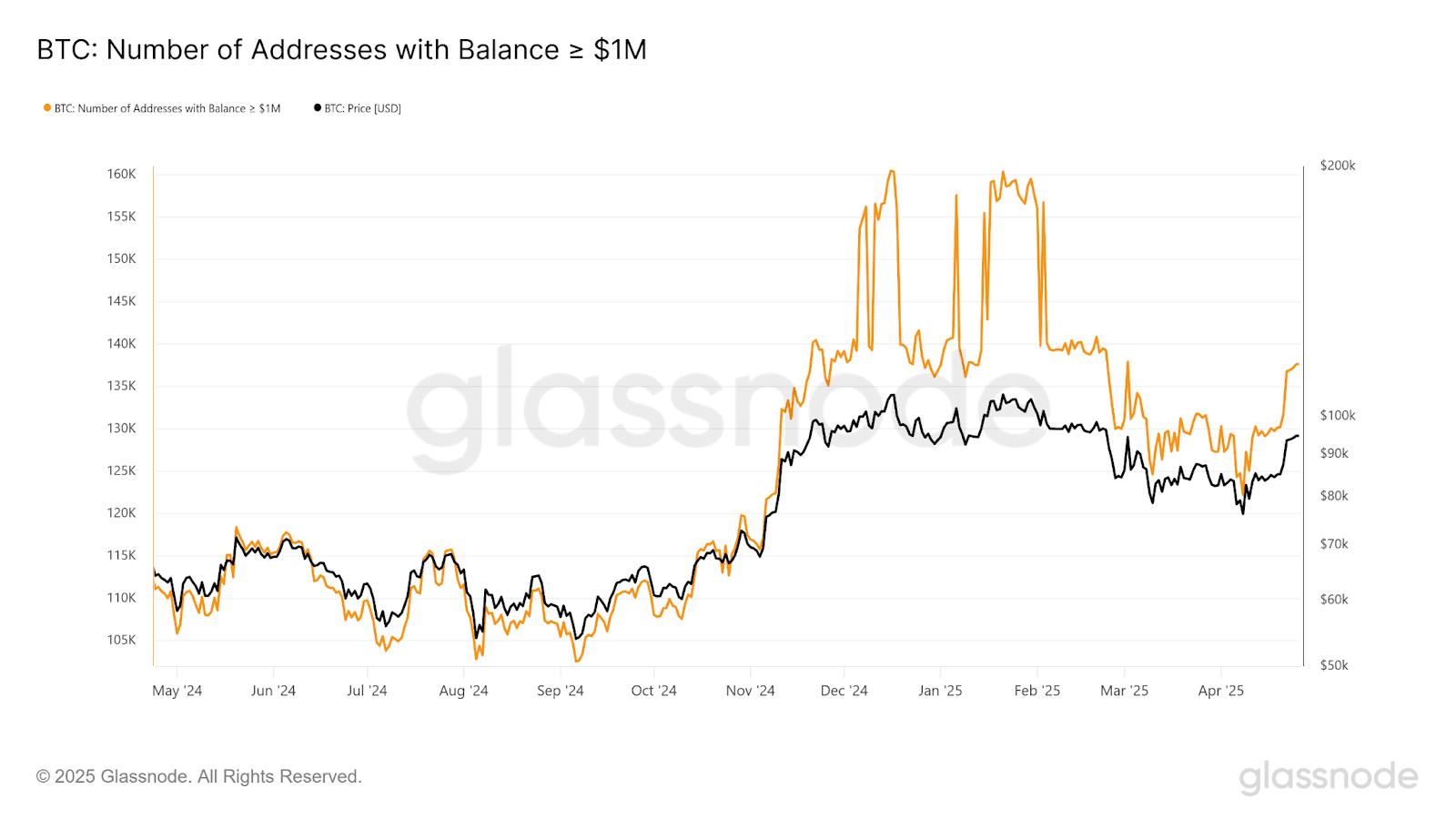

Bitcoin Whale Accumulation

Besides corporate investments, Bitcoin whales are also significantly increasing their holdings. The number of wallets holding at least $1 million worth of Bitcoin has risen considerably in April, signifying renewed confidence among large investors.

This aggressive accumulation by whales has contributed to Bitcoin’s price recovery.

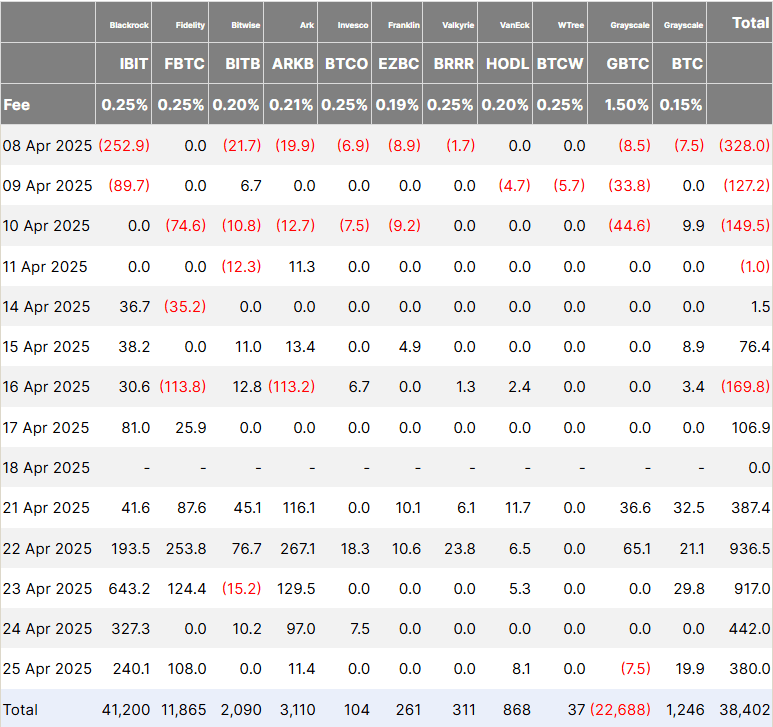

Bitcoin ETF Inflows

Significant inflows into Bitcoin ETFs have further bolstered Bitcoin’s recovery. US spot Bitcoin ETFs have recorded over $3 billion worth of cumulative net inflows in the past week, marking one of their best weeks since launch.

Factors Driving Bitcoin Accumulation

Several factors may be contributing to this renewed interest in Bitcoin:

- Institutional Adoption: Companies like MicroStrategy and Metaplanet are leading the way in corporate Bitcoin adoption, signaling confidence in the cryptocurrency’s long-term value.

- ETF Inflows: The success of Bitcoin ETFs has made it easier for institutional and retail investors to gain exposure to Bitcoin, driving demand and price appreciation.

- Whale Accumulation: Large Bitcoin holders are increasing their positions, indicating a belief that Bitcoin’s price will continue to rise.

- Potential for Price Appreciation: With the upcoming Bitcoin halving event and growing institutional interest, many investors believe that Bitcoin is poised for significant price appreciation.

Potential Risks

While the current outlook for Bitcoin appears positive, it’s essential to be aware of the potential risks:

- Regulatory Uncertainty: Changes in regulations could negatively impact the price of Bitcoin.

- Market Volatility: Bitcoin is a volatile asset, and its price can fluctuate significantly.

- Security Risks: Bitcoin exchanges and wallets are vulnerable to hacking and theft.

Conclusion

The aggressive accumulation of Bitcoin by MicroStrategy and other whales, coupled with strong ETF inflows, suggests growing confidence in the cryptocurrency’s potential. While risks remain, the current trend indicates a possible bullish phase for Bitcoin.