MicroStrategy, under the guidance of co-founder Michael Saylor, may be preparing to add more Bitcoin (BTC) to its already substantial holdings. This follows a recent dip in the cryptocurrency market from its all-time high. Saylor hinted at a possible purchase with a post on X, stating, “I only buy Bitcoin with money I can’t afford to lose.”

Key Takeaways:

- Potential Purchase: MicroStrategy may be preparing for another Bitcoin purchase.

- Previous Acquisition: The company’s last purchase of 7,390 BTC on May 19 was valued at approximately $765 million.

- Total Holdings: If the acquisition happens, MicroStrategy’s total holdings could climb up.

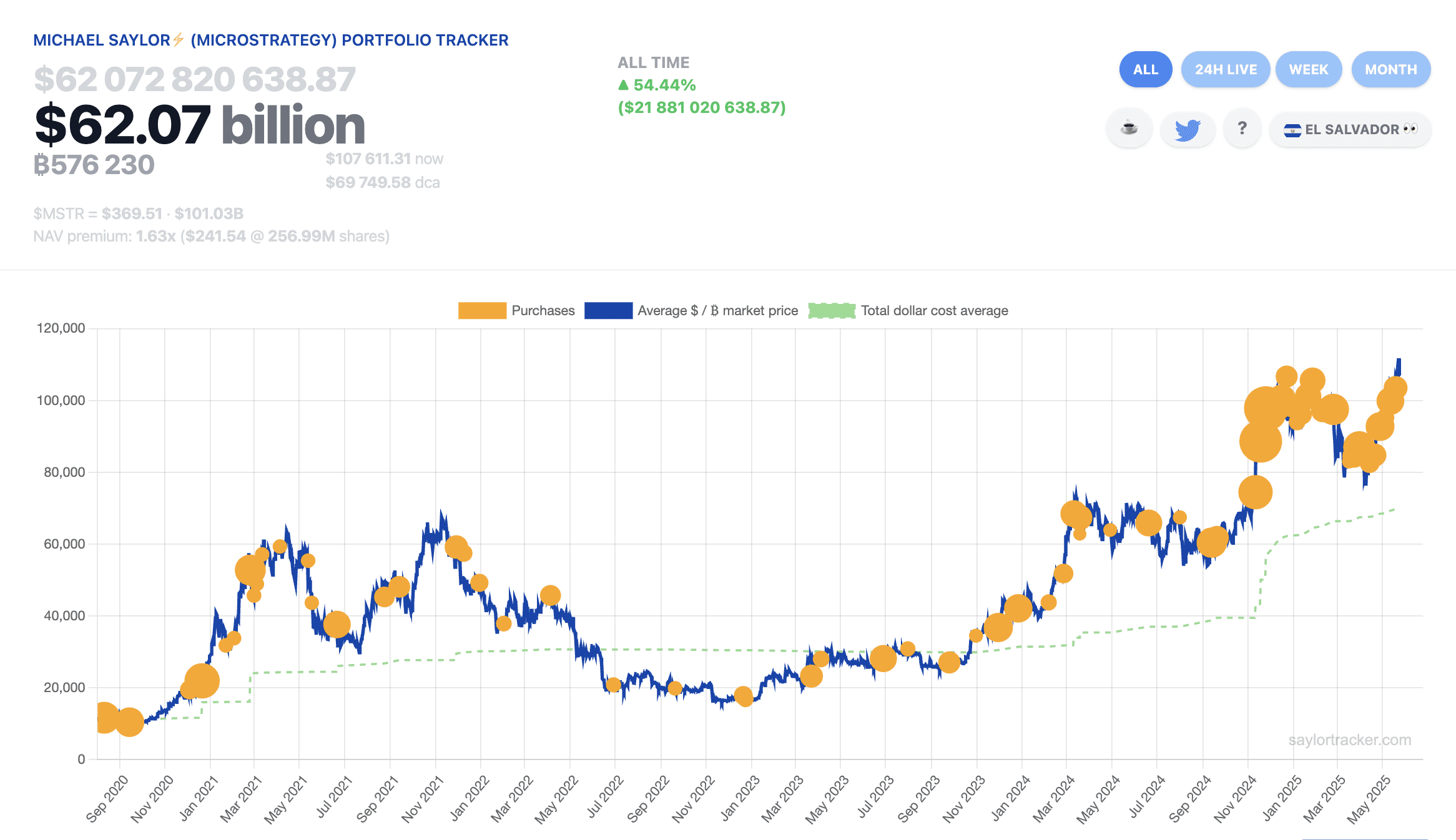

MicroStrategy’s recent acquisition of 7,390 BTC on May 19, valued at nearly $765 million, increased their total holdings to 576,230 BTC. If MicroStrategy proceeds with an acquisition around May 26, it would signify their seventh consecutive week of Bitcoin purchases.

MicroStrategy’s Bitcoin Strategy

MicroStrategy has become increasingly associated with Bitcoin, accumulating significant amounts of BTC for its corporate treasury. This strategy has encouraged other companies to consider adopting Bitcoin treasury plans, contributing to sustained institutional demand for the digital asset and supporting its price.

Analyst Prediction: A $10 Trillion Company?

Market analyst Jeff Walton has suggested that MicroStrategy could potentially become a $10 trillion company and the most valuable publicly traded corporation worldwide, thanks to its growing Bitcoin stockpile. He told the Financial Times that MicroStrategy holds more of the best assets and the most pristine collateral on the planet than any other company.

Walton highlighted MicroStrategy’s ability to raise billions of dollars in capital quickly, which they then use to purchase Bitcoin, a rapidly appreciating asset. This contrasts with traditional companies that typically use capital for operational costs or production improvements.

Michael Saylor’s Bullish Bitcoin Outlook

Michael Saylor has previously forecasted that Bitcoin’s price could reach millions of dollars per coin in the long term. He argues that Bitcoin’s capped supply offers an asymmetric upside compared to fiat currencies. However, Bitcoin has faced challenges in reaching the $150,000 level in the short term. Saylor attributed this to investors taking profits too early and rotating out of BTC due to a lack of long-term conviction.

Factors Influencing Bitcoin’s Price

- Investor Sentiment: Short-term profit-taking can hinder price growth.

- Market Volatility: The cryptocurrency market is inherently volatile, impacting price fluctuations.

- Institutional Adoption: Continued adoption by institutional players is a key driver for long-term price appreciation.

In conclusion, MicroStrategy’s potential continued investment in Bitcoin, driven by Michael Saylor’s long-term vision, has fueled speculation about the company’s future and its potential to become a dominant force in the global financial landscape. While short-term price fluctuations remain a factor, the company’s strategic approach to Bitcoin accumulation positions it as a key player in the cryptocurrency market.