In the face of recent market volatility, investors are increasingly turning to contrasting strategies: leveraged Exchange Traded Funds (ETFs) and safe-haven assets like gold. This approach reflects a desire to capitalize on potential gains while simultaneously mitigating risks associated with unpredictable market conditions.

Key Trends in Investment Strategies:

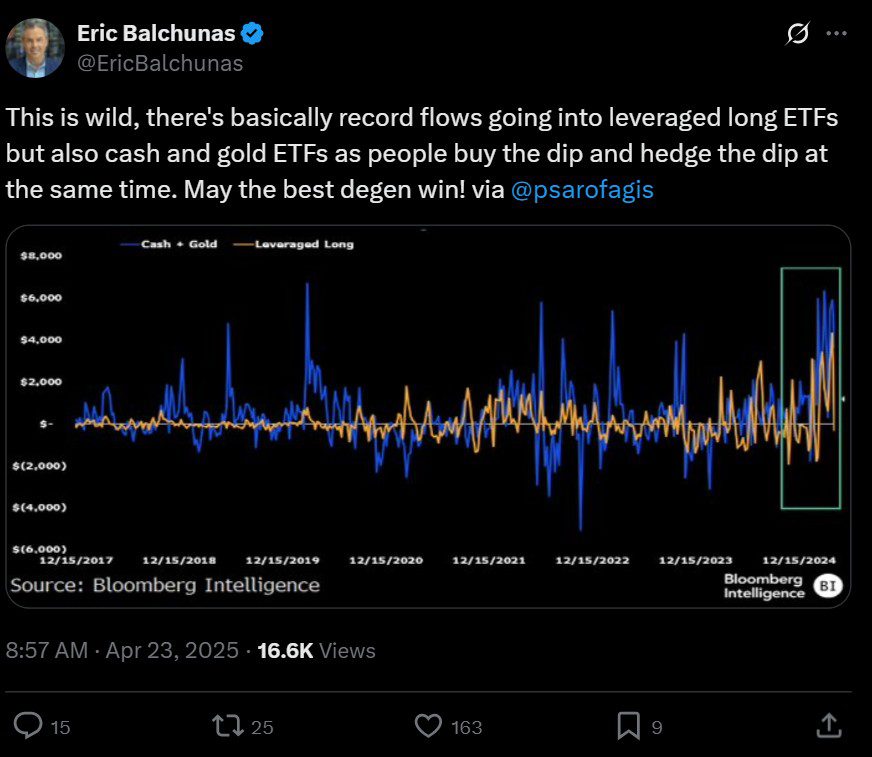

- Leveraged Long ETFs: These funds are designed to amplify daily returns of underlying assets, such as stocks and cryptocurrencies, by a multiple (e.g., 2x or 3x). They’ve seen substantial inflows in 2025, indicating a willingness among some investors to take on higher risk for potentially higher rewards.

- Cash and Gold ETFs: Concurrently, there’s been significant investment in cash and gold ETFs. Gold, traditionally considered a safe haven, is used to preserve capital during economic downturns. Increased investment in these assets suggests a cautious approach to counterbalance the risks associated with leveraged ETFs.

This dual investment strategy highlights the current market sentiment: a blend of speculative optimism and risk aversion.

Factors Driving Market Volatility:

Recent market turbulence can be attributed to several factors, including:

- Tariff Announcements: Proposed tariffs on US imports have introduced uncertainty into the global trade landscape, impacting market confidence.

- Economic Data: Fluctuations in economic indicators, like inflation and employment rates, contribute to market instability.

- Geopolitical Events: Ongoing geopolitical tensions and conflicts contribute to uncertainty and market fluctuations.

Bitcoin’s Performance Amidst Volatility:

Interestingly, Bitcoin (BTC) has demonstrated resilience during this period of market volatility. While traditional assets like stocks have experienced declines, Bitcoin has shown relative stability, even reclaiming price levels above $90,000. This has led to some considering Bitcoin as a form of “digital gold,” although its correlation with traditional safe-haven assets remains a subject of debate.

Bitcoin vs. Gold: A Comparison

- Correlation: Historically, Bitcoin has shown a weaker correlation to gold compared to equities, suggesting it doesn’t always behave as a traditional safe-haven asset.

- Investor Perception: Gold remains the preferred safe-haven asset for many institutional and individual investors.

- Volatility: Bitcoin is known for its higher volatility, which can attract some investors seeking higher returns but deters others.

Cryptocurrency Exchanges Benefit from Volatility

The increased market volatility has led to a surge in trading activity, particularly in financial derivatives such as Bitcoin futures. Cryptocurrency exchanges are capitalizing on this trend by expanding their offerings in this area.

Key Takeaways:

- Market volatility is prompting investors to adopt diverse strategies, including leveraged ETFs and safe-haven assets.

- Bitcoin has displayed resilience amidst market turbulence, but its role as a true safe-haven asset is still under evaluation.

- Cryptocurrency exchanges are benefiting from increased trading activity in derivatives markets.

Understanding these trends is crucial for investors navigating the complexities of the current financial landscape. By carefully considering risk tolerance and investment goals, individuals can make informed decisions that align with their long-term financial objectives.