NFT Artist’s $3 Million Crypto Dream Turns into Tax Nightmare: A Cautionary Tale

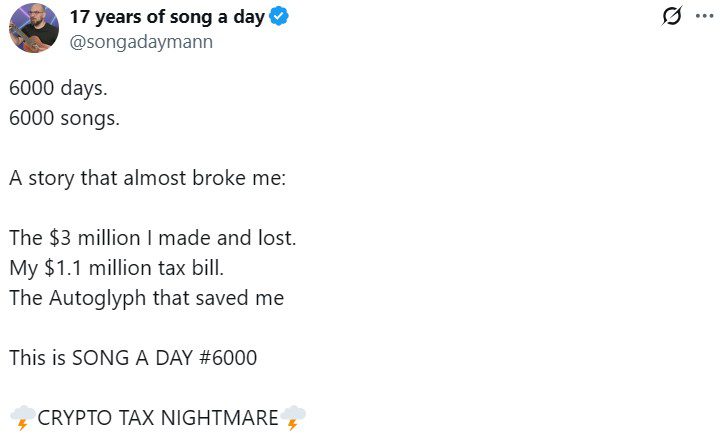

Non-fungible token (NFT) artist Jonathan Mann, the musician behind the “Song A Day” project, has turned his crypto tax ordeal into a cautionary musical tale.

In a new track shared on X, Mann recounted how he made $3 million selling his entire back catalog as NFTs, only to see it vanish as the market crashed during the Terra ecosystem collapse.

“This is the story of how I made three million dollars and lost it,” Mann sings. “And how I owed the IRS more money than I made in 10 previous years.”

Quick Summary of the News

- Jonathan Mann, known for his “Song A Day” project, made $3 million selling his music as NFTs.

- He held the ETH, expecting prices to rise, but the market crashed, especially with the Terra (LUNA) collapse.

- Despite the loss in ETH value, the IRS demanded over $1 million in taxes based on the ETH value when received.

- Mann took out a loan on Aave, using ETH as collateral, which got liquidated during the crash.

- He ultimately sold a rare Autoglyph NFT to cover the tax bill.

Why It Matters

This story highlights several crucial aspects of the crypto world:

- Tax Implications: Crypto earnings are taxable, and the timing of sales significantly impacts the tax burden. Income is usually taxed at the time received.

- Market Volatility: The extreme volatility of the crypto market can wipe out profits quickly, especially when holding assets without a clear strategy.

- DeFi Risks: Using crypto as collateral in DeFi lending protocols carries liquidation risks during market downturns.

- Importance of Planning: A well-thought-out financial and tax strategy is essential for anyone involved in crypto.

Market Impact

While this is a personal story, it serves as a stark reminder of the risks involved in the NFT and crypto markets. Here’s a simplified table illustrating the potential scenario:

| Event | ETH Value | Mann’s Holdings (ETH) | USD Equivalent |

|---|---|---|---|

| NFT Sale (Jan 2022) | $800/ETH | 3700 | $2,960,000 |

| ETH Crash (Terra Collapse) | ~$200/ETH (Hypothetical) | 3400 (After Aave Liquidation ~300ETH) | $680,000 |

This simplified example highlights the potential value destruction in a crypto crash. The tax liability, however, remains tied to the higher initial value.

Expert Take or Personal Insight

Mann’s situation, while unfortunate, is a common pitfall for newcomers in the crypto space. The allure of quick riches can overshadow the need for careful planning and risk management. I think this serves as a wake-up call: crypto success requires not just identifying opportunities but also navigating the complexities of taxes, regulations, and market volatility. We need better financial literacy within the crypto community. Education on tax implications should be as readily available as information on new NFT drops.

Actionable Insight

For traders and investors, here’s what to watch and do:

- Diversify: Don’t put all your eggs in one basket. Diversify your crypto portfolio and consider traditional assets as well.

- Plan for Taxes: Consult a tax professional who understands crypto. Set aside a portion of your profits for tax liabilities.

- Understand DeFi Risks: If using DeFi platforms, be fully aware of liquidation risks and collateralization ratios.

- Stay Informed: Keep up-to-date with market trends, regulatory changes, and tax policies.

Conclusion

Jonathan Mann’s story is a reminder that crypto investing, while potentially lucrative, comes with significant risks. As the crypto space matures, a focus on responsible investing, tax planning, and risk management is essential for long-term success. The future of crypto hinges not just on technological innovation but also on financial responsibility and education.