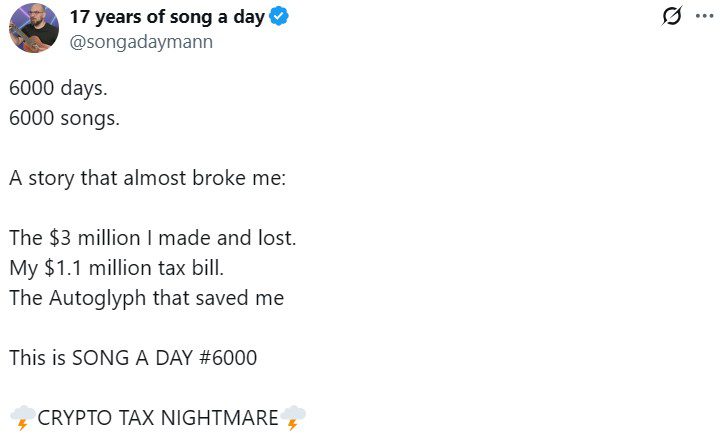

Non-fungible token (NFT) artist Jonathan Mann, the musician behind the “Song A Day” project, has turned his crypto tax ordeal into a cautionary musical tale.

In a new track shared on X, Mann recounted how he made $3 million selling his entire back catalog as NFTs, only to see it vanish as the market crashed during the Terra ecosystem collapse.

“This is the story of how I made three million dollars and lost it,” Mann sings. “And how I owed the IRS more money than I made in 10 previous years.”

Musician owed $1.1 million in taxes on NFT sales

Mann said it all began on Jan. 1, 2022, when he sold 3,700 songs at $800 each, netting him roughly $3 million — all in Ether (ETH).

Excited but unprepared, Mann and his wife decided to hold onto the crypto, hoping ETH prices would increase. “We didn’t have a plan,” Mann admitted in the song.

Things took a turn when ETH’s value declined in January 2022, and the couple was unsure about how much to sell or when. To add to their woes, the US Internal Revenue Service (IRS) came knocking at their door.

As Mann explained in the song, his earnings from selling NFTs are taxed as income. This means that tax is based on the value of the ETH when received, regardless of whether the crypto asset later crashes in value. Because of this, even though their $3 million in ETH went down in price, their tax bill remained the same.

To avoid selling their crypto at a loss, Mann said they took out a loan through the lending protocol Aave, using some of the ETH as collateral. But disaster struck as the market started to crash, driven by the Terra collapse.

The incident triggered a cascade of liquidations across the ecosystem, which included Mann’s loan. In a flash, 300 ETH disappeared. “A lifetime of work erased in a moment,” he lamented.

Scrambling to find a way out, Mann spent months combing through transactions with his accountant to determine how much they owed — they found out it was $1,095,171.79.

Rare Autoglyph NFT saves the day

With the threat of potential liens on their home and risks of losing his wife’s retirement account, Mann turned to one last option: selling a rare Autoglyph NFT he purchased back in crypto’s early days.

The musician said he attempted to sell the NFT through X but did not get a good reception. However, he found a broker with a client who offered $1.1 million for the NFT. Mann said that he accepted the deal to pay for the IRS taxes.

Because of the losses incurred in the Aave loan, Mann did not owe capital gains taxes on the Autoglyph sale. “It felt so bittersweet to be done,” he sings at the end.

Despite the ordeal, Mann continues writing daily songs and selling them as NFTs, still hopeful he’ll one day earn another $3 million.